3 ways to make practical use of real-time payments

4 benefits to paying foreign suppliers in their own currency

Payments transformation continues to gain momentum for businesses with the expansion of instant payments through the RTP® network and FedNow® Service. Created to improve money movement for corporate treasury departments, both digital payments services provide immediate settlement and 24/7 availability for high-value transactions, but they have developed on different timelines.

The RTP network launched in 2017 with a $25,000 transaction limit. Since then, The Clearing House (which is owned by the nation’s largest commercial banks) has regularly increased the maximum transaction size. The most recent move raised the limit for a single instant payment to $10 million in February 2025, and the network now averages more than 1 million payments per day.

The Federal Reserve launched FedNow Service in July 2023. Developed to work in tandem with the RTP® network, the FedNow Service expanded the reach of instant payments to smaller banks and credit unions that weren’t already members of the RTP network. The Federal Reserve announced that its participation surpassed 1,000 financial institutions in October 2024, but it has a long-term goal of expanding to up to 8,000 participants.

This expansion means payers can send instant payments to even more beneficiaries, accelerating the treasury transformation that has been building for years. After all, the RTP network already reaches 70% of U.S. bank accounts, according to The Clearing House. And its transaction and revenue volume have been growing rapidly. In fact, the RTP network surpassed 500 billion total transactions in November 2024.

“The evolution of instant payments has brought us to an exciting place in offering digitization of payments through multiple rails and solutions,” says Adam Carter, group product manager in Global Treasury Management at U.S. Bank. “It allows our clients to continue their journey from paper-based products to digital solutions, so they can better control their funds, better understand settlement timing, and improve service to their customers.”

Like the RTP network, the FedNow Service is built to provide round-the-clock instant settlement of payments between senders and receivers and offer rich messaging capabilities.

Both instant payments networks provide faster, more reliable and safer payments that eliminate the inefficiencies associated with paper-based payments or traditional electronic payments like ACH and wires with limited processing windows.

Since instant payments aren’t restricted by processing times, there’s more control over payment timing with the ability to make and receive payments 24 hours a day, even on weekends and holidays. And instant payments can be executed “just in time,” without any concerns around loss of float revenue.

Payments data from the RTP network highlights the popularity of 24/7 availability, with 42% of transactions happening overnight, on weekends or on holidays.

Track the rise of instant payments.

Adoption of instant payments is on the rise, according to our survey of more than 2,000 senior finance leaders. The research showed 51% of businesses are currently using instant payments and 80% plan to use them by 2026. Dive into what’s driving the rise of instant payments.

As computers and other digital devices became omnipresent, the payments ecosystem irreversibly shifted toward offering increased speed, more choices and simpler ways of sending and receiving payments.

With high dollar transaction limits and data rich capabilities, the RTP network and FedNow Service were developed to help businesses move payments at the speed of modern business.

The RTP network and FedNow Service both offer:

Immediate payments, available 24/7/365

Irrevocable, good funds payments

ISO 20022 global standard information to deliver data rich messages

The RTP network, which is operated by The Clearing House, now supports instant payments up to $10 million. The FedNow Service, which is operated by the Federal Reserve, has a $500,000 maximum.

Expanding the number of financial institutions in the instant payment ecosystem created multiple benefits. It enabled more businesses to send instant payments and extended the reach to more potential receivers – great news for businesses that had limited their instant payments volume, or not started, because of concerns about the availability of some beneficiaries.

“The Fed worked closely with The Clearing House to ensure compatibility of functionality and rule sets between the two rails,” Carter explains. The Federal Reserve has a long history of providing payment services alongside private-sector providers, like it does with the dual ACH rails that are also operated by The Clearing House and the Fed.

That kind of redundancy means the two networks can back up one another if either one ever goes down, and creates benefits by allowing for both types of instant payments.

At U.S. Bank, clients don’t have to tell the bank they want to send a particular payment through the FedNow Service or by the RTP network. All they need to do is instruct the bank to make an instant payment. Carter says the bank then uses the two rails, in tandem, to offer a seamless instant payment solution with broader coverage than either could provide on its own.

“The bottom line is that instant payments will ultimately become ubiquitous,” Carter says, “and the faster businesses start to use them, the faster they will see the benefits.”

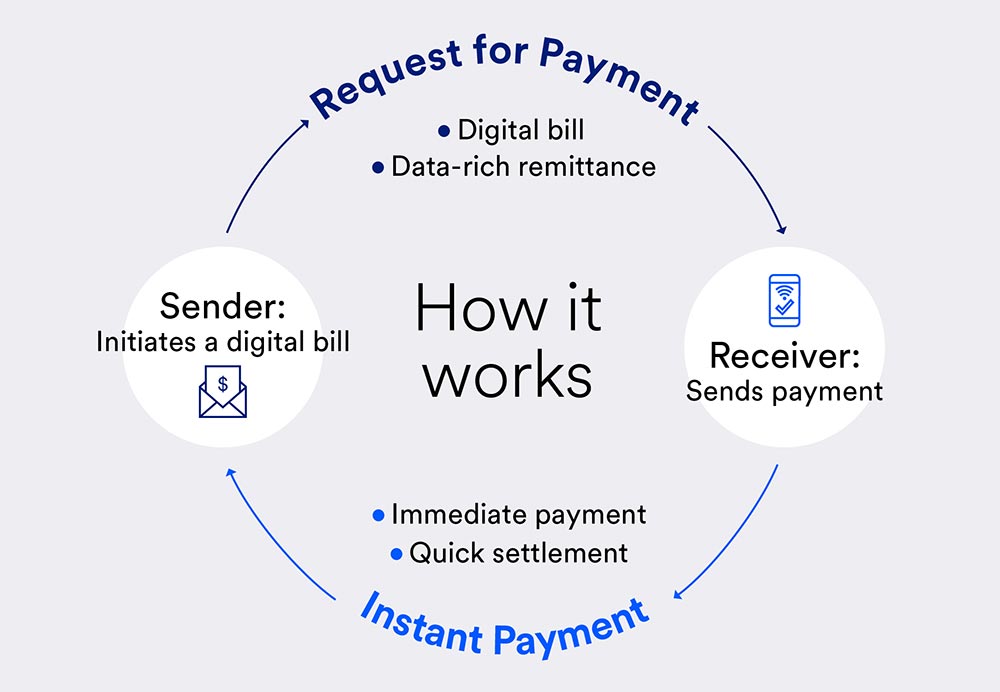

Businesses can send a Request for Payment (RfP) through the RTP network to receive instant payment with immediate settlement. The FedNow Service will also add RfP capabilities over time.

This functionality extends the value of instant payment by attaching it to a digital bill. It can be applied to recurring or one-time transactions, including subscriptions and one-time payments from vendors, partners or consumers.

RfP is especially well-suited for supply chain transactions, creating the ability to match the moment of delivery and confirmation with immediate billing and instant payment. And that delivery/transaction can happen any time, any day, with straight-through processing and reconciliation.

Instant payments move at the speed of the digital economy.

With Request for Payment (RfP), immediate billing and payment is available 24/7/365.

Businesses can utilize RfP in many ways, like enabling payment upon delivery. In that scenario, the driver can send the RfP from the dock, right after confirming the value of the load. And the recipient can pay the bill with one click that is verified immediately.

The RfP workflow processes payments through the following steps:

All of this happens within seconds, any time of day, any day of the year.

RTP provides process automation and simplification by aligning with the global ISO 20022 standard, along with two-way data-rich messaging. These detailed messages enable straight-through processing and speedy reconciliation. The FedNow Service is expected to add similar capabilities. They enable:

Confirmation – Generates message to sender and recipient that transaction was successful

Remittance advice – Details payment and additional customer data as a single conversation

Messaging, not just transacting – Non-value data messages like Request for Information and Acknowledgements allow messaging tied directly to the payments, simplifying communication between sender and receiver.

These features not only streamline payment processing, but also help reduce fraud often associated with paper-based payments, batch ACH and traditional wires.

The exchange of information on the instant payment networks takes seconds to complete, rather than the usual one to two days for a standard ACH transaction or longer for other methods like checks. From a settlement standpoint, this saves both sides of the transaction time and expense compared to more traditional payment methods.

From an adoption standpoint, instant payments usage keeps increasing as availability continues to grow. The RTP network surpassed 500 billion total transactions in November 2024, the same month that the Federal Reserve expanded the instant payments footprint with its launch of the FedNow Service. That growth is supported by a U.S. Bank survey of senior finance leaders that showed 42% of U.S. businesses already use instant payments, with 68% planning to do so by 2025.

While Treasury organizations have traditionally focused on streamlining internal processes, creating a seamless, immediate experience for customers and suppliers can be a key driver of payments transformation. Instant payments, especially those embedded in a company’s web experience, can deliver just that.

For example, a large automotive dealership group transformed its online car market by using RTP to pay immediately when its representative picks up a car in the seller’s driveway. And a broker/dealer in financial services uses RTP to allow investors to move money in and out of their online brokerage accounts instantly and securely, 24-hours a day, 365 days a year.

Other opportunities to leverage the power of instant payments include:

Delivering urgent payments to customers immediately (e.g., insurance claims)

Managing recurring monthly payments efficiently (e.g., utilities, gym memberships, cell phone bills)

Enabling control to pay bills with precision (e.g., on due dates)

Sending large payments outside normal business hours (e.g., real estate closings, merchant settlements, supply chain payments)

Ultimately, instant payments will have ubiquitous reach through the RTP network and the FedNow Service, so companies that are committed to adding instant payments should start the conversations with their financial institution now.

At U.S. Bank, we listen, understand and meet our customers where they are on their digital journey and work collaboratively to remove friction in the payments process. We were part of the first payment on the RTP network and participated in the FedNow pilot.

The work we’ve done over the years in real-time payments brings the expertise to help accelerate your digital payments strategy. Our knowledgeable team can provide guidance to help you navigate the payments landscape and expertise to help you achieve your long-term goals.

To learn how instant payments are changing the way companies do business, visit our instant-payments resource page, explore our survey of more than 2,000 American businesses, or schedule a call with a treasury management expert.