FDIC-Insured - Backed by the full faith and credit of the U.S. Government

Key takeaways

An annuity is a contract between you as an investor and an insurance company and generates regular income payments in retirement.

A fixed annuity guarantees you a fixed rate of return for a specific period of time.

A variable annuity is tied to the market and can bring greater returns—and greater risk.

After you retire, you will still need a form of income to pay your monthly bills and maintain your lifestyle. Social Security can provide one income stream, and perhaps your company provides a pension, too.

A retirement investment portfolio with IRAs and a 401(k) can supplement these income sources, but another way to generate a retirement income is by purchasing an annuity.

Annuity definition

“An annuity is a contract between you, as an investor, and an insurance company,” says Stephen Truso, senior vice president, investment product group at U.S. Bancorp Investments. “You pay a lump sum or a monthly premium in exchange for regular income payments that can begin immediately or can be scheduled to start in the future.”

"Annuities are the only product outside of a pension or Social Security that provide lifetime income guarantees. They can help keep you from depleting your assets and running out of money in your retirement years."

Stephen Truso, senior vice president, investment product group at U.S. Bancorp Investments

Two types of annuities: Fixed and variable

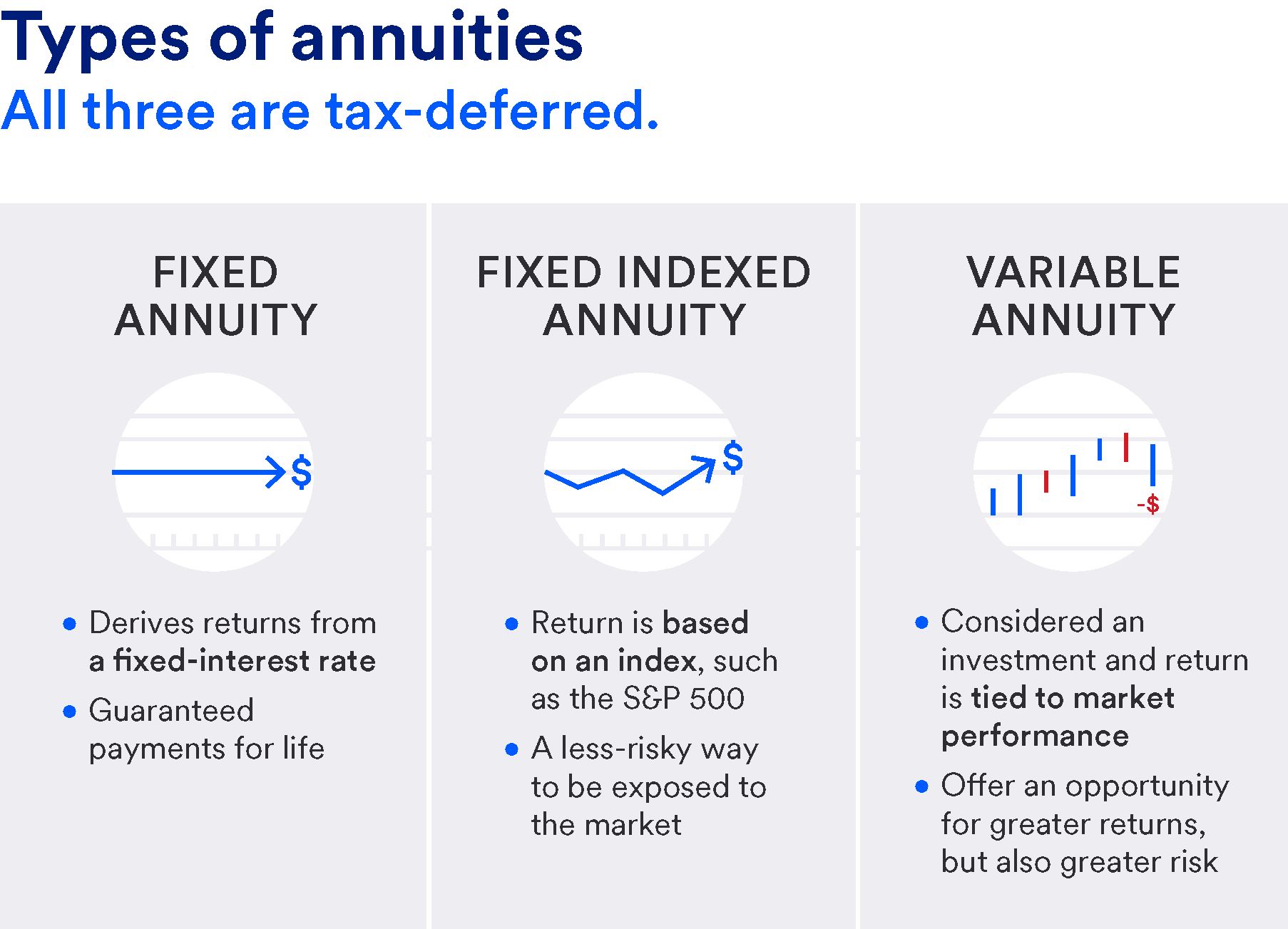

You can choose from two main annuity categories: fixed and variable.

A fixed annuity derives its return from a fixed-interest rate paid by the insurance company. You can also purchase a fixed indexed annuity, which has a return based on an index, such as the S&P 500.

“Fixed annuities are generally used as tax-deferred accumulation vehicles,” says Truso. “The nice thing about a fixed annuity is that as long as the funds remain in the annuity until the end of the surrender period, the holder of that product can't lose principal.”

Variable annuities, on the other hand, are tied to the market and provide an opportunity for greater returns similar to mutual funds. “They also introduce risk, because the market can go down,” says Truso.

Fixed annuities vs. variable annuities

Fixed annuities are purely insurance contracts, while variable annuities are filed with the Securities and Exchange Commission and are considered investments.

Both types of annuity products have insurance guarantees and can be converted to a guaranteed stream of lifetime income. However, variable annuities (for an additional fee) can lock in higher-income payments that are guaranteed throughout your lifetime.

Are there any annuity fees or conditions?

Fixed annuities generally don't have fees; money grows in the investment without annual charges or investment fees, says Truso. Variable annuities, however, are filed as securities and have investment charges similar to mutual fund fees.

If you take money out of your annuity before the surrender period, which is the period you must wait before withdrawing funds without penalty, you will generally incur a surrender charge. However, Truso says most annuities have a provision that allows you to access a small percentage of your money without surrender charges. If you become terminally ill or need to move into a nursing home, all your money becomes available penalty free.

Once the surrender schedule has expired, you can freely access your money. Like other retirement vehicles, if you withdraw money before you are 59½ you may be charged a 10% tax penalty, says Truso.

What are the annuity payout options?

Fixed and variable annuities may have provisions called “riders,” which allow you to access a guaranteed amount of income from the annuity every year regardless of the performance of the annuity investments or the remaining contract balance.

There are specially designed fixed and variable products, called immediate or deferred income annuities. With an immediate annuity, income payments will begin within the first 12 months of the contract. A deferred income annuity has an income stream that begins one year or later in the future.

Are there taxes on annuities?

Annuities are taxed similarly to the income you earn with traditional IRAs; the investment gains aren’t taxed while it accumulates. Once you withdraw money, you’re responsible for paying taxes on the growth.

“The advantage of tax-deferred growth is that your dividends, interest and capital gains are reinvested into the annuity,” says Truso. The growth on annuities and other retirement accounts is often taxed at lower rates than non-retirement investments because people are generally in a lower tax bracket in retirement than in their working years. “There's also a special rule in income annuities called an exclusion ratio. A portion of your payment is your principal coming back to you, so you're not taxed on that part of the payment,” Truso adds.

What are the pros and cons of annuities?

Annuities are able to provide a guaranteed form of income that can help you manage costs over your lifetime, especially in retirement. Fixed annuities also offer a guaranteed rate of return, which provides protection for conservative investors who don’t want to accept the risk of uncertain markets. In addition to income guarantees, there are also death benefit guarantees.

However, with certain annuity protections and guarantees there may be costs, restrictions and perhaps, limitations of growth. And just like other retirement accounts, annuities are generally not liquid. “You’re allocating money to annuities with the intention of taking it out at some later point in life,” says Truso. “And with variable annuities, you have the additional risk of losing money in a down market.”

Are annuities right for you?

The best way to know if an annuity would be a good addition to your retirement portfolio is to talk to an investment or tax advisor who understands your financial situation from an income and taxation perspective. An investment advisor can help you buy an annuity, completing the paperwork and submitting the application to the insurance company on your behalf.

If you’re looking for a steady return, a fixed or fixed indexed annuities may be a good choice. If you’re looking for a market-type investment, you’ll want to consider a variable annuity.

“When considering an annuity, it’s important to understand your goals and the level of protection you want,” says Truso. “If you have concerns about the market, that's where an annuity can provide you with some guarantees and some protection that other investment products can’t. Annuities are the only product outside of a pension or Social Security that provide lifetime income guarantees. They can help keep you from depleting your assets and running out of money in your retirement years.”

Learn how we can help you design your retirement income strategy

Related articles

5 investment options to help generate retirement income

Customize your income in retirement with these common investment choices.

How 7 common sources of retirement income are taxed

Don’t overlook the impact of taxes as you plan your retirement income strategy.