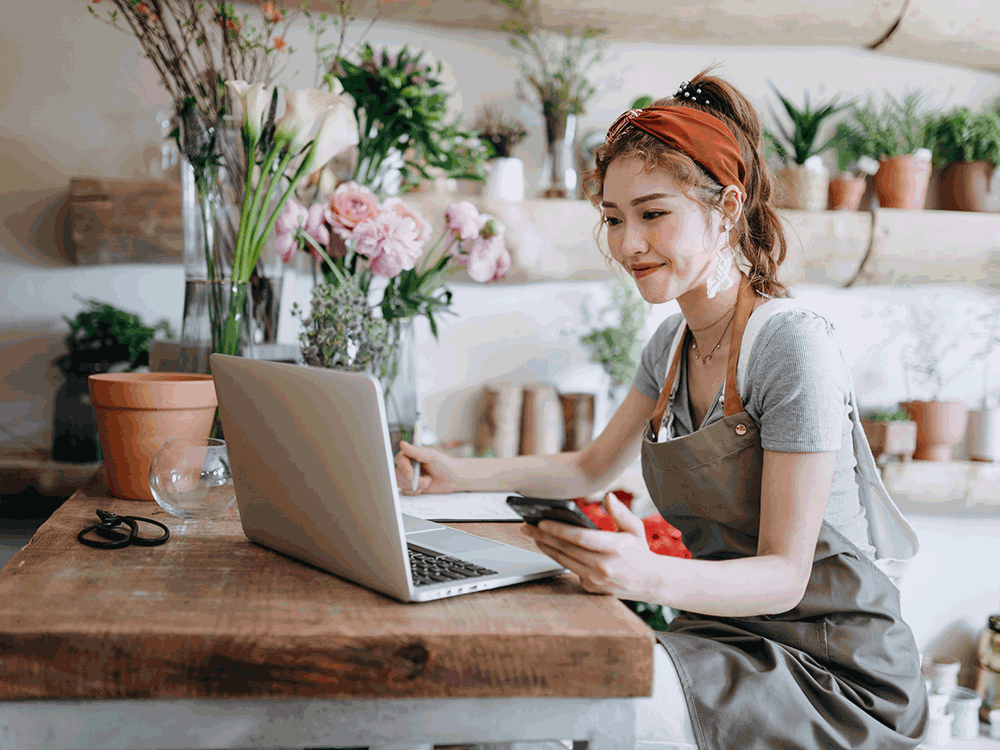

Designed with security and convenience in mind, these advanced digital features make it easy to stay on top of finances from the comfort of your couch.

There are now more ways than ever to do things from your home (or on the go) including banking. Digital platforms like U.S. Bank Smart Assistant and the U.S. Bank Mobile App allow customers to safely manage day-to-day banking without requiring in-person contact. Let’s take a look at a few ways to monitor your money from your home using secure and convenient technology.

Bank by voice

Perfect for those who would rather stay home, the U.S. Bank Smart Assistant allows you to ask banking-related questions and speak requests using voice technology within the U.S. Bank Mobile App. Instead of navigating a series of menus, checking boxes and flipping through a digital interface, the Smart Assistant is readily accessible and similar to an in-person assistant. With a simple text or voice cue, it can help with everything from Zelle™ transfers to checking when your bills are due. You can also ask for data about spending habits and move money quickly, with a quick command like “transfer money from checking to savings.” Instead of making a trip to see your teller, you have the option to communicate with the Smart Assistant without leaving the house.

Use a safe and secure platform

When using or entering financial information online, it’s critically important to take all security measures available to protect your data. The U.S. Bank Mobile App has an Online Risk-Free Guarantee that protects users from unauthorized activity or potential losses if used correctly. To make the log-in process quick, easy and safe, iPhone and iPad users can use TouchID or FaceID, and Android users can use fingerprint authentication.

Debit and credit card controls help you can stay on top of all card activity and monitor for something unusual. You’ll have access to alerts and reminders – including travel notifications – which you can customize to fit your needs and preferences. In the event that you do happen to misplace your card, you can temporarily “lock” it in the app for safekeeping and “unlock” it if you find it. From the app, you can also conveniently report a card lost or stolen and arrange for a new one to be sent to you.

If you’d prefer to bank from your desktop or tablet, online banking is another safe and secure option. The Online Risk-Free Guarantee still applies. Plus, new encryption and firewall technology means your personal information is protected.

Take advantage of digital bills and statements

With the bill pay feature, you can forget the hassle of visiting multiple websites to pay your bills each month. To set it up, simply enroll in bill pay, add each biller and schedule a recurring payment. Once complete, you don’t have to worry about tracking multiple bills and you can rest assured that all your bills are paid on time. Bonus tip: setting up the bill pay feature reduces all that extra paper.

You can review e-statements and transaction history online or directly in the app. If you’re interested in making the switch from paper filing to digital organization, you can view your statements and set up access to electronic tax documents, performance reports and trade confirmations. This digital method allows you to view documents up to three days earlier than by mail, reducing the likelihood of mail fraud and identity theft.

Worried about how you’ll hold onto your records? Most systems let you trace several years of printable statements, so you can often times find what you’re looking for.

Open cards, cash checks and make digital transfers from home

Mobile apps also help you limit your visits to your local branch with its virtual check deposit feature. You can safely deposit your check, 24 hours a day, 7 days a week. Often, the amount is transferred into your account immediately.

To use this feature, within the app take a photo of the front and the back of the signed check, and then deposit them to your account. You’ll see the amount added to your balance within one business day.

The app also helps you send money easily and securely. Send funds to anyone with a bank account in the United States in just a few minutes via Zelle™, a person-to-person money transfer service. All you need to do is enter their email address or mobile phone number and hit “send.” This offers a quick, easy way to split a dinner restaurant bill with friends, or to pay your pet sitter or babysitter without the need for cash or checks. You can even request payments from others. Zelle™ services are completely free when doing personal banking with U.S. Bank.

Digital features made for real life

Sometimes banking requires a visit to your local branch. Visit the U.S. Bank website to find a location or, if you’re on the go, you can use the U.S. Bank Mobile App to locate ATMs and branches near you. Made for busy schedules and remote banking, the U.S. Bank online platform and app have everything you need in one place, accessible at your fingertips.

To send money in minutes with Zelle™ in the U.S. Bank Mobile App or online experience, you must have an eligible U.S. Bank account and have a mobile number registered in your online and mobile banking profile for at least three calendar days. Transactions typically occur in minutes when the recipient’s email address or U.S. mobile number is already enrolled with Zelle™. Users must have a bank account in the U.S. to use Zelle™. Terms and conditions apply.

Requests for money with Zelle™ (including Split requests) sent to a U.S. mobile number require that the mobile number first be enrolled with Zelle™.

Zelle™ and the Zelle™ related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Deposits made using mobile check deposit are subject to the Digital Services Agreement and may not be available for immediate withdrawal. In some cases it may take more than on business day for funds to be available.