There are two ways to find your routing number in the U.S. Bank Mobile App.

The easiest way is to open the app and select U.S. Bank Smart Assistant® Then say, “What’s the routing number for my checking account?”

You can also find it by following these directions:

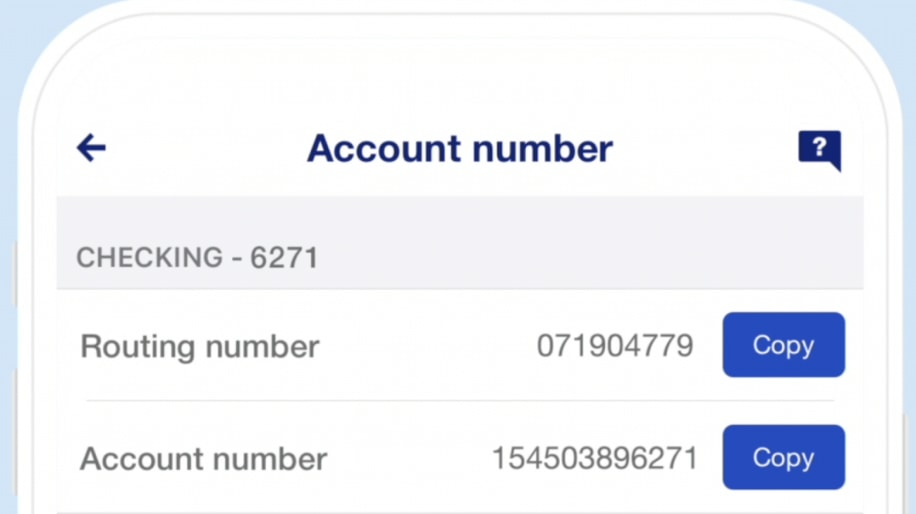

- Log into your account and select the desired account.

- Select the Manage tab.

- Select Account & routing number.

- You’ll see the full account number and the routing number.