Economic forecast for 2023: 3 things to know

Bull and bear markets: What do they mean for you?

FDIC-Insured - Backed by the full faith and credit of the U.S. Government

4 strategies for coping with market volatility

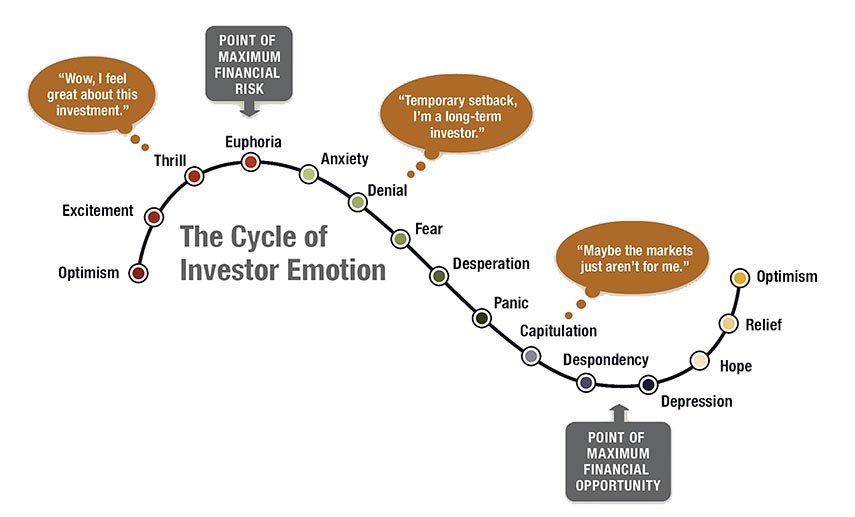

Emotions often play a role in decision-making. When it comes to considering investment decisions in a volatile market, however, following your emotions too closely may point your investments in the wrong direction.

Many factors can inform investment decisions: Financial goals, asset allocation and diversification strategies, tax benefits and indirectly, how investors feel about the market. It’s this last factor that you can control most closely.

When a market is in an upswing, investors sometimes believe it has nowhere to go but up. They may even start to feel euphoric, and that euphoria can lead to making investments in overheated markets. However good the feeling, though, those might be better times to hold or sell.

“We certainly saw that just before the financial crisis in 2007,” says Rob Haworth, senior investment strategist for U.S. Bank. “In the housing market, houses would turn over within weeks because people believed in the inevitability of housing price gains and perhaps magnificent housing price gains.”

That euphoric feeling is at one end of the emotional spectrum for investors, based on a common cycle of investor emotions. At the other end is despondency, which can cause investors to foresee only further declines in the market and pull back — or even exit markets — not realizing that it could be an opportune time to buy.

“The most dramatic example of this was in the depths of the global financial crisis as investors fled stocks at the end of 2008 and in early 2009,” says Haworth. “Despite recovery later that year, investors generally didn’t return until late 2010, losing out on significant gains from the market recovery.”

Source: U.S. Bank

There are generally three different stages of investor behavior that can occur with market uncertainty. All investors won’t go through each stage, but they represent common emotions people have and resulting actions they may take.

The beginning of the COVID-19 pandemic in 2020 is an illustrative example of investor reactions that followed the three-stage sequencing. Increasing evidence of negative economic impacts on global trade from China’s shutdown to combat the virus pressured equity markets in late February.

By mid-March, stocks had declined more than 20% leading to the liquidity phase as losses forced some investors into sales to meet obligations. The market reached its low on March 23; the Federal Reserve intervened and transitioned investors into the fundamental stage.

Market volatility depends on many factors, and it will never disappear. It’s essential for investors to understand how to manage their emotions in the face of volatility. Four steps are key.

Whether you work with a financial professional or invest through a robo-advisor, we’re here to help you balance your risk.

Learn more about investing options from U.S. Bancorp Investments.

Related content