FDIC-Insured - Backed by the full faith and credit of the U.S. Government

Section 1

Building resiliency

Finance leaders are balancing long- and short-term initiatives. Cost cutting is their top priority, but they are also evaluating new business models, generating insights for the wider business and changing capital allocation processes.

Section 2

Leveraging technology

Finance leaders tell us that they face three significant obstacles to successful transformation: resistance to change, lack of awareness of technology’s potential benefits and absence of technology skills.

Section 3

Learning during the pandemic

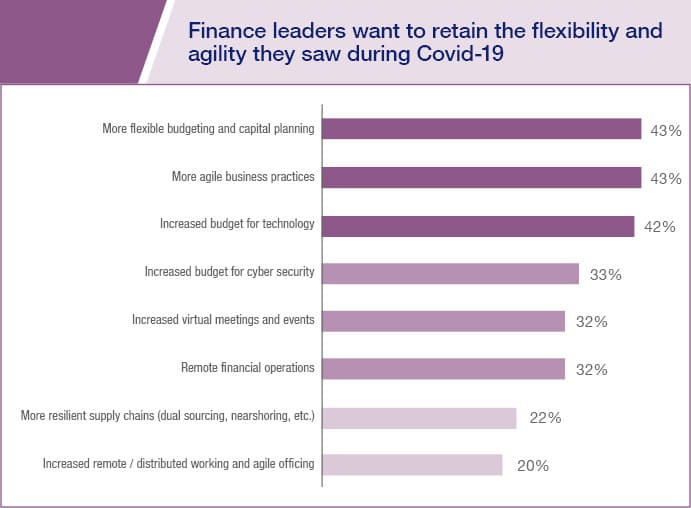

Our survey also asked whether they plan to continue any of the initiatives they introduced during COVID-19. Four in 10 say more flexible budgeting, more agile business practices and increased budget for technology.

Section 4

Focusing on ESG

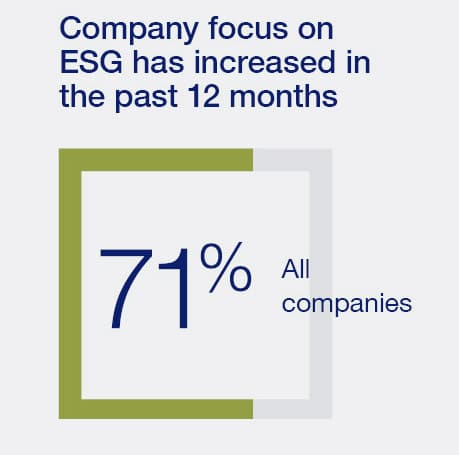

Finally, we explored the role of finance teams in driving sustainable growth. Notably, 71% of businesses say their focus on ESG (environmental, social and governance) has increased in the past 12 months.

About the research

The findings in this report are based on a survey of 300 U.S.-based senior finance professionals across a range of sectors and company sizes.

- All surveyed companies had revenues of more than $100 million.

- 47% of companies generated more than $1 billion in revenue.

- 10% generated more than $5 billion.

The survey was carried out in January and February 2021. We also conducted interviews with two CFOs:

- Denise Chamberlain, CFO, Chicago-based healthcare provider Edward-Elmhurst Health

- Linda Zukauckas, CFO, market measurement firm Nielsen

Section 1

Finance leaders sow the seeds for long-term growth.

Finance leaders face a delicate balancing act. On the one hand, they want to position their businesses for future success through digital transformation and new business models. But on the other, they have to focus on survival today – and for many that means cost cutting and improving cash flow.

Pulled in multiple directions

Striking the right balance is tough: 44% of finance leaders struggle to balance the short- and long-term needs of their business, and 46% struggle to balance the need to cut costs and build resiliency with the need to invest in future growth.

This is an unenviable situation to be in, but our survey data shows that finance leaders have not been completely side-tracked by short-term survival. It is true that their top priorities for 2021 are cutting costs, driving revenue growth and improving cash flow. But they are also supporting ESG initiatives, evaluating M&A opportunities, deploying technology within the finance function and evaluating new business models. By focusing on these areas too, finance leaders are helping to position their businesses for long-term success.

Q: What are your finance function’s greatest priorities for 2021? (Please select up to three.)

Section 2

Finance has to transform itself before it can help the wider business.

To help the wider business grow and transform in the ways described in section 1, finance must first transform itself.

Take the example of generating insights. This will be difficult if finance teams do not have the analytical platforms they need. Just 25% say that deploying technology within the finance function is a top three priority, but having adequate technology within the finance function is fundamental to supporting growth and transformation.

Risk and compliance are ripe for digital transformation.

When we asked which areas within finance would benefit most from digital transformation, finance leaders ranked risk and compliance first. This is likely driven by the fact that COVID-19 has raised awareness of the importance of adequate risk processes, controls and tools. The pandemic has also rapidly accelerated the rate at which customers interact and purchase from businesses through digital channels, which may be forcing finance teams to invest in technologies that help prevent payments fraud.

Do not overlook AP and AR technology.

Survey participants rank accounts receivable (AR) and accounts payable (AP) as the areas of finance that would benefit least from digital transformation. This likely results from the fact that many finance leaders are not fully aware of all of the tools and technologies that are at their disposal and their potential benefits. Indeed, finance leaders say that a lack of awareness about technology is their joint-second most significant barrier to digital transformation within the finance function.

But AP and AR technology can in fact deliver tremendous benefits. Identifying vendors who accept digital payments and deploying technology such as automation and virtual cards to replace paper-based manual work can significantly reduce costs, fraud and the potential for errors. The Digital Bridge report shows how using technology here can free up employees’ time for more value-adding activities while optimizing working capital.

Section 3

Preserving and enhancing the agility learned during COVID-19.

COVID-19 placed a huge amount of strain on finance functions. In many businesses, the workload increased because of reforecasting and budgeting requirements. Like many other teams, finance employees also had to shift to working from home.

When we asked which initiatives from the COVID-19 era respondents would like to preserve when the pandemic is over, more than 40% identified more flexible budgeting and capital planning, more agile business practices and increased budget for technology.

Q: Thinking about initiatives that your finance function and the wider business implemented during Covid-19, which do you plan to continue when the pandemic recedes? Select all that apply.

How can finance leaders inject flexibility into budgeting and capital planning? In addition to adopting a more data-driven approach as we saw in section 1, they can try to enable finance employees that are closest to certain business teams to approve investments – subject to certain parameters. Decentralizing decision-making in this way allows investment projects to be approved more swiftly

Another option is to hold back a certain proportion of the investment budget so that initiatives can be financed on a more opportunistic basis as they arise between planning cycles.

Despite the benefits of remote working, finance leaders are not keen to retain the COVID-19-era level of remote working when the pandemic recedes: only 20% of finance leaders plan to maintain remote and distributed working or agile officing. Instead, many will likely adopt a hybrid approach with greater flexibility that allows a balance of remote and in-office work.

Section 4

Finance teams tackle ESG.

Businesses are increasing their efforts to address ESG (environmental, social and governance) issues: 71% of finance leaders say their business’s focus on ESG has increased in the past 12 months, including 80% of those generating more than $5 billion and 82% of those in the energy and commodities sector.

Finance teams plan to play their part. Two-thirds of finance leaders say that the finance function should play an important role in addressing ESG issues, and three-quarters say they are clear about the role their team can play.

Practically speaking, what are finance teams doing? According to the survey data, 50% are assessing the environmental credentials of potential third parties and investments, and 45% are assessing the risk that climate change poses to the business’s operations and supply chains.

The opportunities for finance teams to push ESG objectives will vary depending on the nature of the business. But there are likely to be opportunities for multiple roles within finance to participate.

From our report

“Finance can and should be involved in ESG in a number of different ways. In my team, the accounts payable and procure-to-pay teams are very involved in environmental data collection and the reporting process. Our real estate team also gathers and reports on a lot of environmental metrics, while our corporate citizenship team captures and reports on our overall environmental footprint.”

Linda Zukauckas

CFO

Nielsen

Finance is ready to thrive.

Finance leaders have had a lot to deal with during the pandemic. But the survey reveals that they are looking forward. Put simply, finance leaders are not standing on the sidelines. They are working alongside other executives to ensure that their businesses not only survive but thrive.

If you would like to discuss any of the findings, please don’t hesitate to get in touch with U.S. Bank.