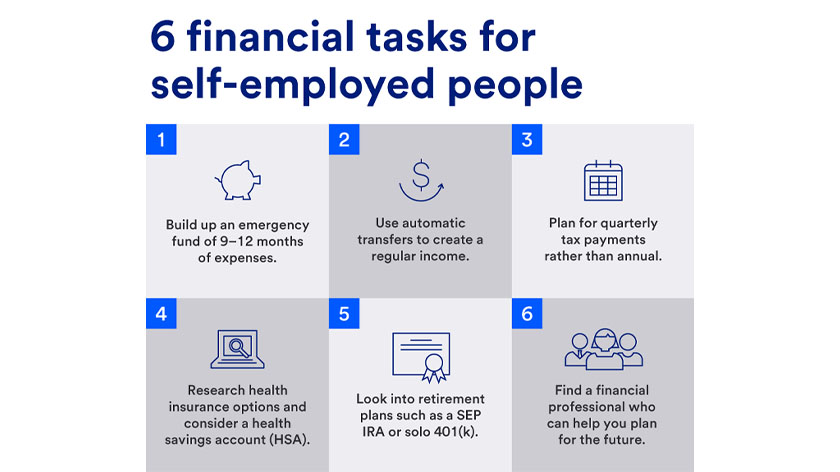

The primary vehicle for this financial cushion is an emergency fund. For people on salaries, it’s often recommended that they build up enough money to pay for three to six months of expenses. But given the varying nature of freelance income and the more frequent tax payments due, you may want to keep an even larger buffer – perhaps nine to 12 months.

You’ll want to keep this cash in an account that’s easily accessible but will help your balance grow, so consider a money market account or high-yield savings account. Set up an automatic transfer from your personal or business bank account each month until you reach your emergency fund target amount.

Finding insurance coverage for self-employed individuals

Employers typically provide health, life and disability insurance to their employees. However, as a self-employed individual, you’re on your own when it comes to selecting and purchasing coverage.

State-based exchanges are a good place to start for browsing health insurance options. Life and long-term disability insurance may also be critical if you have family depending on your income. Make sure to look for an “own occupation” policy tied to your specific career.

If you have a high-deductible insurance plan, consider opening a health savings account (HSA), which is a tax-advantaged way to save for medical expenses as well as retirement.

Self-employment tax planning

Tax planning is one of the more challenging aspects of being self-employed. Instead of your employer taking care of federal and state tax withholdings, you’ll need to do it yourself.

There are two primary tax considerations for self-employed individuals:

- You’re generally required to file an annual income tax return if your net earnings from self-employment were $400 or more in a given tax year.

- In addition to federal income taxes, you must also pay a federal self-employment tax, similar to the Social Security and Medicare taxes that are withheld from most wage earners’ paychecks. As your own boss, you pay the combined employee and employer Social Security tax rate of 12.4% on up to $168,600 of your net earnings, and the 2.9% Medicare tax on your entire net earnings.1

Fortunately, there are a number of self-employment income tax deductions to help offset the share of the taxes that an employer would usually cover, including the self-employment tax deduction, the deduction for self-employed retirement plan contributions, and the qualified business income deduction.

To determine the type and amount of taxes you’ll likely need to pay, you must figure any net profit or net loss from your business using the calculations on the IRS’ Schedule C. On this form, you can offset your self-employment income with business deductions, including the home office deduction available for homeowners and renters. Then, on Form 1040, after you have calculated the total income tax you owe, you can reduce that tax with business credits.

It's worth noting that eligibility for Social Security benefits also requires that you work and pay tax for a certain length of time to accumulate credits. The necessary amount depends on your date of birth, but nobody needs more than 40 credits (or 10 years of work).

Self-employed people pay taxes quarterly, not annually

For each year that you expect to owe at least $1,000 in taxes – including self-employment tax – you must pay estimated taxes quarterly. Self-employed individuals generally use Form 1040-ES to figure estimated tax.

As a rough guide, you can expect to pay taxes of roughly 30% to 35% of the income you make each quarter – which could include paying estimated state taxes if you live in a state that imposes a state income tax. The percentage you pay could also change if you file a joint return with your spouse.

If you don’t pay enough estimated tax each quarter, you may have to pay a penalty. You also may have to pay a penalty if your estimated tax payments are late, even if you are due a refund when you file your tax return.

Be diligent about reporting your entire self-employment income. Many self-employed people receive 1099 forms from their clients that account for the total amount the clients paid them each year. They can use this information to tally their entire self-employment income for the year. Clients are also obliged to send copies of the 1099 forms to the IRS, so the agency can then verify the accuracy of the income you report. While clients are not required to send a 1099 form if they paid you less than $600 during the year, you are still required to report that income on your tax return – as well as all income you received in cash.

Retirement for self-employed individuals

As a self-employed individual, you are the employer and the employee when it comes to employer-sponsored retirement plans. You have access to the same IRS tax qualified retirement plans as an employer with multiple employees, which can provide tax advantages and enhanced savings options potentially greater than just an IRA.

Research retirement plans for self-employed individuals, such as a Simplified Employee Pension (SEP) IRA, or Individual (Solo) 401(k) plans, which have some of the same tax advantages available to traditional employees. Then, set up automatic transfers to your account. A financial professional can help you navigate the options.

Once you are retired, distributions from traditional IRAs, SEP IRAs or Solo 401(k)s are considered taxable income. Roth IRA or Roth 401(k) plan distributions are not taxed when withdrawn at retirement when certain requirements are met.

Be sure to carefully review your situation with your tax professional to determine which qualified retirement plan option works best with your business structure, tax, and savings needs.

When it comes to managing your self-employment income, including self-employment taxes, there’s no getting around the fact that more administrative responsibility rests on your shoulders than it would if you were a traditional full-time employee. But by putting the proper systems in place to track your income, expenses and expected taxes, and building up a financial buffer, you can enjoy the full benefits of being your own boss.

A financial professional can help bridge the gap between your business and personal finances. Find a wealth specialist in your area.