News

Update on effort to help people build wealth, close persistent racial wealth gap

U.S. Bank partners with Urban Institute to create pathways to wealth.

Last year, U.S. Bank launched U.S. Bank Access Commitment™, a long-term approach to help build wealth while redefining how we serve racially diverse communities and provide more opportunities for racially diverse employees. U.S. Bank started with the Black community, because that is where the persistent racial wealth gap in the United States is the largest (Federal Reserve, 2019). Over the past year, U.S. Bank has been focused on making progress to help people build wealth. While it has supported families, businesses and community institutions, U.S. Bank acknowledges it still has more work to do, including evolving the way it measures success (more on that below).

Here’s the forward progress U.S. Bank made in 2021* to help people build wealth:

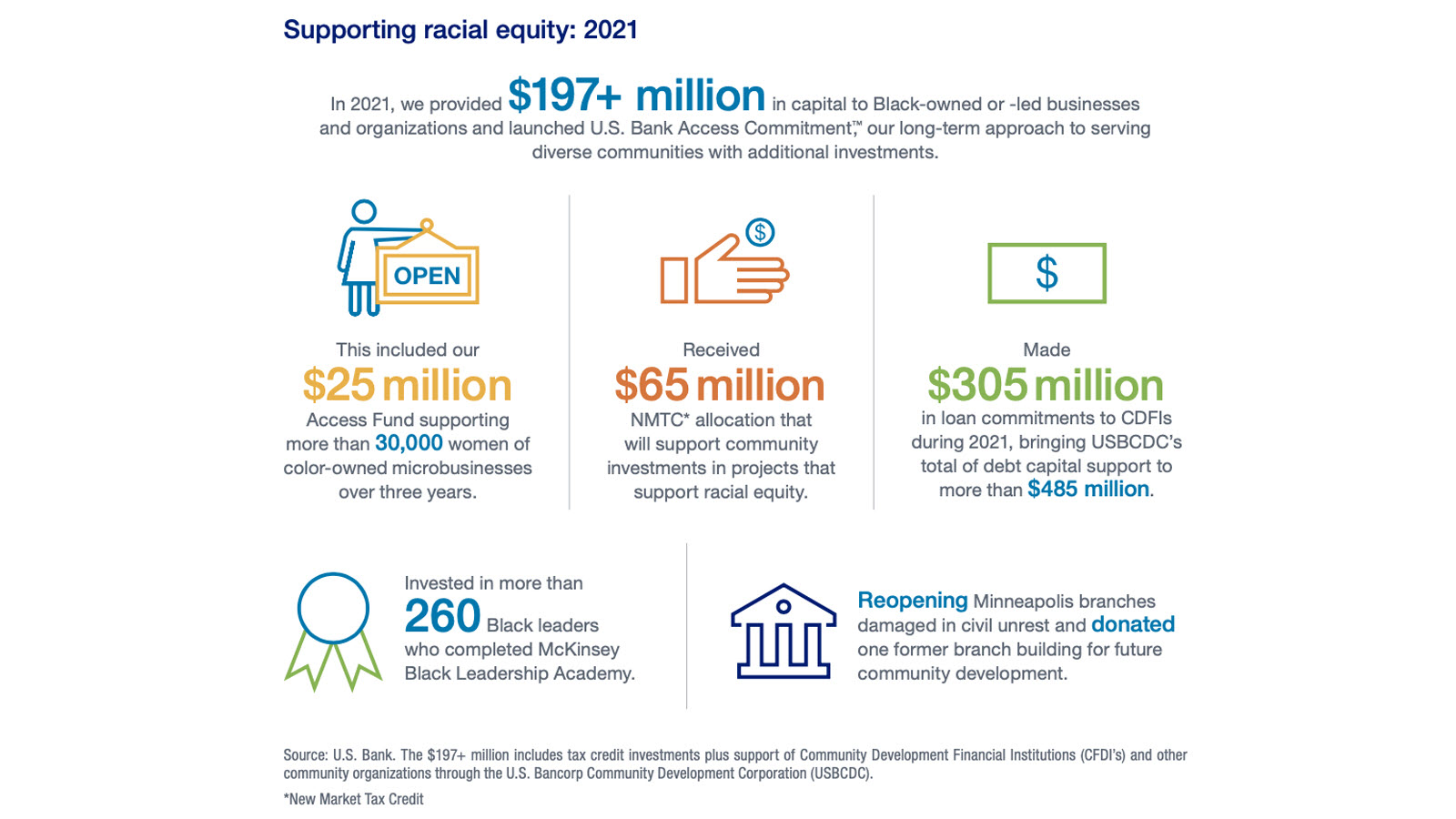

- Provided more than $197 million in capital to Black-owned or -led businesses and organizations through U.S. Bancorp Community Development Corporation (USBCDC), the community investment and tax credit division of the bank.

- This included its $25 million Access Fund supporting more than 30,000 women of color owned microbusinesses over three years.

- Made $305 million in loan commitments to Community Development Financial Institutions (CDFIs) during 2021, bringing USBCDC’s total of debt capital support to more than $485 million since 2016. CDFIs play a critical role in bringing investment and resources to underserved communities and those who may not be eligible for traditional small business financing, with a focus on women and minority-owned businesses and low-to-moderate income communities.

- Received a $65 million New Markets Tax Credit (NMTC) allocation that will help finance community investments in projects that support racial equity.

- Invested in more than 260 Black leaders who completed McKinsey Black Leadership Academy development training.

- Spent $199 million with Black suppliers in 2021 and forged new relationships with dozens of Black suppliers.

- Reopened its West Broadway branch and South Minneapolis branch at 919 E. Lake Street, which were both damaged during the civil unrest in 2020. The company also opened a new East Lake Street branch at 3600 E. Lake Street, donating the 2800 Lake Street building to nonprofit Seward Redesign for future development based on community needs.

- Expanded our inclusive hiring efforts to ensure we have at least one woman or person of color candidate for open roles at all levels as well as for interview panels.

Click here to enlarge this infographic.

“This work is long-term,” said Andy Cecere, chairman, president and CEO at U.S. Bank. “We’re committed to being part of the solution and we believe that access to financial education, career development and capital creates opportunities for systemic change.”

Evolving our measurement approach to assess our work’s impact on people’s lives

“We’re able to measure the actions we’re taking, but our long-term goal is to measure the impact on people’s lives,” said Greg Cunningham, chief diversity officer at U.S. Bank. “Our success has to be based on whether the people we’re trying to help are reaching their goals. Was the entrepreneur able to create one more job because of our Access Fund? Was a family able to buy their first home because of our financial education partnership with Operation HOPE? Did their kids get to go to college because they saved together using the Goalsetter app? When we can measure whether people’s lives were improved in these specific ways, we’ll know whether we are on the right track.”

To that end, U.S. Bank is working with the Urban Institute, a nonprofit research organization that provides data and evidence to help advance upward mobility and equity to develop a “theory of change,” a framework for measuring impact we hope to share in the bank’s full Environmental, Social and Governance (ESG) Report, which will publish later this year. The theory of change will include: 1) initial social impact measures and 2) a roadmap of activities U.S. Bank supports that will help people reach their goals of building wealth.

UPDATE ON U.S. BANK ACCESS COMMITMENT INITIATIVES

U.S. Bank Access Fund

The U. S. Bank Access Fund was established to break down those barriers through $20 million in capital and $5 million in grants to support capacity building, technical assistance and expand mentoring and networking opportunities, as well as business seminars and peer-to-peer learning sessions through our partners Grameen American, African American Alliance of CDFI CEOs, and Local Initiatives Support Corporation (LISC). At year-end 2021, it deployed $13+ million in capital to 10 CDFIs who will lend directly to business owners. Over three years, U.S. Bank estimates this investment will support more than 30,000 microbusinesses.

U.S. Bank Access Business

U.S. Bank Access Business combines our expertise and that of our external partners to provide small business owners with information, connections and capital to position them for success. Business Access Advisors – a new position on the U.S. Bank team – will actively guide entrepreneurs in our pilot markets: Charlotte, Chicago, Colorado Springs, Denver, Los Angeles, Little Rock, Omaha, San Francisco, and the Twin Cities. More information to come as the company trains its Business Access Advisors and gets the program launched.

U.S. Bank Access Home

U.S. Bank is investing to help close these gaps. To help increase representation of Black individuals in the mortgage industry, we are creating a development program that includes a full year of technical and community development in partnership with housing agencies, community leaders and minority realtor trade organizations. The company also launched a trainee program for residential appraisers to increase Black representation in our appraiser roles. To help more Black families access homeownership, U.S. Bank is providing financial education in partnership with local and national organizations through at least 2024, across all markets over three years.

U.S. Bank Access Capital

USBCDC is partnering with CDFIs to support and grow the number of developers led by people of color and help increase locally-led solutions by collaborating to invest in developers of color. The company opened applications for the next round of funding in July 2021 and will announce the next round of grant recipients in Q1 2022.

U.S. Bank Access Wealth

In September, U.S. Bank launched the Building Black Wealth study and we learned three things:

- Black Americans far more likely than non-Black respondents to feel a sense of duty to lift their communities financially.

- This research highlights the important role our industry plays in reducing the racial wealth gap, and we know we have much more work to do.

- Representation matters: Black consumers need to see themselves in financial teams to build trust.

U.S. Bank created a mentoring program to help ensure our advisors reflect the communities they serve. In October 2021, the company provided its first “class” of Black Consumer and Business Banking (CBB) bankers interested in becoming a Wealth Management advisor with a mentor within Wealth Management. U.S. Bank is also excited about its Each One Teach One financial literacy curriculum developed by wealth advisors. The content extends to Access Business and Access Home initiatives, is available on usbank.com and shared with U.S. Bank’s internal Black Heritage Business Resource Group and presented to 300+ high school students, their parents and faculty at Harris Stowe University.

For more information

Learn more about Access Commitment and progress to-date.

How to get access

While many of the Access Commitment initiatives are fully allocated and funded, there are still opportunities to access financial education and information about funding. To find a full list of initiatives and contact information, visit: https://www.usbank.com/dam/documents/pdf/access-commitment-resource-guide.pdf

*This includes calendar year 2021 data only. We did provide an update in the middle of 2021 in which some of these dollars were disclosed. U.S. Bank will continue to report activity on a calendar year basis going forward.

Media center

Press contact information, latest news and more

Learn more

Company facts, history, leadership and more

Work for U.S. Bank

Explore job opportunities based on your skills and location