Working together for your clients.

Supporting both the asset and liability sides of your clients’ balance sheet can be an effective way to differentiate your practice. We can provide your clients with a variety of lending and credit options to help them advance their wealth goals.

You remain the primary point of contact for your clients, but add value by providing an easy way to meet short-term funding, bridge financing, tax payments and other liquidity needs. Wealth Banking Services offers a way to help meet your clients’ lending requirements.

U.S. Bank Flexible Capital Line of Credit®

Grow your practice with our U.S. Bank Flexible Capital Line of Credit, a securities-based lending option that enables your clients to secure financing with eligible assets in their investment portfolios.

Flexible Capital Line of Credit helps you unlock client liquidity while expanding your practice capabilities. Your clients gain access to attractive interest rates, flexible repayment options and other benefits.

U.S. Bank Flexible Capital Platform®

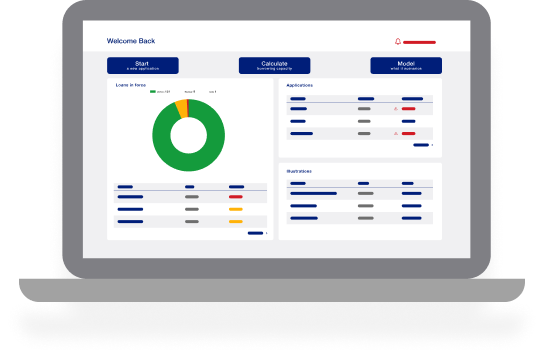

The U.S. Bank Flexible Capital Platform is a powerful tool for establishing and managing lines of credit for your clients. The platform provides you with online access to powerful tools that let you illustrate different lending options, propose strategies and closely monitor the approval process.

To access this platform, you and your firm first need to be entitled. Contact your U.S. Bank Wealth Services relationship manager, who can start the onboarding process and answer your questions.