Trends in economics, immigration and mobility policy

Improve government payments with electronic billing platforms

Post-pandemic fraud prevention lessons for local governments

Webinar: Empower your AP automation with strategic intelligence

Webinar: Building digital bridges for treasury optimization

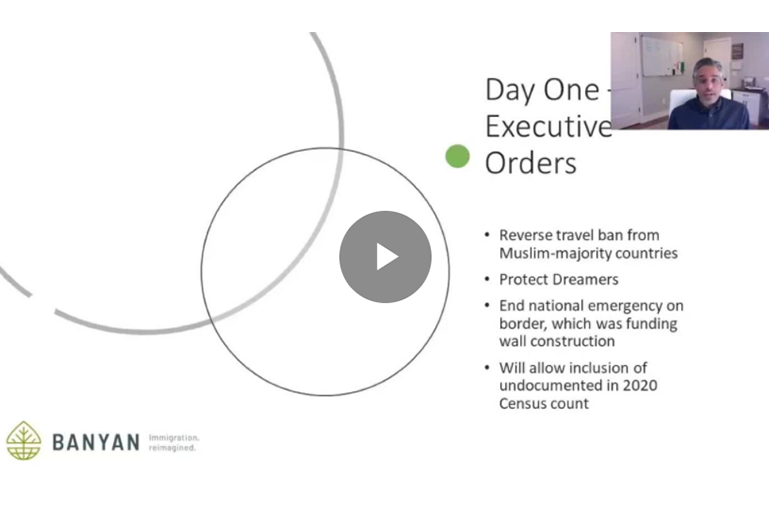

Webinar: Key issues impacting relocation in 2021

Webinar: The future of digital onboarding for U.S. Bank clients

Webinar: Driving innovation to impact treasury management

Webinar: CRE treasury leader roundtable

Webinar: Redefine your business with technology

Webinar: Economic, political and policy insights

Webinar: The impact of innovation on processing receivables

Webinar: International payments

Government agency credit card programs and PCI compliance

Modernizing fare payment without leaving any riders behind

Access, flexibility and simplicity: How governments can modernize payments to help their citizens

Navigate changing consumer behavior with service fees

What government officials should know about real-time payments

Tap-to-pay: Modernizing fare payments pays off for transit agencies and riders

How emerging banking solutions enable better decisions

Managing the rising costs of payment acceptance with service fees

Ways prepaid cards disburse government funds to the unbanked

How to accept credit card payments without transaction fees

3 reasons governments and educational institutions should implement service fees

Government billing survey: The digital transformation of the payment experience

3 ways to make practical use of real-time payments

Flexibility remains essential for public sector workforces

ABCs of ARP: Answers to American Rescue Plan questions for counties

Mobile treasury management – redesigned with your business in mind

Tips for navigating a medical hardship when you’re unable to work