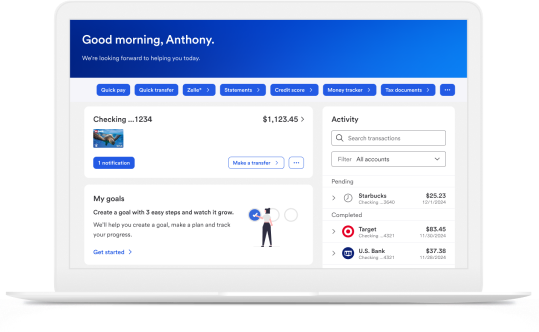

Online banking lets you manage your money, deposit checks and monitor your bank accounts from a desktop, tablet or mobile device.

Banking made easy

Explore the basics of online and mobile banking along with some of our tools.

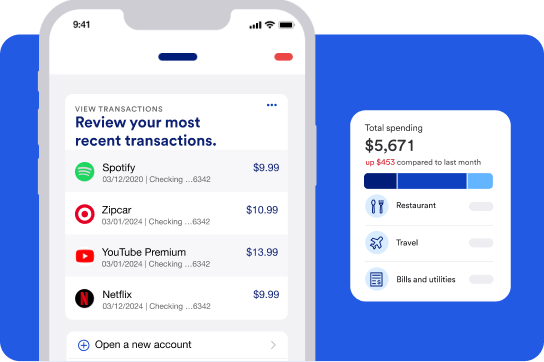

Mobile banking allows you to bank on the go using your smart phone or tablet. You can access and manage your account profile, review your transactions, send money or redeem rewards all from one location.

Track your spending.

See all your finances in one place, breeze through budgets and track spending through personalized insights.

Set personalized savings goals.

Set a goal in the mobile app or online banking for things such as retirement and major purchases. Then set up regular transfers to a savings or investment account to reach them.

Tackle monthly bills.

View, track and pay your bills securely with the top-ranked U.S. Bank bill pay.

Send, receive and request money.

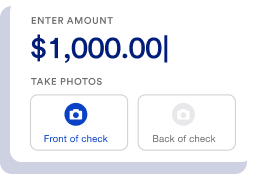

Deposit checks anytime, from anywhere.

Take a photo with your mobile device and upload it through the mobile app.

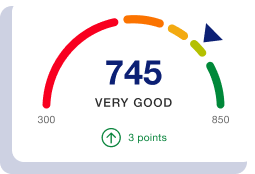

Keep tabs on your credit score.

Check, monitor and improve your credit for free.3

We have your back with secure online banking.

Our industry-leading encryption and security features are always on to protect you and your information.

Digital security guarantee

You aren’t liable for any unauthorized transactions made with the mobile app or online banking.4

Security center

Boost the security of your accounts in minutes by easily enabling security features.

Data privacy

Share your financial information only with those you choose.

Automatic security alerts

There’s no need to sign up for alerts that inform you of important activity such as requests to change your password.5

Bank securely from home or anywhere else.

Download the award-winning and secure U.S. Bank Mobile App6 and open a checking or savings account in minutes.

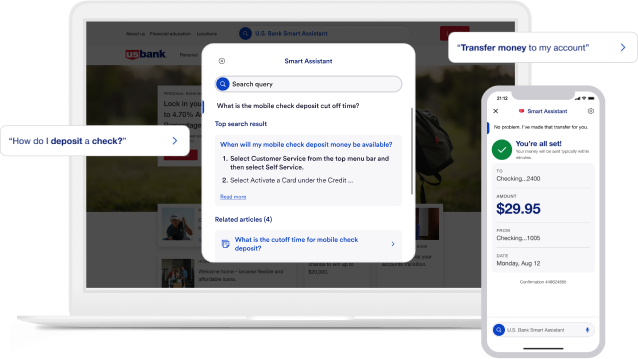

Ask U.S. Bank Smart Assistant® for help in the U.S. Bank Mobile App and online banking.

Get answers and complete common banking tasks quickly with our virtual assistant.

Frequently asked questions about online and mobile banking.

The major difference between online and mobile banking is how you access your account. With online banking, you log in to your account via a desktop, tablet or mobile device using your username and password. With mobile banking, once you download the app from your app store onto your mobile device or tablet, you can access your account through the app. Another difference between the two is the mobile app allows you to deposit checks using your mobile device or tablet.

For personal accounts: Gather your U.S. Bank card or account number and PIN along with your Social Security number to complete a one-time enrollment process. If you don’t have a PIN or need a new one, please contact 24-Hour Banking at 800-USBANKS (872-2657).

For business accounts: You’ll need an ATM or debit card. You can apply for these at a branch. Use your PIN to log in to mobile or online banking. Next, create a unique username and password to log in securely in the future. Then, just follow the instructions on the enrollment page.

Most account information is updated in real time as transactions are processed throughout the day. Mobile and online banking offers you the most current balance and transaction information available.

You can see all of your accounts – ones you have with other financial institutions as well as your U.S. Bank accounts – in one view. Easily connect them with the mobile app or in online banking.

Yes. Your U.S. Bank checking, savings and money market accounts are eligible to send and receive external transfers both through online banking and the mobile app.

You can change or reset your username or password in the mobile app or online banking.

You can select from a wide variety of alerts to stay informed of account activity that is important to you. Some common ones by account type include:

For checking and savings accounts:

- Negative balances

- Balances that fall below a dollar amount you choose

- Deposits or withdrawals that exceed a specified dollar amount

- Overdrafts and overdraft protection transfers (checking only)

- Availability of new statements and other online documents

For credit cards:

- Balances and transactions that exceed a dollar amount you choose

- Available credit that falls below a specified dollar amount

- Payments and credits posted to your account

- Payments due or overdue

- AutoPay payments scheduled or processed

- Transactions with higher fraud risk, such as ATM cash withdrawals, international transactions, gas station purchases, and purchases made without a card present

- Declined transactions

For ATM/debit cards:

- ATM cash withdrawals

- Transactions that exceed a dollar amount you choose

- International transactions

- Gas station purchase

- Purchases made without a card present

- Declined transactions

The most important thing you can do is keep your login credentials confidential. Logging out of your account when you are finished using digital services is also important. It is also important to never send money to those you do not know and trust. U.S. Bank offers a digital security guarantee that covers you from being liable for unauthorized transactions initiated through the mobile app or online banking. We also offer Paze®, an online checkout solution for purchases that doesn’t require your card numbers and provides added security. See how we protect you with Paze®. Visit Financial IQ to see a large selection of articles and videos related to protecting yourself again fraud.