From LA to the Bay Area, we’re here for California.

No matter the goal, we can help you reach it.

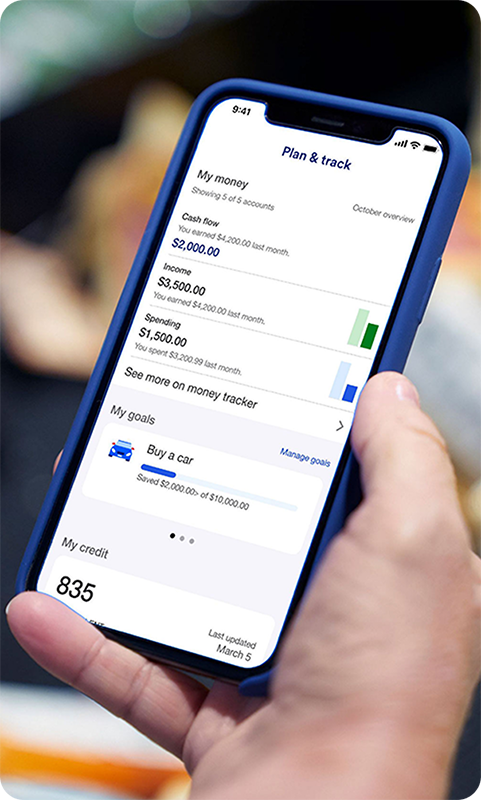

With tools to help you track your spending and grow your savings, U.S. Bank Smartly® Checking and Savings makes each step toward your financial goals easier.

Start earning cash-back rewards, fee discounts, rate bonuses and overdraft fee forgiveness 1 with a U.S. Bank Smartly® Checking account and U.S. Bank Smart Rewards®.

With U.S. Bank Smartly® Savings, your rates and benefits increase as your combined qualifying account balances grow with the presence of an additional eligible account. 2 Plus, easy-to-use digital tools help you set goals and stay on track.

We’re a proud sponsor of your favorite teams because we’re a proud supporter of you. For all of life’s passions, hopes and goals, you’ll have a network of people cheering you on.

"Best in class” scorecard rating for our mobile app and online banking

U.S. Bank Mobile App rated nearly 5 stars in both major app stores

Book an appointment with one of our financial representatives and get started in under 5 minutes.

Our sponsorship helped the benefit raise over $100 million to aid wildfire recovery and prevention efforts. (Photo credit: Jake West Photo)

With Access Home Loan, prospective homeowners may qualify for down payment assistance and up to $5,000 in lender credit.

The Business Access Advisor program assists small business owners in Los Angeles with education and capital.