LGBTQ+ folks are much less likely to own a home than heterosexual people. Here are tips on how the LGBTQ+ community can prepare to buy a home and begin to close the gap.

While having a home to call your own is a common life goal, those in the LGBTQ+ community face longstanding barriers to homeownership.

As of March 2021, the Fair Housing and Equal Credit Opportunity Act expressly prohibits discrimination based on sexual orientation and gender identity. However, the lack of legal protection in the past is at least in part responsible for homeownership among the LGBTQ+ population to be significantly lower than that of the overall U.S. population.

An estimated 49 percent of the LGBTQ+ community owns a home compared with nearly 64 percent of the total U.S. population, according to an analysis by Iowa State University researchers.

To help you achieve your homeownership goals, this guide lays out a two-step process specifically for LGBTQ+ homebuyers. From organizing your finances to building your homebuying team, you’ll have actionable steps to help forge a path toward a home to call your own.

Prepare your finances for homeownership

Having your financial house in order is the first step toward homeownership. Go through the checklist below to make sure you have everything ready when you approach a mortgage lender.

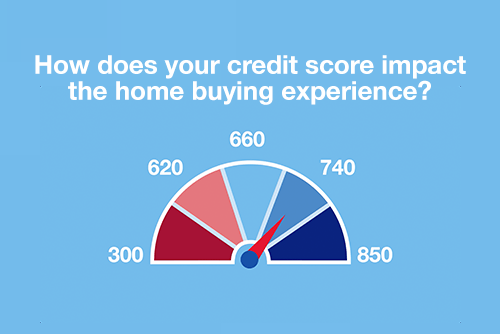

- Request your credit reports: You can get a free copy of your credit report from all three credit bureaus once per year. Knowing your credit score and current credit profile will identify anything you need to fix before applying for a mortgage.

- If needed, takes steps to raise your credit score: A higher credit score may mean you’ll get a lower interest rate on your mortgage, which translates to a lower total cost. If you need to bring up your score, here are ways to do that.

- Gather your tax returns: Most lenders will need copies of your tax returns for the two most recent years. Having copies on hand can speed your pre-approval process.

- Organize your pay stubs: If you receive a W-2 from your employer, gather your most recent two months’ worth of paystubs as proof of income.

- Locate your financial account statements: This includes bank accounts, investment accounts and retirement accounts. Your lender will need proof of your assets.

- Figure out your homebuying budget: Knowing how much you’re comfortable spending each month on your mortgage is the first step to figuring out your price range. An affordability calculator can help you explore what you’re comfortable paying.

- Determine your down payment: While there are mortgages that require less, some conventional mortgages will require a 20 percent down payment. Having an idea about your down payment can help you determine how long you’ll need to save before starting to shop for a home.

Building your LGBTQ+-friendly homebuying team

To smooth your path toward homeownership, you’ll want an LGBTQ+-affirming homebuying team by your side.

“Having a real estate agent and a mortgage lender that you trust is a simple but really important way to feel confident and protected as you go into what is one of the most important financial decisions you’ll make,” says Stephen Truso, CFP®, senior vice president, Investment Products Group at U.S. Bancorp Investments. Most people only buy a home once or twice in their life, so building a team that will understand you and your needs will make that home purchase an ultimately more satisfying and valuable process.

Finding an LGBTQ+-friendly real estate agent

You can begin your search for an agent by reaching out to your own network. If you’re moving to a new area where you don’t yet have a support network, look into local organizations that could help. You can seek out chapters of the National Gay and Lesbian Chamber of Commerce (NGLCC) or the LGBTQ+ Real Estate Alliance to find a real estate agent.

As you speak to potential agents, don’t be shy about asking each about their experience in the market and how they typically work with clients. Some agents are more hands-off and will only show you the listings you send them. In contrast, others will help you tour potential neighborhoods and add an extra layer to your home search, including recommending nearby queer-owned businesses and LGBTQ+ events in the area.

Finding an LGBTQ+-friendly mortgage lender

Gay couples are 73 percent more likely to be denied a mortgage than heterosexual couples with the same creditworthiness, according to an Iowa State University analysis of national mortgage data. That’s one reason why finding a lender who’s LGBTQ-affirming is important.

As you consider different mortgage lenders, keep in mind that your loan type, term and interest rate are only part of your total mortgage equation. Be sure to ask about estimated closing costs, documentation requirements and time to close; 30 days from an accepted offer is standard. Having this data will help you better compare loans and lenders.

Get pre-approved for a home mortgage

Once you have your finances in shape, a real estate agent in your corner and a mortgage lender by your side, it’s time to get pre-approved.

Mortgage pre-approval is the process where a lender gives you tentative approval for a mortgage based on your financial and employment information. Once you’re pre-approved, the lender will issue you a letter with your loan type, maximum loan amount and interest rate.

Mortgage pre-approval is an essential step because it lets you know if there are additional steps you need to take to improve your finances. It also indicates to both your agent and a seller’s agent that you're a serious buyer and likely to be able to close on the loan.

And now, the only thing you have left to do is take your time and find your dream home.

“Homeownership is a long-term strategy for accumulating wealth for the LGBTQ+ community,” Truso says. “With the right finances and team by your side, you’ll be off to a strong start on what’s hopefully a lifetime of financial prosperity.”

The mortgage team at U.S. Bank has a long track record of working with LGBTQ+ borrowers. Connect with a mortgage loan officer near you.