Common investment portfolio management fees

Investment fees are generally tied to the costs related to handling your assets and the expertise required to help manage your portfolio.

They could include:

- Trade commissions or brokerage fees. These are charged when you buy and sell securities, including stocks, bonds, mutual funds and exchange traded funds (ETFs).

- Transaction fees. These are charged when you buy and sell some mutual funds and ETFs.

- Sales load. This is a commission you pay to a broker or salesperson when you buy or sell a mutual fund or ETF.

- Management or advisory fees. This is the fee you pay your financial advisor for their services. It’s usually based on a percentage of the assets under management (AUM). For example, an advisor might charge 1.5% of AUM up to $150,000 and a slightly lower percentage as AUM rises.

- Expense ratio. This is an annual fee that some mutual funds and ETFs charge. The amount is based on a percentage of your investment in the fund.

- 401(k) fees. Your 401(k) plan sponsor charges this fee to cover the costs of plan administration and recordkeeping. It’s often passed on from the employer to plan participants.

Visible vs. invisible investment management fees

According to Haworth, the most obvious fees are the visible fees that appear as line items on a statement, such as an hourly charge for a financial professional, commissions on trades, loads on select mutual funds and redemption fees.

What doesn’t usually appear on statements, however, are the “invisible” fees that managers of mutual funds and exchange-traded funds (ETFs) charge.

Rather than providing guidance and investing advice like a financial professional, fund managers are responsible for implementing a fund’s investment strategy and managing trading activities. Fees associated with fund managers, which vary widely and are enmeshed in the day-to-day activities of the fund, are reflected in the daily net asset value of a share – not as a stand-alone figure.

“Financial professionals pay a lot of attention to costs embedded in funds, but clients may not ask about those fees unless they’ve been digging through the fund prospectus or semiannual report,” Haworth says.

Evaluate investment management fees and costs

Given the impact that expenses can have on your investment returns, Haworth suggests starting any fee discussion with two key questions:

- What do I get for this fee? Dig into the full scope of the offering. For example, if you’re creating a financial plan and there’s a planning fee, does that encompass creating the plan, adhering to it and the relevant investment research? Is there a team working for you? What services are included? What isn’t included that you might want? Consider the value of the expertise being provided. Do you have complex investments within your portfolio? Does your plan fulfill several goals and objectives?

- Is paying a higher fee worth it? Does a higher fee on an actively managed mutual fund — which uses a manager or team of managers in an attempt to outperform the market — make sense compared to a lower-cost index fund such as a passively managed fund —which simply follows the market index?

On the latter point, if the actively managed fund and the passively managed fund have a similar profile with many common holdings, it might make sense to opt for a lower-cost passively managed fund option. But if you’re considering an asset class where some selectivity can potentially enhance performance, then an actively managed investment might be more beneficial in the long run.

“We think a good case can be made for both active and passive investments, but you have to look at the data,” Haworth says.

When working with a financial professional, you may see fees in a variety of forms, such as in commissions; in the form of an hourly rate, or a flat fee calculated as a percentage of your assets under management. Many financial firms offer a sliding scale fee structure that drops as assets under management increase.

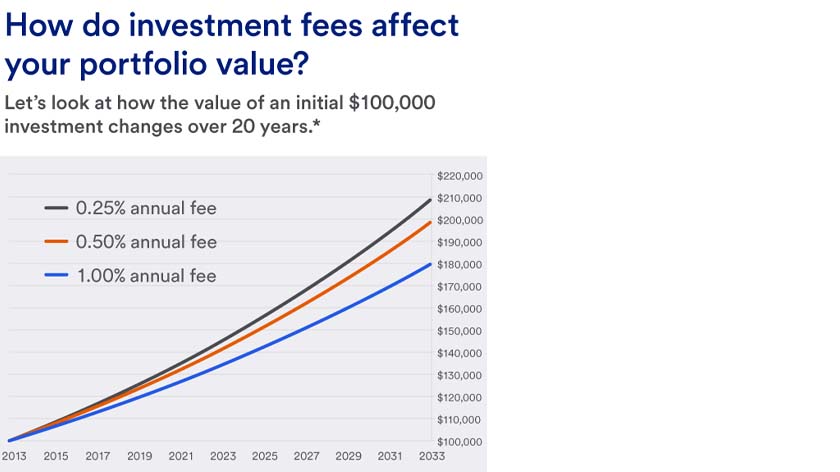

How investment fees impact your portfolio

The impact of fees on investment returns can add up over time, even if the fees themselves are relatively low. This can significantly lower your portfolio’s investment return over time.

For example, let’s say you have a $100,000 investment portfolio with a 4% annual return over 20 years. An annual fee of 0.50% would reduce the value by $10,000, compared with a portfolio with a 0.25% annual fee. If your annual fee were 1%, your portfolio value would be reduced by nearly $30,000 compared with a 0.25% annual fee.1