When it comes to time horizon, most investments fall into one of two broad categories: short-term or long-term investments. Each type can play an important role in a diversified investment portfolio, depending on your goals and investing timeframe.

What are short-term investments?

Short-term investments are those that can easily be converted to cash in less than three years without penalty or risk of loss, according to Rob Haworth, senior investment strategy director with U.S. Bank Asset Management.

Conversely, long-term investments are usually held in vehicles such as 401(k)s, IRAs and 529 education savings plans to meet long-term goals such as retirement and saving for college.

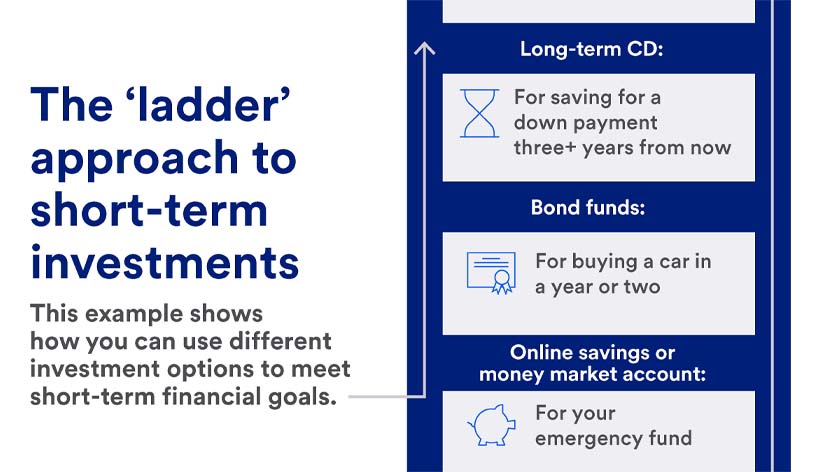

Short-term investments seek to strike the right balance between risk and reward. When saving money for near-term goals, you generally want to earn the highest yield while taking on the lowest risk possible.