Building the home of your dreams or falling in love with an older home that has lots of character is an emotional choice. But there’s a financial impact too.

There are a lot of factors to consider before deciding whether to build a house or buy one. There’s customization—choosing new finishes or going with historic charm; location—settling into a newer community or an older established neighborhood; and timelines—the speed of purchasing an existing house versus waiting for your dream home to be built. But what about the cost? Which is actually cheaper?

In general, buying an existing home is cheaper. According to the National Association of Home Builders and the U.S. Census Bureau the median cost to buy a house today is $410,600 which is $28,800 less than building one. But there are a lot of factors that could affect the final price, including the cost of the land, labor and materials, and short and long-term maintenance. Here are some things to consider before making your decision.

Pros and cons: Building a house

You can build a basic home for about $150 per square foot. But it’s easy to spend $500 per square foot if you want the best of everything. Still, building your own home means you’ll be paying for things you really want, like a large eat-in kitchen—and not items you may not need, like a separate formal dining room. Get ideas on building a unique dream home that fits your life.

Another plus is that new homes come with fewer long-term costs. For example, new homes with more energy-efficient building materials can mean lower utility bills. Also, new homes tend to have fewer repairs and lower maintenance costs.

Finally, newer homes may return a higher rate when you’re ready to sell.

On the downside, construction timelines are longer today than they were a few years ago due to labor shortages and difficulties sourcing construction materials. The U.S. Census Bureau reports that the average time it takes to build a home is 6.8 months, but that can easily extend to a year or more for owner-built homes. And you’ll have to budget for a place to live while your new home is being built.

Demand is also up, making the cost of building your dream home rise as well. According to the U.S. Census Bureau, the average price of a new-construction home has gone up $84,700 over the same time last year.

Pros and cons: Buying a house

There are fewer construction costs when you buy a house—unless you’ve bought a fixer-upper—and the transaction time is much shorter. But you may not get the exact home of your dreams.

Still, if you need to move quickly because you’re relocating for a new job or your children are starting at a new school, this may be a better option.

Also, if location is important, it may be easier to find an existing house than to find a lot to build a new house.

Another option is to look for a newly built home. That way you get the new-build smell but without the hassle of building the home yourself. Those homes are typically more expensive than an existing older home, but you’ll probably pay less for routine maintenance, repairs and energy costs.

Either way, buying an existing home can be a challenge in today’s market due to a shortage of supply in some parts of the country.

The bottom line

Home prices vary greatly depending on location, this is true for new construction as well as existing housing stock, so your best bet is to work with a real estate agent and contractor to model the costs for building versus buying. Make sure you look at:

- Home price trends in your chosen region

- The size of the home you want and any special design requests

- Construction costs, including labor and materials

- Cost of updates and renovations to an older home

- Whether you have the skills and time to do some of the work yourself

- The cost of living in a temporary place while construction is underway

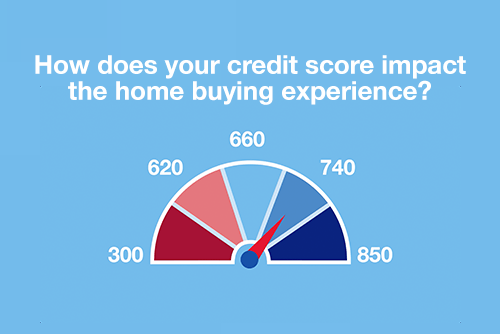

- The type of mortgage you choose

- Cost of maintenance and repairs over the long-term

- Average energy use

- How much your home might appreciate

Financing your home

According to CoreLogic, U.S. home sale prices were up nearly 16% year-over-year with the expectation that home price increases would slow moving forward, providing some market stabilization. That’s good news for buyers.

Getting your financing in place ahead of time can help you move quickly when you’re ready to buy. Start now by saving for a down payment and meet with a mortgage lender to go over your loan options and to get preapproved for a mortgage.

Keep in mind that if you decide to build your dream home the way you pay for it can vary, with many people opting for a mortgage to buy the land and then paying for the construction from savings or securing a construction loan. Having a construction loan can lead to two sets of closing costs, but other financing tools exist, so meet with a mortgage loan officer to go over your options.

Find out more about buying your next home including whether to remodel or move and get help with buying an existing home or building a new one.