Webinar replay: Spring investment outlook

FDIC-Insured - Backed by the full faith and credit of the U.S. Government

Source: Global Economic Health Check, U.S. Bank Asset Management Group, May 19, 2023.

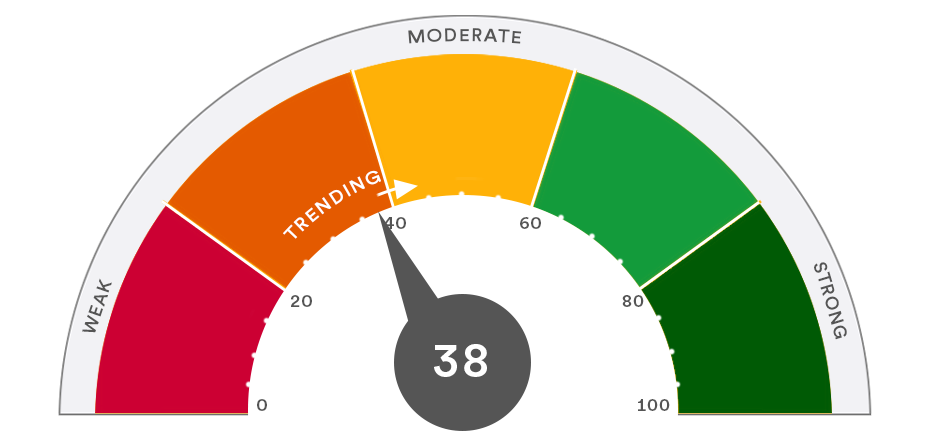

U.S. Bank Global Economic Health Check

The U.S. Bank proprietary Global Health Check incorporates more than 1,000 data points — including business climate factors and economic sector categories for 22 major economies representing 80 percent of total global wealth — to reflect our view of the current strength of worldwide economic growth.

Number of the week:

30.8%

The year-to-date return of communication services stocks in the S&P 500. The sector lost 40.4% in 2022.

Term of the week:

Communication Services sector

This sector includes social media companies, internet search firms, video game makers, telecommunications providers and streaming media. Companies in this sector include Netflix, Facebook parent Meta, Google parent Alphabet, AT&T and Verizon.

Quote of the week:

“Large companies are driving performance. The five largest companies by market cap in the S&P 500 — Apple, Microsoft, Alphabet, Amazon and NVIDIA — are up between 33% and 114% in 2023. Artificial intelligence-oriented NVIDIA and social media giant Meta (Facebook) are both up more than 100%. Additionally, the weighted average return of the 20 largest companies in the S&P 500 Index is 32%, more than three times higher than the broad index return of 9.2%.”

― Terry Sandven, Portfolio Manager, Chief Equity Strategist, U.S. Bank

Global economy

Quick take: U.S. economic data continues to moderate, though the housing market is stabilizing. Japan’s economy exited recession while China’s activity remains modest, despite the end of the pandemic.

Our view: Our U.S. Health Check is at levels consistent with historical recessions as the Federal Reserve (Fed) continues tightening monetary policy to combat elevated inflation. Our foreign scores are below median but improving, with Japan indicating above-average economic activity and China’s trend improving to a 21-month high.

- Friday morning’s breakdown in negotiations dashed investors’ hopes for progress toward a debt ceiling resolution. President Biden and House Speaker Kevin McCarthy scheduled a discussion for Monday afternoon to restart work on a deal. Treasury Secretary Janet Yellen reaffirmed the U.S. is likely to run out of money to satisfy all obligations as early as June 1.

- Retail sales perked up modestly in April, growing for only the second month in the past six. Sales rose 0.4% for the month after falling 0.6% in March and February. Auto and gasoline sales disappointed while core retail sales rose 0.6%. The report generally demonstrated a slowing pace of consumer spending.

- Despite still-elevated mortgage rates, housing market activity appeared more stable in April. Home builder sentiment improved to its highest level since August 2022. Housing starts ticked higher to a 1.4 million annualized rate from 1.37 million in March. Existing home sales slowed modestly from March to 4.28 million but remained above the January trough.

- Japan’s economy emerged from recession, with its first quarter gross domestic product rising 1.6% annualized. Consumer spending contributed the bulk of the recovery after contracting in the fourth quarter of 2022. Activity appears strong to start the second quarter, and consumer inflation accelerated to 3.5% year-over-year in April from 3.2% in March.

- China’s April economic data improved from March but was generally softer than consensus economic forecasts. Year-over-year industrial output and retail sales both improved over March, growing 5.6% and 18.4%, respectively. The underperformance relative to expectations indicates the pace of reopening and recovery from coronavirus shutdowns remains modest.

Equity markets

Quick take: Growth-oriented U.S. equity indices and sectors continue to inch higher, bolstered by large-cap artificial intelligence-related companies, as the first quarter reporting period draws to a close.

Our view: Persistent inflation, rising interest rates and uncertainty over the pace of earnings growth in 2023 remain headwinds to advancing equity prices.

- Growth-oriented companies are driving the S&P 500 higher amid narrow performance leadership. The S&P 500 closed Friday up 9.2% for the year, led by Communication Services (30.8%), Information Technology (27.4%) and Consumer Discretionary (17.9%). The year-to-date performance of the remaining eight sectors range between -9.4% and 1.4%. By this metric, performance breadth is narrow, which typically is consistent with periods of uncertainty and heightened volatility.

- Large companies are driving performance. The five largest companies by market cap in the S&P 500 — Apple, Microsoft, Alphabet, Amazon and NVIDIA — are up between 33% and 114% in 2023. Artificial intelligence-oriented NVIDIA and social media giant Meta (Facebook) are both up more than 100%. Additionally, the weighted average return of the 20 largest companies in the S&P 500 Index is 32%, more than three times higher than the broad index return of 9.2%. Investors may attribute the favorable year-to-date performance of large companies to reversion-to-the-mean dynamics following last year’s underperformance or a flight-to-safety given ongoing economic uncertainty.

- First quarter results are trending modestly above expectations as the reporting period draws to a close. As of Friday, 94% of S&P 500 companies have reported first quarter results, with sales advancing 4.4% and earnings declining 3.5% over year-ago levels, both modestly above expectations. From releases last week, consumer spending remains strong on experiences and essentials and spending on durable goods is soft. Overall retail inventory levels are in relatively good shape, which bodes well for profit margins (fewer markdowns) in the current quarter.

- Consensus estimates for 2023 remains largely unchanged; broad market valuation is near the 30-year average. The S&P 500 trades at price-earnings multiple of roughly 19.0 times the current year estimate of approximately $220 per share, in line with the 30-year historical average of 18.6 times, according to Bloomberg. By this measure, broad market valuation is fair.

Bond markets

Quick take: Investor confidence grew in the Fed’s outlook for maintaining currently restrictive rate settings. Moderating expectations for interest rate cuts later in the year caused rising Treasury yields and falling bond prices last week. Bond yield volatility continues amid ongoing debt ceiling uncertainty.

Our view: Tighter credit conditions and the Fed’s plan to maintain restrictive monetary policy settings to deal with high inflation present headwinds to riskier asset prices. We see opportunities in high-quality bonds, which now offer meaningful income and can help diversify equity volatility in portfolios.

- Fed officials’ comments last week reflected a growing consensus in favor of maintaining current policy settings. Fed Chairman Jerome Powell recognized the lagged economic impact of rate increases and tighter credit conditions result in a more balanced outlook for policy. High inflation keeps pressure on the Fed to maintain restrictive monetary policy. Interest rate markets expect around 0.6% in rate cuts by January, down from 1.0% more recently and reflective of growing confidence in the Fed’s plan to maintain rates near current levels this year. However, interest rate volatility remains high given the combination of high inflation and potential for restrictive policy to create financial market stress, with debt ceiling uncertainty adding to yield volatility. Maintaining benchmark interest rate sensitivity can help balance these two-sided risks.

- Reasonable valuations and strong but gradually weakening fundamentals support normal allocations to corporate and municipal bonds. The incremental yields on investment-grade corporate and municipal bonds that compensate for credit risk remain near long-term average levels. These yields represent fair compensation for issuers’ strong credit fundamentals. However, riskier bonds may be more vulnerable to swings in investor sentiment as high borrowing costs gradually weaken some issuers’ debt servicing capabilities. Moody’s, a bond rating agency that scores issuers’ credit fundamentals, downgraded corporate credits at a faster pace than they upgraded credits recently, reflecting a general weakening in credit trends.

Real assets

Quick take: All asset classes within real assets trailed the S&P 500 last week. Commodities were the best-performing asset class led by energy stocks. Infrastructure was the worst performer; utilities stocks sold off strongly, with rising interest rates reducing the attractiveness of dividend-producing assets.

Our view: We continue to see value in real assets’ defensive sectors. We favor tangible assets with stable cash flows as the market moves through a year plagued by declines in economic growth and corporate earnings. Commodities remain vulnerable as expectations for falling inflation and decelerating economic growth come to fruition.

- Real Estate trailed the S&P 500 by 4% last week with interest rates rising significantly. Offices were the top-performing properties, still trailing the broader market by 2.1%, while data centers trailed the S&P 500 by 8.3%. We believe the public real estate market offers compelling value at current levels relative to privately held real estate but acknowledge that near-term risk is elevated, and sentiment can change abruptly.

- Infrastructure trailed the S&P 500 by 4.1% last week. Midstream energy led performance, beating the broader market by 3%. The ONEOK purchase of Magellan Midstream Partners lifted the sector overall. However, utilities trailed the broader market by 6%.

- Crude oil prices rose 2.2% last week despite a larger-than-expected increase in domestic crude supplies and a rising dollar. We see the crude market as undersupplied over a longer time horizon, which should be supportive for prices, but we acknowledge downside exists as the global economy slows.

This information represents the opinion of U.S. Bank Wealth Management. The views are subject to change at any time based on market or other conditions and are current as of the date indicated on the materials. This is not intended to be a forecast of future events or guarantee of future results. It is not intended to provide specific advice or to be construed as an offering of securities or recommendation to invest. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Not a representation or solicitation or an offer to sell/buy any security. Investors should consult with their investment professional for advice concerning their particular situation. The factual information provided has been obtained from sources believed to be reliable but is not guaranteed as to accuracy or completeness. U.S. Bank is not affiliated or associated with any organizations mentioned.

Based on our strategic approach to creating diversified portfolios, guidelines are in place concerning the construction of portfolios and how investments should be allocated to specific asset classes based on client goals, objectives and tolerance for risk. Not all recommended asset classes will be suitable for every portfolio. Diversification and asset allocation do not guarantee returns or protect against losses.

Past performance is no guarantee of future results. All performance data, while obtained from sources deemed to be reliable, are not guaranteed for accuracy. Indexes shown are unmanaged and are not available for direct investment. The S&P 500 Index consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general.

Equity securities are subject to stock market fluctuations that occur in response to economic and business developments. International investing involves special risks, including foreign taxation, currency risks, risks associated with possible differences in financial standards and other risks associated with future political and economic developments. Investing in emerging markets may involve greater risks than investing in more developed countries. In addition, concentration of investments in a single region may result in greater volatility. Investing in fixed income securities are subject to various risks, including changes in interest rates, credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. Investment in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities. Investments in high yield bonds offer the potential for high current income and attractive total return but involve certain risks. Changes in economic conditions or other circumstances may adversely affect a bond issuer's ability to make principal and interest payments. The municipal bond market is volatile and can be significantly affected by adverse tax, legislative or political changes and the financial condition of the issues of municipal securities. Interest rate increases can cause the price of a bond to decrease. Income on municipal bonds is free from federal taxes but may be subject to the federal alternative minimum tax (AMT), state and local taxes. There are special risks associated with investments in real assets such as commodities and real estate securities. For commodities, risks may include market price fluctuations, regulatory changes, interest rate changes, credit risk, economic changes and the impact of adverse political or financial factors. Investments in real estate securities can be subject to fluctuations in the value of the underlying properties, the effect of economic conditions on real estate values, changes in interest rates and risks related to renting properties (such as rental defaults).

Insights from our experts

How we approach your long-term investing success

We use a data- and process-driven three step methodology to develop an investment strategy unique to you.

The debt ceiling debate in focus

With the U.S. government’s authority to borrow money bumping up against the federally mandated debt limit this year, is a political confrontation brewing that could impact capital markets?

How we analyze the economy

The economy doesn’t just move in a straight line. Our Health Check assesses its direction and how fast it’s moving.