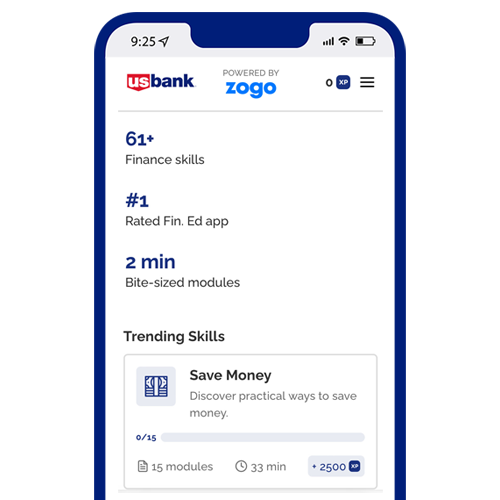

Learn at your own pace.

Explore gamified learning modules that are catered to your specific interests. This bite-sized content covers a range of topics from building a strong financial foundation to planning for your future retirement and more.

Saving

Jump start your saving habits.

Use these tips and resources to start building your emergency fund or save for a goal.

Budgeting

Spend and save with purpose.

Making a budget can give you better picture of how to work toward your financial goals.

Understanding credit

Get the lowdown on credit.

Find out what goes into getting a good credit score, why credit matters and how you can improve your score.

Managing debt

Manage your debt.

Knowing how to manage debt is a critical component of building your financial wellness. Get started with these tips.

Avoiding fraud

Keep your info safe and sound.

Get strategies for keeping your financial and personal data out of the hands of fraudsters, find out how to spot a scam and more.

Get personalized guidance.

Bring your goals to life by meeting with a goals coach who can work with you to turn your passions into plans.