Guide for investing

How does an electronic point of sale help your business keep track of every dime?

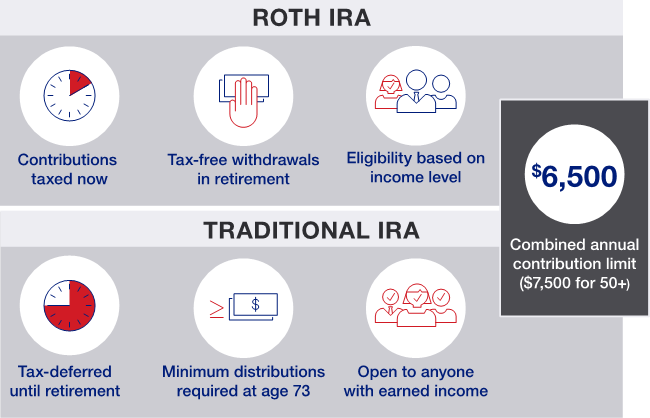

Start a Roth IRA for kids

Investing myths: Separating fact from fiction in investing

How much money do I need to start investing?

5 financial benefits of investing in a vacation home

7 diversification strategies for your investment portfolio

Effects of inflation on investments

4 times to consider rebalancing your portfolio

ETF vs. mutual fund: What’s the difference?

5 questions to help you determine your investment risk tolerance

4 major asset classes explained

Why compound interest is important

Do your investments match your financial goals?

Understanding yield vs. return

What type of investor are you?

How to start investing to build wealth

Investment strategies by age

Saving vs. investing: What's the difference?

4 strategies for coping with market volatility

Can fantasy football make you a better investor?

How do interest rates affect investments?

What types of agency accounts are available for investors?