How to create a financial plan to grow your LGBTQ+ family

LGBTQ+ adoption 101: What prospective parents should know

How to create a financial plan to grow your LGBTQ+ family

Prospective LGBTQ+ parents must face unique hurdles on their journey to parenthood. Here we explore what it financially takes to grow your family and how to create a financial plan to help get you there.

Having a family and raising kids is a lot of work, but for prospective parents in the LGBTQ+ community, family planning comes with unique financial hurdles. If you're in the process of trying to grow your family, here are some steps you can take to create a comprehensive financial family growing plan.

Any parent will tell you that children are expensive, but just what level of expense should you prepare for? According to the USDA, the cost for raising a child is roughly $12,980 annually in a middle-income, two-parent home. This cost grows as the child does, along with an inflation increase. Somewhat surprisingly, most of that cost (29%) goes towards housing.

For LGBTQ+ parents-to-be, having a child starts with the expensive first step of bringing that child into the picture, whether through adoption or artificial reproduction. We spoke to expectant mother Ann, whose wife is currently carrying their second child, to better understand the hurdles in this unique situation. When asked about how she and her partner prepared for their journey, Ann said feeling financially comfortable was their first step. “I always knew kids were expensive,” she said. “I think most people do. We got to a point where we got a handle on [our loans] and we bought a house in the latter part of our 30s, too. Knowing that it was going to be a little bit more of a financial uphill to go through and process, I think that comfort level was key for us before we even entertained the idea of having kids.”

Whether through birth or adoption, both paths to growing your LGBTQ+ family have additional legal or healthcare-related fees attached. It's important to understand the costs involved in having children—from birth costs to seemingly far-off ones such as college tuition—when making the decision to grow your family.

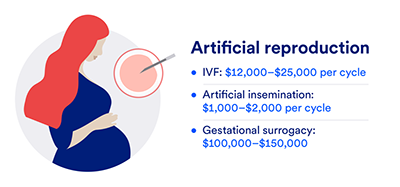

Most prospective LGBTQ+ parents have two options when it comes to having children: through adoption or through assisted reproductive technology (ART). Within those options are methods that range in price, from close to no cost to upwards of hundreds of thousands of dollars. For prospective parents who are nonbinary or transgender, having a child may mean preserving sperm or freezing eggs ahead of any gender-affirming procedures. Let’s explore the most common methods for growing your family:

In vitro fertilization, or IVF, is where mature eggs are fertilized with sperm in a lab setting before being placed in a uterus. As with most healthcare procedures, this process comes with some hefty costs. Your health insurance may cover some of the fees needed for IVF, and your employer may also offer family expansion assistance as well. Without coverage, prospective parents are looking at fees of $12,000 to $17,000 per cycle (with medicine, the cost is closer to $25,000 per cycle). For intended parents who need donated biological material like eggs or sperm, costs will be higher.

For those deciding to go down the IVF route, knowing how much you are willing to spend is a decision that should be made before the process starts. When asked about any surprises that came up in her journey to parenthood, Ann had this to say: “You have so little control and the process is inherently riddled with big emotions. You can put a plan in place, but you’ll inevitably go a little astray from that plan. We ended up spending more money than we thought we would. We had many more tries than we thought we needed, too.” Setting spending caps ahead of the process will help prevent your family from spending outside your means, rather than waiting to make those tough financial decisions until you have faced a failed cycle.

For those who can carry children, artificial insemination (the process of delivering sperm directly into the uterus) is a more affordable way to grow a family, however, carries a lower success rate when compared to in vitro fertilization. Prospective mothers can undergo this procedure either in a medical facility or conduct it in their own home. Sperm samples range in price from $700 - $1,000 per vial, and procedural costs range from $300 - $1,000, but those costs may qualify for coverage under your health insurance.

For people who cannot carry their own child, surrogacy is the most popular option for assisted reproduction—and one of the most expensive. Depending on how many cycles are needed for the egg to properly plant itself in the uterus, the cost of a surrogate can range from $100,000 – 150,000. As with adoptions, surrogates can be found through an agency, or you can make arrangements with a surrogate independently.

Here is a breakdown of average costs associated with surrogacy:

When a transgender or nonbinary person wants to become a parent, it’s recommended they store their eggs or sperm before undergoing gender-affirming surgeries or hormone treatments. You may be able to pause your treatments if you are planning on having a child, but you and your doctor will have to come up with a plan together that’s best for your health needs. Freezing eggs, including the hormones and additional lab work that’s required of this process, costs between $8,000 and $12,000. Storing those eggs also comes at a cost, ranging from $500 and $600 per year. Freezing sperm, however, is far less expensive. For collection, testing and containment, you can expect to pay around $1,000, plus $150 - $300 a year for storage.

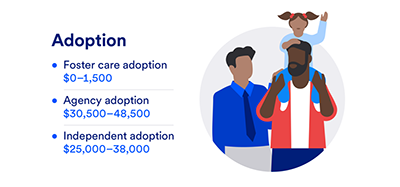

Adoption options for growing LGBTQ+ families

Adoptions have a reputation for being expensive. However, adopting through your local government is surprisingly affordable compared to other family expansion options. Foster care adoptions are funded through the state, meaning less fees for you to have to cover. According to Adopt Us Kids, the cost to adopt through the foster care system is anywhere from $0 - 1,500, depending on what state you live in.

An agency adoption is completed through a licensed adoption agency. The cost for adoption adds up quickly, with several legal requirements to meet. Costs include:

It is also recommended that you acquire a lawyer prior to starting your adoption journey, so consider those fees as well. According to Adoption.org, the average cost of an agency adoption is between $30,500 – 48,500.

Private adoption is where parents and birth mothers find each other and is a legal method of adoption in most states. It’s very important that both parties have legal counsel if doing an independent adoption for the protection of both the adoptive parents and the birth mother. Private adoption is usually more affordable than agency adoption, estimated to range from $25,000 – 38,000.

Your employer may offer benefits that help with costs associated with agency adoption and adoption through fostering. You can also take advantage of the Adoption Tax Credit by claiming on your federal tax return for a credit of $14,300 per child to help cover costs.

How to save for growing your LGBTQ+ family

Once you have come to a decision on how to bring a child into your life, it’s time to form a savings plan. When we asked Ann how she and her wife prepared financially, she said, “It’s just like planning for [any other] big financial goal. It goes back to any kind of big spending decision. Set aside ample time to plan for it as much as you can. Do as much online research as possible to have an idea of what you’re getting into. Take time to talk to a fertility doctor and clinic to get more precision around actual costs given your personal circumstances. You may or may not need to go right to IVF or the most expensive route. Estimate potential expenses, know what you can afford, and my best advice is set a budget. Having a ceiling to your spending will help you manage through the emotion side of the experience.”

Having a child also adds to your family’s cost of living, and depending on the size of your family, may require you to move to a larger home. Make a list of all the financial goals you must meet, as well as a timeline for when you need those funds available. This way, you can start saving for your most immediate needs first, while putting away smaller amounts for your less immediate goals.

If you need help structuring your finances to meet your goals, U.S. Bank offers free consultations with our goals coaches who can give you advice and help create a timeline.

The first thing you should do is sit down and review what is financially possible. How long will it take for you to save for a child? Can you afford the increase in healthcare, food and housing costs? Do you have unnecessary expenses that you can forego? Are you paying down debt in a fiscally responsible way, or could you consolidate or refinance for a smaller payment? Prioritize the goal of saving for the birth of your child first, but don’t jump into the process until you also have a reserved emergency fund.

The journey of having a child is a long and difficult one for queer people, so having support is crucial, whether that be financial, emotional or physical. If you need help reaching your financial goals, there are resources out there that could help. LGBTQ+ family building grants are made available to help queer families grow, offering trusts and scholarships.

For parents-to-be, having emotional support is just as important as having financial support. Bringing a child into your world is a complicated process, with many hurdles along the way. Luckily, there are lots of other parents who are on this journey with you who can relate. “You might feel like you’re alone,” said Ann when asked about her experience, “But LGBTQ+ people are everywhere. Same-sex couples having kids is becoming more and more common these days.” Take advantage of online social groups and forums and seek out other LGBTQ+ parents in your community. The internet is a treasure trove of information for parents navigating this tricky journey.

You also want to be supported by the medical and legal people helping you along this journey, like your doctor or lawyer. “You have to find a [clinic] that you’re comfortable with,” said Ann about her support system. “You have to feel welcome; you have to know that they’ve worked with other LGBTQ+ couples before. You have a choice in terms of your comfort level with your doctor, so take the time to interview them.”

Of equal importance is patience. When asked about hurdles she faced on her own journey, Ann had this to say: “I think for us, just like any other couple, this process just takes a lot of time and is definitely not for the faint of heart. The amount of bills you’re going to get and tracking it and spending time on the phone with healthcare providers… it’s an incredible amount of time. So just be prepared for that.”

Interested in learning more about how to plan financially for your growing LGBTQ+ family? Continue reading to learn more about your financial options and considerations.

Related content