Changes in credit reporting and what it means for homebuyers

What’s the difference between Fannie Mae and Freddie Mac?

How I did it: Turned my side hustle into a full-time job

Closing on a house checklist for buyers

Checklist: 10 questions to ask your home inspector

Is it cheaper to build or buy a house?

Know your debt-to-income ratio

Is it cheaper to build or buy a house

Overcoming high interest rates: Getting your homeownership goals back on track

For today's homebuyers, time and money are everything

How I did it: Bought my dream home using equity

Buying a home Q&A: What made three homeowners fall in love with their new home

Should you buy a house that’s still under construction?

Crypto + Homebuying: Impacts on the real estate market

Preparing for homeownership: A guide for LGBTQ+ homebuyers

How I did it: Built living spaces to support my family

Your guide to breaking the rental cycle

What are conforming loan limits and why are they increasing

Webinar: Uncover the cost: Building a home

Community activist achieves dream of homeownership

Checklist: 6 to-dos for after a move

Military homeownership: Your guide to resources, financing and more

Bringing economic opportunity to underserved communities one home at a time

Saving for a down payment: Where should I keep my money?

How I did it: Bought a home without a 20 percent down payment

Home buying myths: Realities of owning a home

Are professional movers worth the cost?

The lowdown on 6 myths about buying a home

Get more home for your money with these tips

First-time homebuyer’s guide to getting a mortgage

4 ways to free up your budget (and your life) with a smaller home

Quiz: How prepared are you to buy a home?

How you can take advantage of low mortgage rates

Webinar: Mortgage basics: How much house can you afford?

Webinar: Mortgage basics: Prequalification or pre-approval – What do I need?

What to know when buying a home with your significant other

Webinar: Mortgage basics: 3 Key steps in the homebuying process

How do I prequalify for a mortgage?

Webinar: Mortgage basics: Finding the right home loan for you

Webinar: Mortgage basics: Buying or renting – What’s right for you?

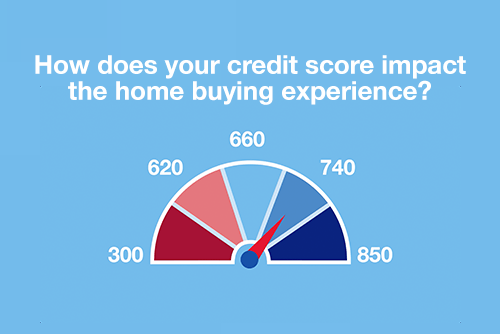

Webinar: Mortgage basics: How does your credit score impact the homebuying experience?

8 steps to take before you buy a home