FDIC-Insured - Backed by the full faith and credit of the U.S. Government

How does an IRA work?

Learn how IRAs work, including IRA tax advantages and other IRA benefits, and understand the difference between an IRA and 401(k), with our at-a-glance guide to individual retirement accounts.

One of the most popular—and useful—tools you can use for retirement savings is an individual retirement account (IRA).

Think of an IRA as a bucket that you can fill with stocks, bonds, mutual funds, exchange-traded funds (ETFs) and other investment vehicles.

The investments in your IRA bucket provide tax advantages that regular investments don’t offer. Even better, the money you invest in an IRA is compounded tax-free year over year, helping your nest egg grow over time.

Here are some common questions about how an IRA works and whether it could be a good option for you as you save for retirement.

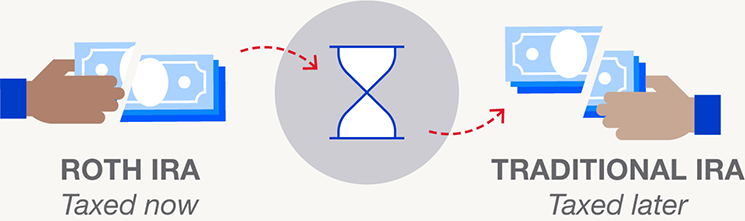

Traditional IRA vs Roth IRA: Which should I choose?

It depends on your goals. The biggest difference between traditional IRAs and Roth IRAs is how they’re taxed. There are also differences related to withdrawals and required distributions.

INSERT CHART

- Roth IRA: “Tax-free.” You invest after-tax dollars in a Roth IRA, but when you withdraw money after retirement, you’re not taxed on it. Roth IRAs can be useful if you’re a younger investor and are in a lower tax bracket than you expect to be as you progress in your career.

- Traditional IRA: “Tax-deferred.” You can receive a tax deduction on the money you contribute to your traditional IRA each year.* Then, when you withdraw the money in retirement, it will be taxed as ordinary income. It’s worth noting that you won’t pay taxes on your untaxed earnings or contributions until you start taking required minimum distributions—currently, when you turn 73.

Learn more about different types of IRA accounts.

When can I open an IRA, and how much can I contribute to an IRA?

If you open an IRA before April 18, you can deduct your contribution on the filing year’s taxes. This can reduce your taxable income for that year.*

The amount of money that you contribute to an IRA before April 18 counts toward the prior year’s limit ($6,500 for tax year 2023). For example, if you open a new IRA in January, you could jumpstart your investment by contributing $6,500 before April 18 and then another $6,500 (or whatever the current limit) before April 18 of the following year.

Should I choose an IRA, a 401(k) or both?

Many people have both an IRA and a 401(k), because they both will help toward their retirement goals. Here’s a look at the requirements and benefits of each.

|

|

IRA |

401(k) |

|---|---|---|

|

Maximum annual contribution |

$6,500/year ($7,500 if age 50+) |

$22,500/year ($30,000 if age 50+) |

|

Setup |

You set it up yourself through your bank or an investment broker, like U.S. Bancorp Investments. An IRA is also a common option for those whose employers don’t offer a 401(k) (such as those who are self-employed, own their own business or are part of the gig economy). |

A 401(k) is usually part of an employer’s benefits package, where they have an agreement with an investment broker to offer investments. |

|

Investment options |

You can choose any mix of investments to include in your IRA. You can make these decisions yourself or use a guided investment solution to fill your bucket. |

An employer-sponsored 401(k) plan usually has limited investment options, and many times your portfolio is added to a general target-date fund (the year you’re aiming to retire). |

Maximum annual contribution

IRA

$6,500/year ($7,500 if age 50+)

401(k)

$22,500/year ($30,000 if age 50+)

Setup

IRA

You set it up yourself through your bank or an investment broker, like U.S. Bancorp Investments. An IRA is also a common option for those whose employers don’t offer a 401(k) (such as those who are self-employed, own their own business or are part of the gig economy).

401(k)

A 401(k) is usually part of an employer’s benefits package, where they have an agreement with an investment broker to offer investments.

Investment options

IRA

You can choose any mix of investments to include in your IRA. You can make these decisions yourself or use a guided investment solution to fill your bucket.

401(k)

An employer-sponsored 401(k) plan usually has limited investment options, and many times your portfolio is added to a general target-date fund (the year you’re aiming to retire).

How do I manage an IRA?

|

|

Automated investing |

Self-directed investing |

Financial professional |

|---|---|---|---|

|

|

Offered exclusively by U.S. Bancorp Investments |

Offered exclusively by U.S. Bancorp Investments |

|

|

Who manages it? |

Robo-advisor |

You |

A financial professional |

|

Effort |

Low |

High |

Varies |

|

How does it work? |

The robo-advisor builds an online investment portfolio for you based on your goals and preferences. It monitors and adjusts your account as the market fluctuates. |

Gives you complete freedom if you’re an experienced and hands-on investor. You can buy and sell specific investments online. |

You’ll work with a professional to create a financial plan that is aligned with you retirement goals. |

|

Works well if… |

you are starting out and want a diversified mix of investments selected and managed for you. |

you are confident in making your own investment decisions. |

you have more sophisticated or complex financial needs or prefer personal guidance. |

|

More information |

Automated investing

Offered exclusively by U.S. Bancorp Investments

Self-directed investing

Offered exclusively by U.S. Bancorp Investments

Financial professional

Who manages it?

Automated investing

Robo-advisor

Self-directed investing

You

Financial professional

A financial professional

Effort

Automated investing

Low

Self-directed investing

High

Financial professional

Varies

How does it work?

Automated investing

The robo-advisor builds an online investment portfolio for you based on your goals and preferences. It monitors and adjusts your account as the market fluctuates.

Self-directed investing

Gives you complete freedom if you’re an experienced and hands-on investor. You can buy and sell specific investments online.

Financial professional

You’ll work with a professional to create a financial plan that is aligned with you retirement goals.

Works well if…

Automated investing

you are starting out and want a diversified mix of investments selected and managed for you.

Self-directed investing

you are confident in making your own investment decisions.

Financial professional

you have more sophisticated or complex financial needs or prefer personal guidance.

More information

Automated investing

Self-directed investing

Financial professional

*Your deduction may be reduced or eliminated based on income.

What is an IRA?

Simply put, an IRA is an investment account that you can use to save for retirement.

How does an IRA work?

Think of an IRA as a bucket. You choose how you want to fill that bucket. You can fill it with investments like stocks, bonds, mutual funds, exchange-traded funds (ETFs) and more.

When investments are in this bucket, they offer tax advantages that regular investments don’t offer.

Why is an IRA beneficial?

People use IRAs to invest for retirement because of the tax advantages and the value of compounding.

Tax advantages of IRAs

An IRA has tax advantages that don’t apply to other types of investment accounts.

Tax advantages are based on the type of IRA you choose:

- Traditional: You can deduct the amount you contribute from your yearly taxable income*

- Roth IRA: In retirement, you can withdraw the funds tax-free

How compounding works

The money you invest is compounded year over year, helping it grow over time.

Compounding can create a snowball effect, as interest earned is reinvested and can make more money.

How does an IRA differ from a 401(k)?

401(k)s and IRAs are two ways to invest for retirement. It’s not uncommon to have both to maximize the benefits of each while saving for retirement.

Set up

401(k): Usually part of an employer’s benefits package, where they have an agreement with an investment broker to offer investments.

IRA: You set it up yourself through the bank or an investment broker, like U.S. Bancorp Investments.

An IRA is also a common option for those whose employers don’t offer a 401(k) option: those who are self-employed, own their own business or are part of the gig economy.

Investment options

401(k): An employer-sponsored 401(k) plan usually has limited investment options, and many times your portfolio is added to a general target-date fund.

IRA: You can choose any mix of investments to include in your IRA. You can make these decisions yourself or use a guided investment solution to fill your bucket.

Additional contributions

Whether you invest enough in a 401(k) to receive the company match or you max it out, an IRA is a way to add even more toward your retirement.

You can complement a 401(k) with an IRA if you stay below the investment limits.

- 401(k): $20,500/year ($27,000 if age 50+)

- IRA: $6,000/year ($7,000 if age 50+)

Said another way, you can max out both for a total of $26,500 ($34,000 if age 50+) per year.

How do you open an IRA?

Automated investing

Offered exclusively by U.S. Bancorp Investments

Managed for you

Effort: Low

An online investment portfolio is built for you based on your preferences. Your account is monitored and adjusted as the market fluctuates.

Works well if… you are starting out and want a diversified mix of investments selected and managed for you.

Self-directed

Offered exclusively by U.S. Bancorp Investments

Manage your own

Effort: High

Complete freedom for the hands-on investor. Buy and sell specific investments online.

Works well if… you are confident in making your own investment decisions.

Financial professional

Effort: Varies

Work with a professional to create your financial plan.

Works well if… you have more sophisticated or complex financial needs or prefer personal guidance.

IRA tips

Why does April 18—Tax Day—matter?

Last year’s taxes

If you open an IRA before April 18, you can deduct your contribution on the filing year’s taxes. This can reduce your taxable income for that year.*

Contribution limit

The amount of money that you contribute to an IRA before April 18 counts toward the prior year’s limit. For new IRAs, it is kind of like a jumpstart, since you could basically contribute $6,000 before April 18 and have the whole next year to count toward that year’s limit.

What’s the difference between a Roth IRA and a Traditional IRA?

The biggest difference is the tax advantage. There are also differences related to withdrawals and required distributions.

Roth IRA

Tax implications: “Tax-free.” When you withdraw money after retirement, you are not taxed on it.

Traditional

Tax implications: “Tax-deferred.” You can receive a tax deduction on the money you place in the account. When you withdraw the money in retirement, it will be taxed as ordinary income at that time.

Investment and insurance products and services including annuities are:

Not a deposit ● Not FDIC insured ● May lose value ● Not bank guaranteed ● Not insured by any federal government agency

U.S. Wealth Management – U.S. Bank and U.S. Bancorp Investments is the marketing logo for U.S. Bank and its affiliate U.S. Bancorp Investments.

The information provided represents the opinion of U.S. Bank and U.S. Bancorp Investments and is not intended to be a forecast of future events or guarantee of future results. It is not intended to provide specific investment advice and should not be construed as an offering of securities or recommendation to invest. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Not a representation or solicitation or an offer to sell/buy any security. Investors should consult with their investment professional for advice concerning their particular situation.

U.S. Bank, U.S. Bancorp Investments and their representatives do not provide tax or legal advice. Your tax and financial situation is unique. You should consult your tax and/or legal advisor for advice and information concerning your particular situation.

For U.S. Bank

Deposit products are offered by U.S. Bank National Association. Member FDIC. Credit products offered by U.S. Bank National Association and subject to normal credit approval.

U.S. Bank does not offer insurance products. Insurance products are available through our affiliate, U.S. Bancorp Investments.

U.S. Bank is not responsible for and does not guarantee the products, services or performance of U.S. Bancorp Investments, Inc.

For U.S. Bancorp Investments:

Investment and insurance products and services including annuities are available through U.S. Bancorp Investments, the marketing name for U.S. Bancorp Investments, Inc., member Bancorp FINRA and SIPC, an investment adviser and a brokerage subsidiary of U.S. Bancorp and affiliate of U.S. Bank.

U.S. Bancorp Investments is registered with the Securities and Exchange Commission as both a broker-dealer and an investment adviser. To understand how brokerage and investment advisory services and fees differ, the Client Relationship Summary and Regulation Best Interest Disclosure are available for you to review.

Insurance products are available through various affiliated non-bank insurance agencies, which are U.S. Bancorp subsidiaries. Products may not be available in all states. CA Insurance License #0E24641.

Pursuant to the Securities Exchange Act of 1934, U.S. Bancorp Investments must provide clients with certain financial information. The U.S. Bancorp Investments Statement of Financial Condition is available for you to review, print and download.

The Financial Industry Regulatory Authority (FINRA) Rule 2267 provides for BrokerCheck to allow investors to learn about the professional background, business practices, and conduct of FINRA member firms or their brokers. To request such information, contact FINRA toll-free at 1-800-289-9999 or via https://brokercheck.finra.org. An investor brochure describing BrokerCheck is also available through FINRA.

U.S. Bancorp Investments Order Processing Information.