The startup scene in Reno: The story of Breadware

The startup scene in Reno: Emerging tech leads the way

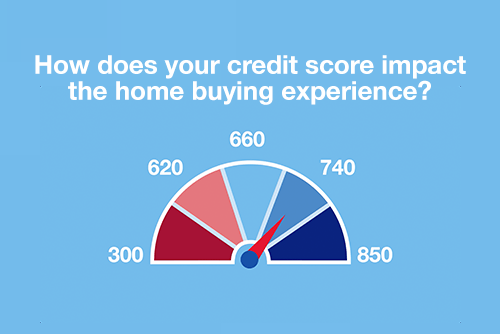

Changes in credit reporting and what it means for homebuyers

What’s the difference between Fannie Mae and Freddie Mac?

Business tips and advice for Black entrepreneurs

How I did it: Turned my side hustle into a full-time job

Talent acquisition 101: Building a small business dream team

Make your business legit

How to test new business ideas

How to get started creating your business plan

5 principles for avoiding ethics pitfalls on social media

3 simple brand awareness tips for your business

Community development in action: Revitalizing the old into new

How this photography business persevered through tough times

When small business and community work together

How tenacity brought Taste of Rondo to life

How Gentlemen Cuts helps its community shine

How running a business that aligns with core values is paying off

Meet the Milwaukee businessman behind Funky Fresh Spring Rolls

How a family-owned newspaper is serving its community

Community behind Elsa’s House of Sleep

How Shampoo’ed is transforming hair and inspiring entrepreneurs

How Lip Esteem is empowering women

How community gave life to lifestyle boutique Les Sol

The business behind environmental sustainability

5 ways to build your business through community engagement

5 financial goals for the new year

Year-end financial checklist

How to manage your money: 6 steps to take

Key components of a financial plan

Good money habits: 6 common money mistakes to avoid

How to talk about money with your family

4 tips to help you save for retirement in your 20s

How to build wealth at any age

Retirement income planning: 4 steps to take

Preparing for retirement: 8 steps to take

Achieving their dreams through a pre-apprenticeship construction program

How I did it: Switched career paths by taking an unexpected pivot

Do your investments match your financial goals?

Investment strategies by age

Preparing for adoption and IVF

11 essential things to do before baby comes

Closing on a house checklist for buyers

Webinar: Uncover the cost: Starting a family

Checklist: 10 questions to ask your home inspector

Checklist: financial recovery after a natural disaster

Webinar: Uncover the cost: College diploma

Co-signing 101: Applying for a loan with co-borrower

How I did it: Paid off student loans

Practical money skills and financial tips for college students

5 things to know before accepting a first job offer

How to build credit as a student

Webinar: Bank Notes: College cost comparison

The A to Z’s of college loan terms

Tips for handling rising costs from an Operation HOPE Financial Wellbeing coach

5 tips for creating (and sticking to) a holiday budget

Is it cheaper to build or buy a house?

Stay committed to your goals by creating positive habits

5 things to consider when deciding to take an unplanned trip

Friction: How it can help achieve money goals

Working with an accountability partner can help you reach your goals

Growing your savings by going on a ‘money hunt’

Webinar: Smart habits and behaviors to achieve financial wellness

A who’s who at your local bank

Your 4-step guide to financial planning

What military service taught me about money management

Does your savings plan match your lifestyle?

Webinar: Uncover the cost: Wedding

Adulting 101: How to make a budget plan

How having savings gives you peace of mind

Allowance basics for parents and kids

Personal loans first-timer's guide: 7 questions to ask

Are savings bonds still a thing?

Tips to overcome three common savings hurdles

Helpful tips for safe and smart charitable giving

Webinar: Mindset Matters: How to practice mindful spending

How to save money while helping the environment

You can take these 18 budgeting tips straight to the bank

Do you and your fiancé have compatible financial goals?

9 simple ways to save

How to save for a wedding

It's possible: 7 tips for breaking the spending cycle

Here’s how to create a budget for yourself

Multiple accounts can make it easier to follow a monthly budget

7 steps: How couples and single parents can prepare for child care costs

5 reasons why couples may have separate bank accounts

Dear Money Mentor: How do I set and track financial goals?

Money Moments: 8 dos and don’ts for saving money in your 30s

30-day adulting challenge: Financial wellness tasks to complete in a month

What’s in your emergency fund?

Certificates of deposit: How they work to grow your money

How to stop living paycheck to paycheck post-pay increase

What you need to know about renting

Bank from home with these digital features

Building a financial legacy for your family and community

It’s time for a fresh start: A new way of thinking

Is a home equity loan for college the right choice for your student

Your financial aid guide: What are your options?

Parent checklist: Preparing for college

How grandparents can contribute to college funds instead of buying gifts

Using 529 plans for K-12 tuition

How to talk to your lender about debt

How to apply for federal student aid through the FAFSA

Be careful when taking out student loans

Know your debt-to-income ratio

How to use debt to build wealth

How to use your unexpected windfall to reach financial goals

Is it cheaper to build or buy a house

Overcoming high interest rates: Getting your homeownership goals back on track

For today's homebuyers, time and money are everything

How I did it: Bought my dream home using equity

Buying a home Q&A: What made three homeowners fall in love with their new home

Should you buy a house that’s still under construction?

Crypto + Homebuying: Impacts on the real estate market

Preparing for homeownership: A guide for LGBTQ+ homebuyers

How I did it: Built living spaces to support my family

Your guide to breaking the rental cycle

What are conforming loan limits and why are they increasing

Webinar: Uncover the cost: Building a home

Community activist achieves dream of homeownership

Checklist: 6 to-dos for after a move

Military homeownership: Your guide to resources, financing and more

Bringing economic opportunity to underserved communities one home at a time

Saving for a down payment: Where should I keep my money?

How I did it: My house remodel

How I did it: Bought a home without a 20 percent down payment

Home buying myths: Realities of owning a home

Are professional movers worth the cost?

Money Moments: Tips for selling your home

The lowdown on 6 myths about buying a home

Get more home for your money with these tips

First-time homebuyer’s guide to getting a mortgage

4 ways to free up your budget (and your life) with a smaller home

Quiz: How prepared are you to buy a home?

How you can take advantage of low mortgage rates

Webinar: Mortgage basics: How much house can you afford?

Webinar: Mortgage basics: Prequalification or pre-approval – What do I need?

What to know when buying a home with your significant other

Webinar: Mortgage basics: 3 Key steps in the homebuying process

How do I prequalify for a mortgage?

Webinar: Mortgage basics: Finding the right home loan for you

Webinar: Mortgage basics: Buying or renting – What’s right for you?

Webinar: Mortgage basics: How does your credit score impact the homebuying experience?

8 steps to take before you buy a home

6 questions to ask before buying a new home

Webinar: Uncover the cost: Home renovation