FDIC-Insured - Backed by the full faith and credit of the U.S. Government

Supporting renewable energy

Much of our environmental finance activity happens through U.S. Bancorp Community Development Corporation (USBCDC), our tax credit and community investment division detailed in the Community Engagement section of this report. The USBCDC environmental finance business invests Renewable Energy Tax Credit (RETC) equity in projects that help provide clean energy options to our nation’s homes, towns and businesses through wind, solar and other renewable energy projects. Over the years, U.S. Bancorp has been a leading investor in solar financing. These projects are not only good for the environment, but they also create tens of thousands of jobs in local communities across the United States. In 2021 we invested $830 million in RETC equity.

Building with sustainability in mind.

To date, we have 26 LEED certified branches and are continuing to follow sustainable principles in the design of our new facilities with plans to maintain this focus in the future.

Eco-friendly debit cards that make a difference

With an estimated 6.3 billion payment cards shipped around the world each year, we’re turning the tide on the plastic waste problem by introducing the U.S. Bank Visa® Debit Card made with recovered ocean-bound plastic. Using upcycled litter collected in areas that are highly likely to feed into the water, these eco-friendly debit cards prevent more waste from entering our oceans.

Partnerships

Through community engagement and organizational partnerships, U.S. Bancorp works to better understand environmental issues and identify solutions.

American Indian College Fund

U.S. Bank continues our work with the American Indian College Fund to award scholarships to students pursing post-secondary degrees in fields of study that lead to careers in solar energy. The College Fund supports higher education attainment, career readiness services, hands-on training, and job placement for these scholars, thereby supporting environmental sustainability and energy sovereignty for tribal communities. Since 2017, the U.S. Bank Foundation has provided $150,000 in funding for scholarships.

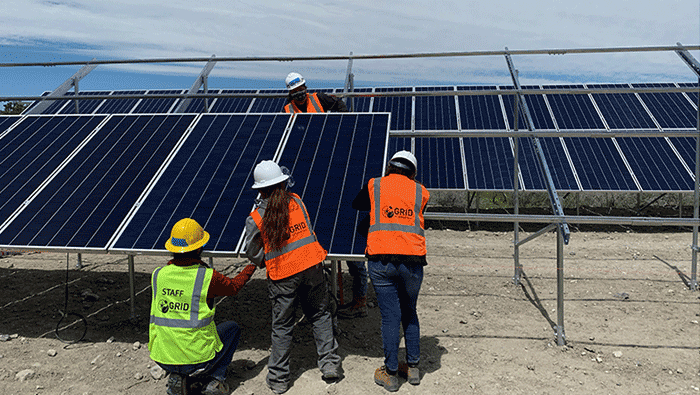

GRID Alternatives

Since 2010, U.S. Bank has been a partner of GRID Alternatives. GRID Alternatives is the nation's largest nonprofit solar installer, with the mission to make renewable energy technology and training accessible to underserved communities.

Through our partnership, GRID Alternatives has provided hands-on solar training for 207 Indigenous trainees who put in 15,000 training hours, provide intensive professional development opportunities for tribal members through their SolarCorps Fellowship Program and strengthen partnerships with tribal colleges and job training organizations in tribal communities. These programs have served 300 tribal families through 218 projects and more than 3.2 megawatts of solar power has been installed to benefit tribal communities, resulting in $13.6 million in long-term savings over the lifetime of the systems and 76,000 tons of carbon emissions have been prevented, which is the equivalent of planting more than 1.8 million trees.

Evergreen Climate Innovations

Starting in 2019, U.S. Bank joined forces with Evergreen Climate Innovations to develop a U.S. Bank Foundation Cleantech Inclusion Award. This award supports entrepreneurs who are female and/or people of color and who are building innovative companies that benefit the environment, create jobs, and drive economic development.

“Supporting female and minority business owners and environmental sustainability is at the heart of our commitment to being a socially responsible company,” said Reba Dominski, Chief Social Responsibility Officer for U.S. Bank. “Through this award and our work with Evergreen Climate Innovations, we are able to help accelerate innovative technology and support startups.”