Last week’s broad capital market agita continued into Monday’s trading. Asia opened first, with Japan’s Nikkei Stock Index falling 12.4%, followed by a more modest retreat in Europe’s Euro STOXX 50 index (-1.4%). U.S. markets opened lower as well, with the S&P 500 declining as much as 4.3% in early trading before recovering some of the day’s losses to finish down 3.0%. Ten-year Treasury yields, which move in the opposite direction of price, have fallen from 4.17% one week ago to 3.78% Monday, reflecting expectations for more aggressive Federal Reserve (Fed) rate cuts.

Why

Equity prices began to drop following Thursday’s downbeat U.S. manufacturing data, while Friday’s disappointing U.S. jobs report spurred additional investor concerns that the decelerating, but still satisfactory, labor market may deteriorate further. We note the labor market is a key catalyst for consumer spending, and consumers compose the primary engine for economic and corporate earnings growth. Monthly new job creation is slowing, but the July jobs report may reflect weather-related factors. Credit card delinquencies remain near historically average levels after rising from low levels. Loan growth is tepid, while inflation-adjusted consumer savings returned to pre-COVID trends, emphasizing the importance of jobs and current income on the ability of consumers to spend. Interest rate markets suggest the Federal Reserve is late in cutting interest rates as the focus shifts from inflation concerns to labor market health, as the Fed alluded to during last week’s policy announcement.

Global central bank policies are diverging, transitioning from a period of broadly tightening measures to thwart inflation pressures to policymakers now addressing disparate growth and inflation outlooks across major economies. Last week, the Bank of England enacted its first interest rate cut of this cycle in a narrow 5-4 vote, the U.S. Federal Reserve kept interest rates unchanged in a unanimous decision but signaled a September cut, while the Bank of Japan (BoJ) hiked its target interest rate to 0.25%, exceeding analysts’ forecasts. The BoJ also announced plans to cut its monthly asset purchases in half by early 2026 as it starts to wind down its historic era of easy monetary policy. Across the globe, we have witnessed more policy rate cuts than rate increases starting in the fourth quarter last year as inflation began decelerating in earnest.

Market reactions reflect rapidly shifting Federal Reserve expectations and knock-on effects from the BoJ’s more-hawkish-than-anticipated decision. After last week’s softer data releases and resultant capital market concerns, interest rate markets priced in aggressive expectations for Fed rate cuts, including 0.50% of cuts by the September meeting (twice the normal 0.25% incremental change) and between four and five 0.25% cuts prior to year-end.

Additionally, the BoJ’s surprise rate hike and changes to its balance sheet strategy triggered capital market volatility. Japan’s negative interest rate policy and depreciating currency previously provided global investors an opportunity to borrow at low Japanese interest rates and in Japanese currency to fund investments in other higher-yielding opportunities, known as a carry trade. The BoJ’s surprising decision led to a quick appreciation in Japan’s currency, the yen, with higher interest rates and an appreciating currency abruptly increasing global traders’ borrowing costs, resulting in a quick reversal as investors unwound some of these speculative trades.

Historical perspective

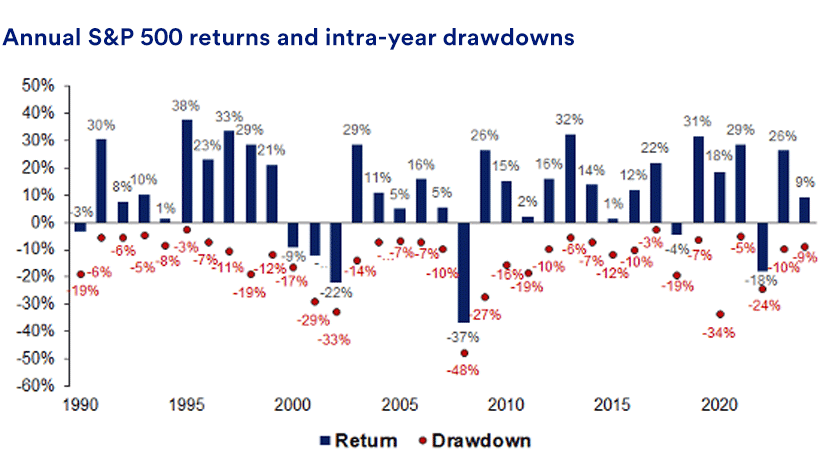

Intra-year drawdowns, while unsettling, are normal features within generally upward trending equity markets. The current decline of 8.5% from the S&P 500’s all-time high on July 16 to today’s market close is within a normal historical range. Even a correction, often defined as a 10% decline from a recent market peak, can (and often does) occur within an overall positive return year and represents an arguably arbitrary numerical change within the more complex context of economic and capital market considerations.