What are 0% intro APR credit cards?

7 min read

What are the different types of credit cards?

7 min read

What is a secured credit card and how does it work?

4 min read

Credit Card Basics

Credit utilization ratio measures how much of your available revolving credit you're using and plays a major role in your credit score.

Keeping your utilization below 30% could help you qualify for better loan rates and credit card offers.

Your credit utilization can be calculated by your individual credit accounts or your total credit usage.

Credit utilization ratio measures the amount of revolving credit you use divided by the total amount of revolving credit you have available. Lenders use your credit utilization to get an idea of how well you’re managing your credit.

Understanding your credit utilization ratio is important to achieve and maintain a good credit score. Let’s take a closer look at how credit utilization works and how it affects your financial health.

Credit utilization is the percentage of available credit you’re currently using and is one of the major factors that help determine your credit score. Revolving credit allows you to continually borrow money up to a set limit without reapplying, like credit cards or a home equity line of credit.

Your credit utilization ratio is only about revolving accounts. Installment loans like auto loans and mortgages aren’t included.

Experts generally agree you want to keep your credit utilization below 30%. If it increases to anything higher than that, lenders may assume you have trouble managing your credit.

While a 30% credit ratio is a good rule of thumb, it’s not written in stone. Each scoring model may weigh your credit utilization differently. So, it’s best to keep track of your balances regularly and pay your monthly balance on time and in full.

There are two ways to calculate your credit utilization ratio: total credit utilization and individual utilization.

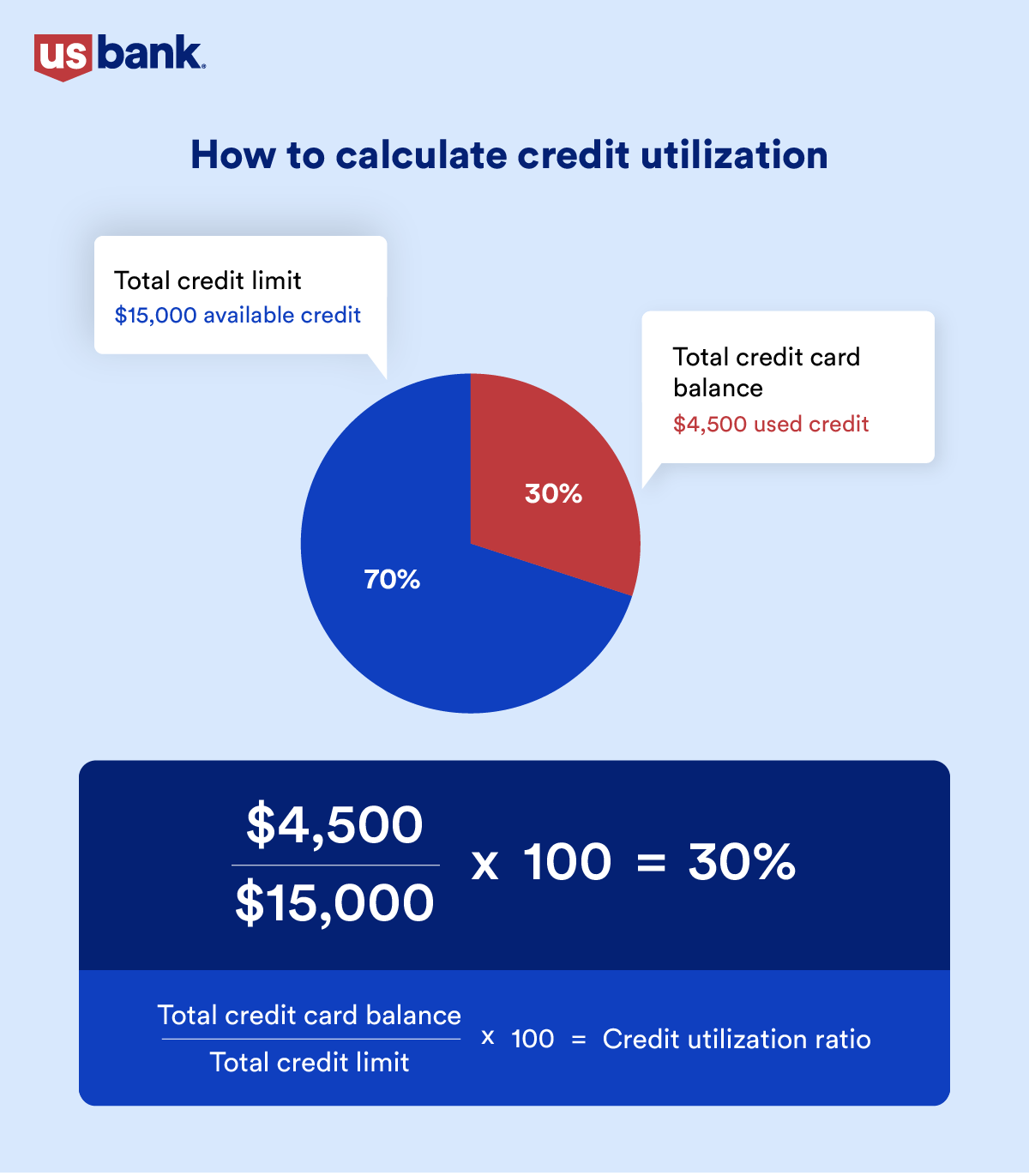

Total credit utilization accounts for the available credit from all revolving accounts. The formula for that is:

Credit utilization ratio = (Total credit card balance ÷ Total credit limits) x 100

Let’s say you have two credit cards. Card A’s limit is $10,000, and the balance owed is $1,500. Card B’s limit is $5,000, and the balance owed is $3,000.

That means your total available credit is $15,000, while you owe $4,500. The formula looks like this:

30% = ($4,500 ÷ $15,000) x 100

Your total utilization ratio is 30%, which most lenders find acceptable.

The other way to calculate your credit utilization ratio is by individual cards. Here’s the formula:

Individual card utilization ratio = (Card balance ÷ Credit limit) x 100

When you calculate the numbers for each credit card, you should find that your utilization ratio for Card A is only 15%, but Card B is 60%.

While total utilization may be the main number credit scoring models use to evaluate your usage, your individual utilization also matters. Having one maxed-out credit card can negatively affect your score because lenders interpret that you’re stretching your available credit.

Credit utilization can significantly impact your credit score. A higher utilization rate, especially one over 30%, typically lowers your score. But the reverse is also true: A lower utilization rate often raises your credit score.

Your credit utilization ratio gives lenders insight into how well you manage debt. A lower credit utilization ratio typically tells lenders that you manage your credit responsibly, which can make lenders more inclined to approve an application for new credit and offer more favorable terms and interest rates. If you have a higher credit utilization ratio, it could suggest that you rely heavily on credit and may make it difficult to qualify for new credit or loans.

One common misconception is that carrying a balance from month to month helps your credit score. That can increase your utilization and potentially hurt your credit. Paying off your balance each month helps keep your ratio low.

Another thing to note is that even if you pay your balance in full, your credit utilization might not reflect as 0%. Credit card companies usually report your balance at a specific point in the billing cycle — often before your payment is due. So, if your balance was high when it was reported, that’s what gets reflected in your credit report.

Because credit utilization can have a major impact on your credit score and, therefore, your financial goals, lowering it can be a smart decision.

Increasing your credit limit is a good way to improve your credit utilization ratio. Sometimes, your credit card provider may automatically increase your credit limit if you’ve used your card responsibly. If not, you can request an increase by calling your bank or submitting a request online. Be prepared to share details about your income, and your provider might check your credit history as part of the process.

Paying more than the minimum payment on your credit card each month helps lower your balance, and that can improve your credit utilization ratio. If you only pay the minimum amount due on your statement, you won’t see much of your card balance decrease.

Old or barely used credit cards might feel tempting to have around, but it may be a good idea to keep your cards open. If you close an old credit card, you’ll lose that card’s available credit. If you still carry balances on other cards, your overall credit utilization ratio increases because you’re now using a higher percentage of your remaining available credit.

Your credit utilization ratio is more than a number – it's a key indicator of how well you manage your credit and one of the most important factors in determining your credit score. Keeping your utilization low can increase your credit score, which may give you access to lower interest rates and better terms in the future. So, check your credit utilization regularly to move toward your financial goals more confidently.

7 min read

7 min read

4 min read