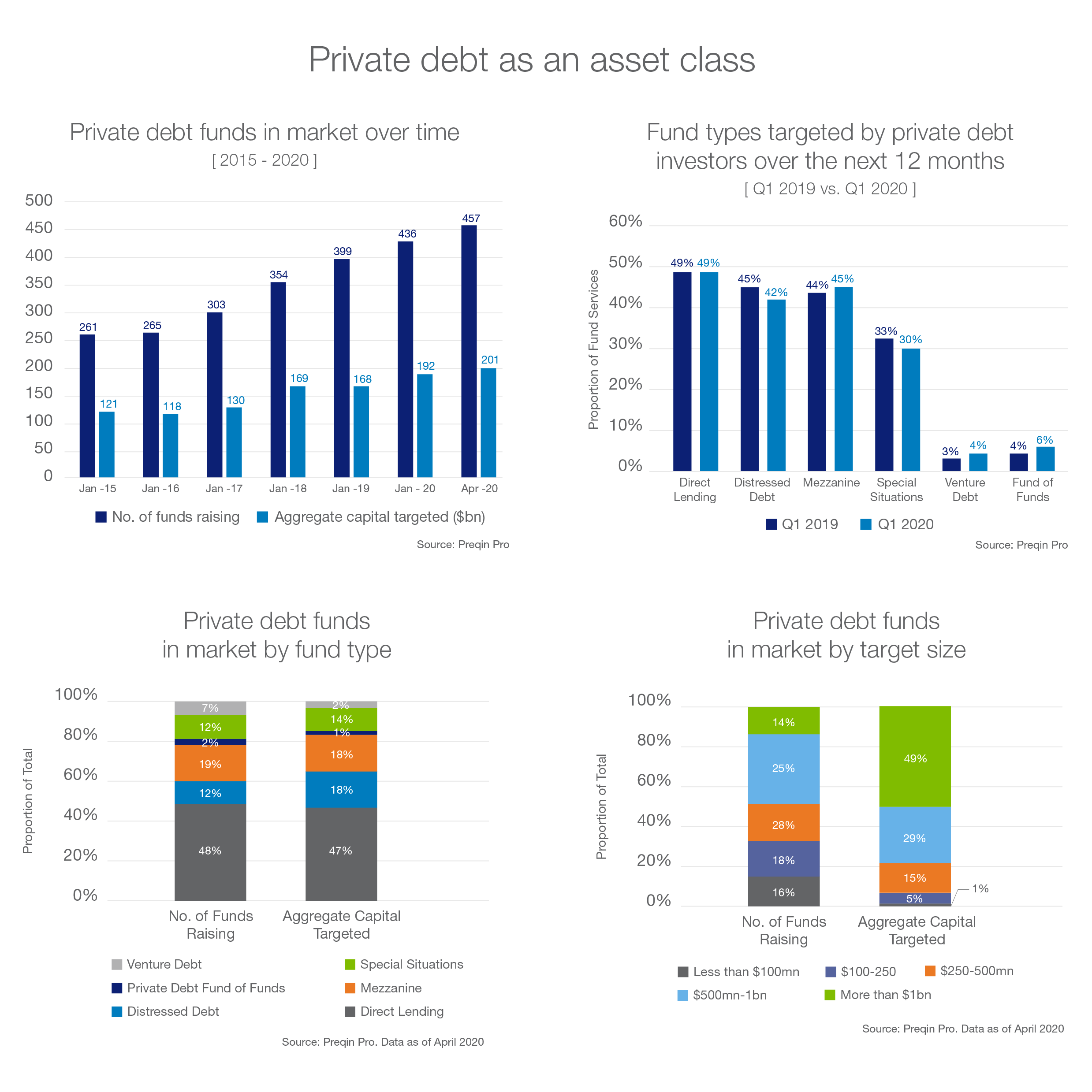

In uncertain markets, volatility and risk present opportunities for credit managers in the private debt space. Learn how pension fund and institutional investors can access these opportunities in the evolving COVID-19 recovery landscape as policy decisions continue to impact the market.

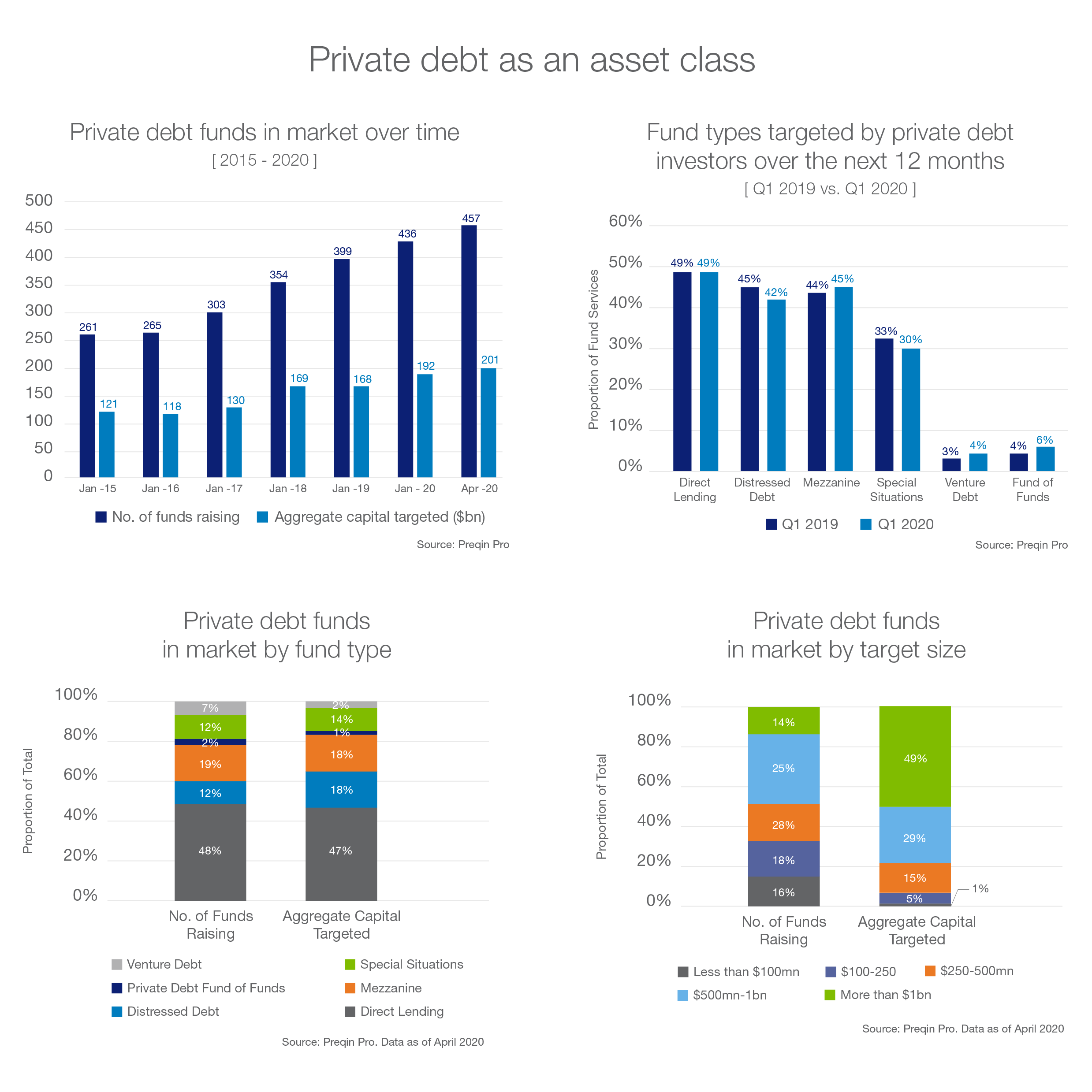

Private debt currently ranks as the third-largest asset class in private capital1, ahead of infrastructure and natural resources. During periods of market instability, prospects abound for managers in the credit space.

Source: Preqin Quarterly Update: Private Debt Q1 - April 2020

Structuring options in the post-2008 environment

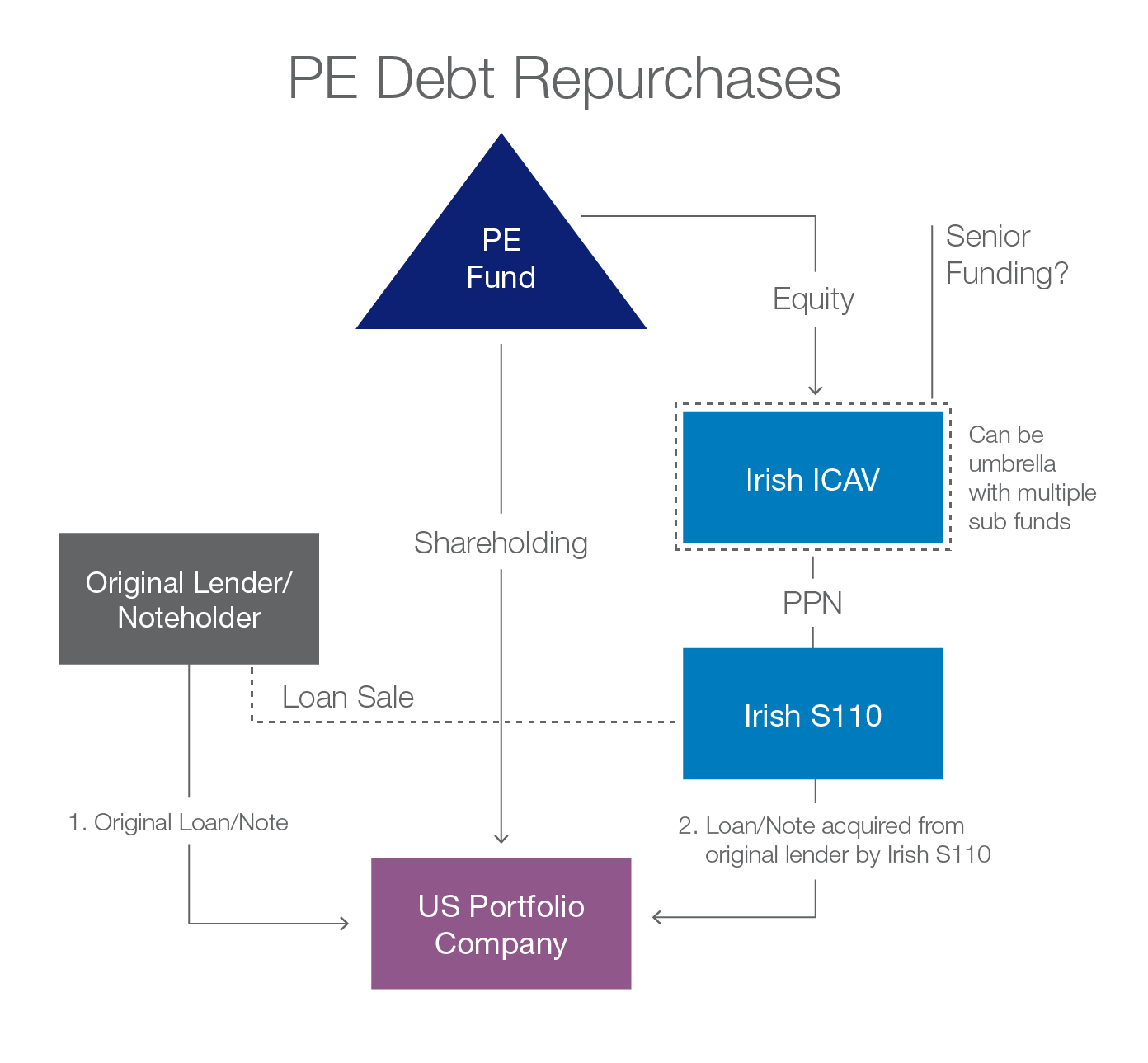

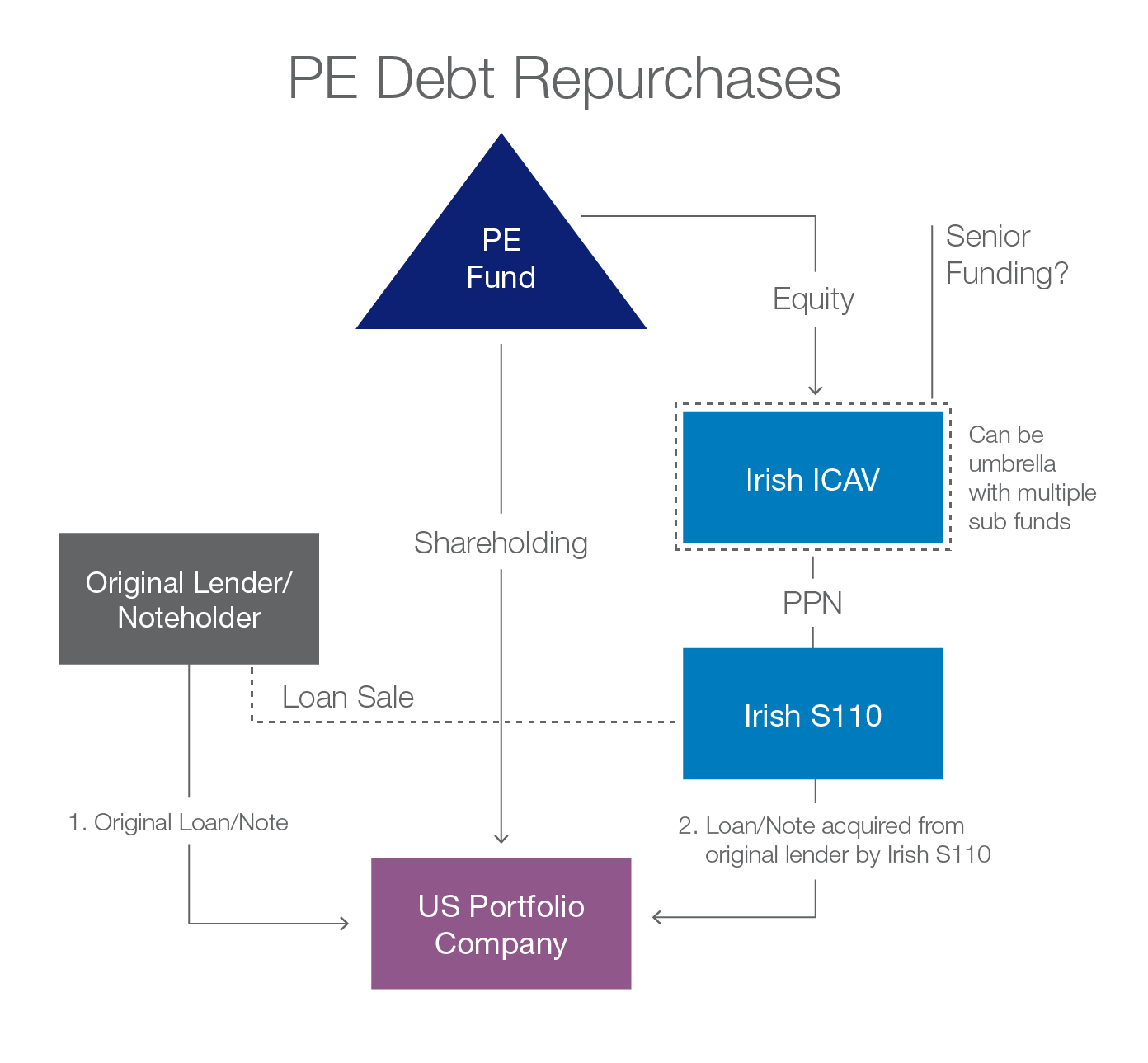

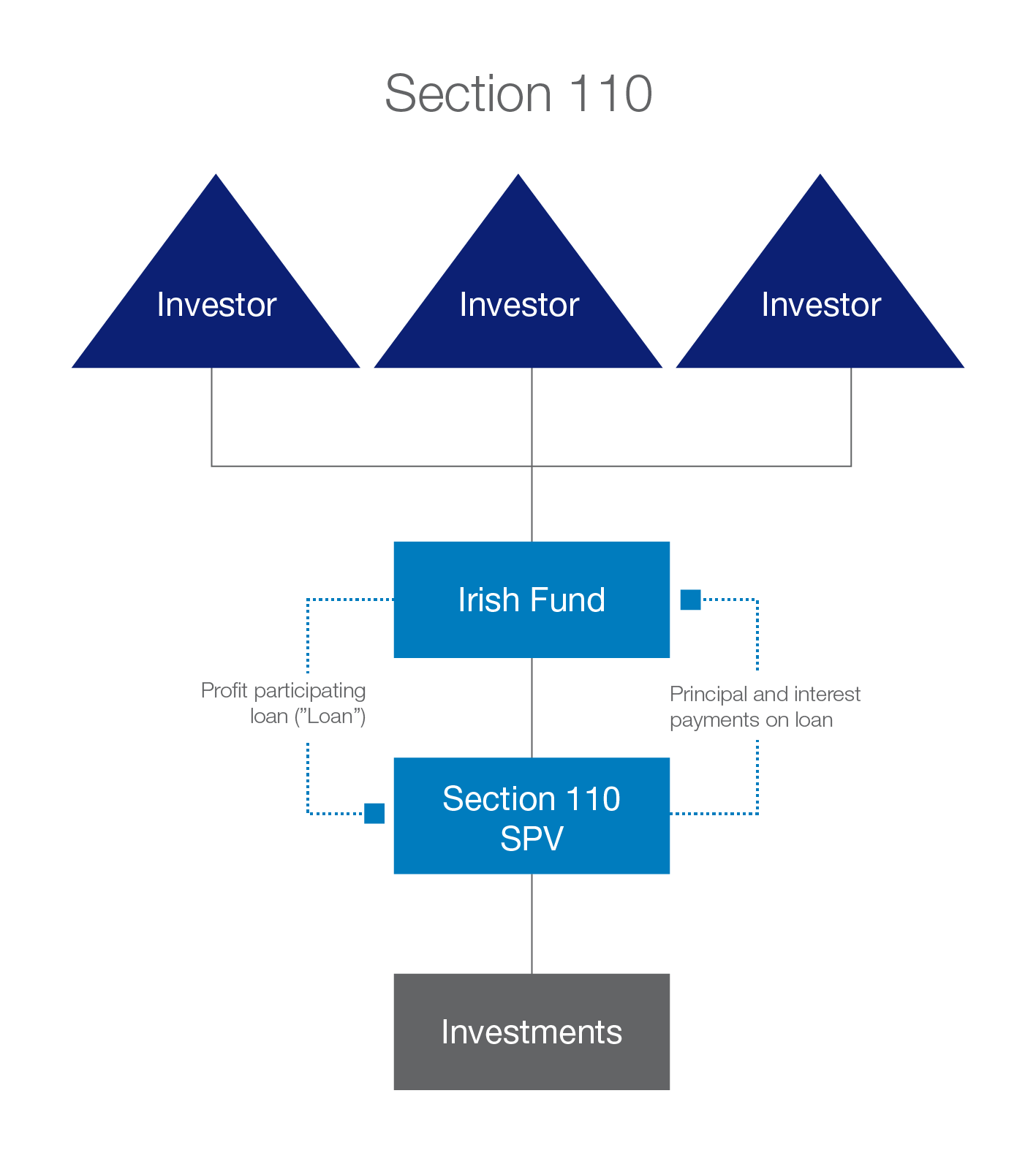

In the aftermath of the credit crisis of 2008, the unregulated Irish section 110 was a vehicle of choice for structuring debt and credit investments. The Irish section 110 is quickly established, providing speed to market. It also accommodates multiple corporate-debt restructuring and buyback transactions within one vehicle, which is especially beneficial in the face of a downward credit cycle.

Combined ICAV and Section 110 structuring opportunities

Increasingly, the regulated Irish Collective Asset-management Vehicle (ICAV) and unregulated Irish Section 110 are being deployed in combination as part of double tax, treaty-based structuring options for global managers.

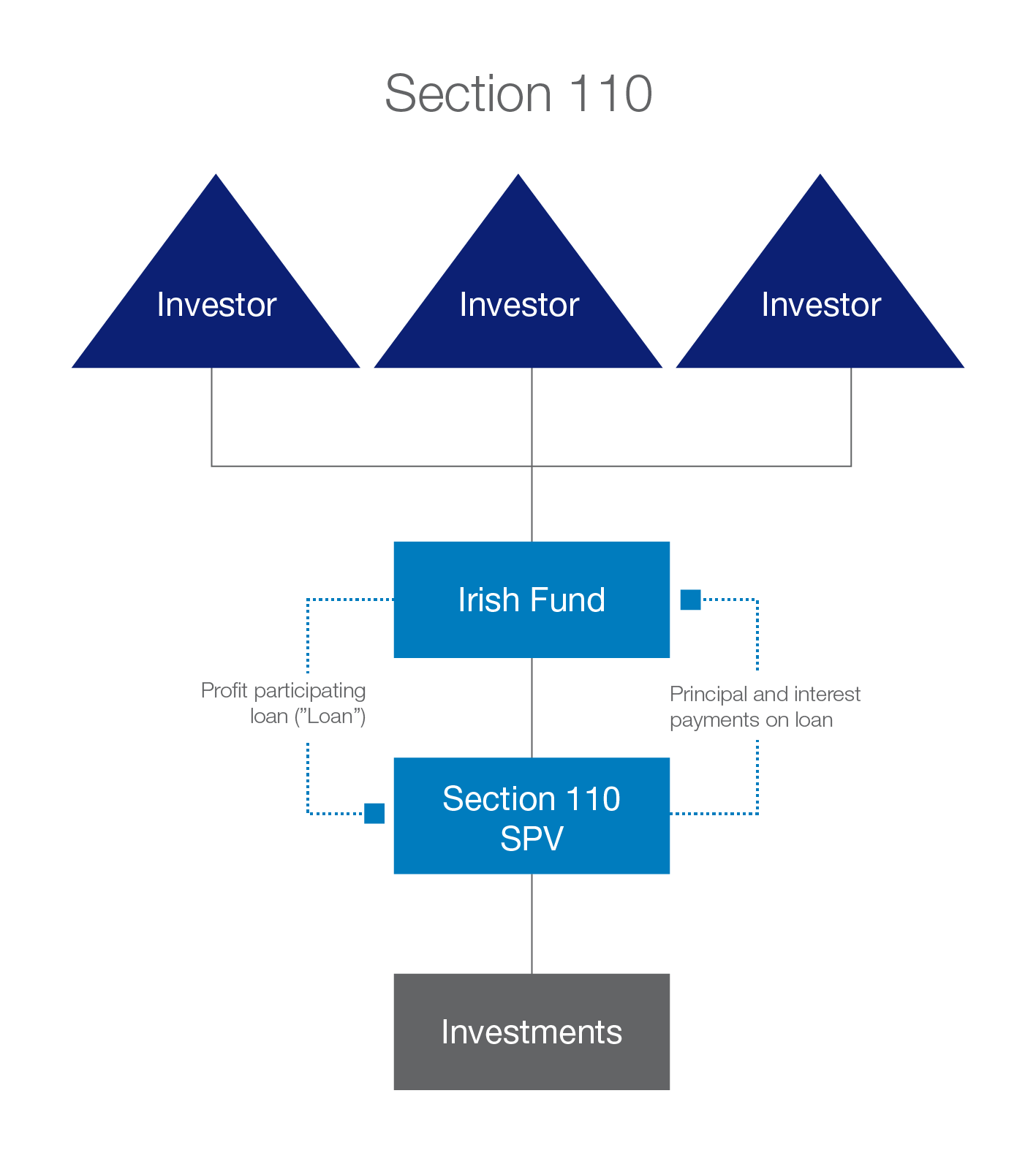

The disintermediation of banks, or the reduction of middlemen, continues to drive private credit opportunities. Section 110 represents a scheme with a specialised Irish taxation treatment that’s often used for securitizations, but is also adaptable to other scenarios, including direct lending / loan origination and distressed debt acquisitions.

In certain structures, a regulated ICAV is being interposed between the section 110 company and the investors. The ICAV supports regulated and unregulated vehicles within the overall structure and can help achieve the most efficient outcome for investors. Depending on the structure, a similar result can sometimes be accomplished solely by using an ICAV.

The ICAV is also viewed as a go-to vehicle for U.S.-based credit and debt investment opportunities, particularly where U.S. treaty access is critical to the efficiency of the investment structure. Deploying an ICAV – with its U.S./Irish double tax treaty benefits – can assist managers in solving structuring inefficiencies that would otherwise arise when acquiring U.S.-based investments.

Increased appetite for regulated structures

Institutional investors, including pension funds, tend to favour making allocations to regulated structures such as the ICAV. The impact of the Organisation for Economic Co-operation and Development’s (OECD) base erosion and profit shifting (BEPS) initiative and the EU's Anti-Tax Avoidance Directives (ATAD) also makes a regulated approach worth considering, with a direction of travel towards regulated structures emerging.

Benefits of a regulated option

A regulated option has benefits for both advisors and investors. Since it has the flexibility to be open-ended in nature, a regulated fund can facilitate a wide variety of investment liquidity profiles. It can provide ongoing tax efficiency. It can also safeguard the interests of investors, both through the regulatory requirements that apply to it and the regulated service providers with oversight responsibilities that are appointed to it.

Governance around regulated products usually includes the following parties:

- National regulator

- Fund administrator

- Depositary/custodian (for oversight of monies being invested)

- Fund manager/investment manager or advisor

Luxembourg, Ireland and Guernsey/Jersey serve as the main centres for private equity and credit funds in Europe, and they offer a variety of structured solutions. Ireland, for instance, provides an array of potential fund structures, both regulated and unregulated. Options vary in terms of levels of investment flexibility, minimum subscription requirements, tax regimes and regulatory requirements for service providers – all depending on which structure is chosen as the appropriate vehicle for a project.

ICAV (introduced in 2015)

The most popular regulated vehicle in Ireland is the ICAV. Unregulated structures are generally housed within a Section 110 company or an unregulated limited partnership structure. Ireland's regulated investment limited partnership structure is currently undergoing a legislative update. In Luxembourg, the RAIF, SICAV, SIF and SCSp serve as the comparable approaches on both the regulated and unregulated front. SCSp is especially favoured for GP/LP structures.

To help you best take advantage of regulated and unregulated structuring opportunities, the right partner can facilitate all vehicles in one integrated scheme. Learn more about our comprehensive, all-in-one solution at U.S. Bank.

1Source: Prequin