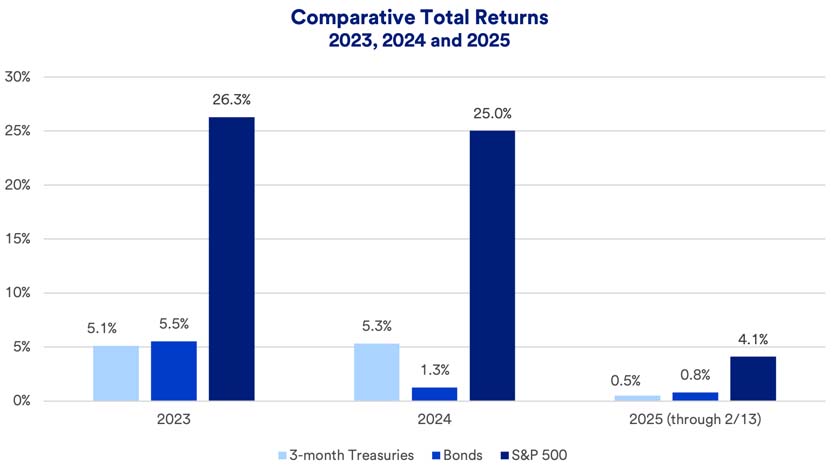

In an era of higher interest rates, investors may naturally wonder if it’s appropriate to increase cash positions in their portfolios. Short-term cash opportunities appear attractive, but those seeking to achieve long-term goals need to position assets with their goals and time horizon in mind.

There’s a proper role for cash in any asset mix. It is always important to have cash on hand to meet emergency needs or to fund short-term opportunities. Cash can also play an important role in long-term financial planning. Yet investors always want to be cautious about holding too much cash. This is particularly true at a time when higher yields are available on cash-equivalent vehicles.

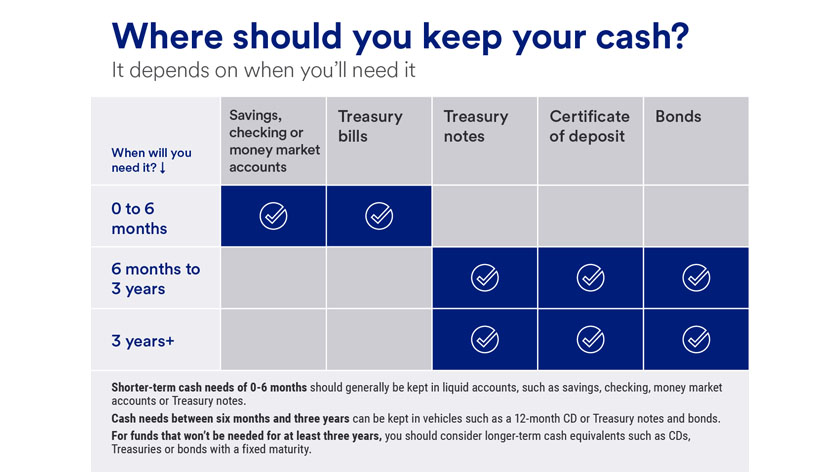

What are cash equivalent vehicles? They’re typically defined as accounts like savings, checking and money market accounts, as well as short-term investments with maturities less than 90 days, such as CDs, bonds and Treasuries.

What is the role of cash and cash equivalents in my investment portfolio?

“From an investor’s perspective, cash serves different purposes depending on the objective,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management. “Everybody has a need to maintain at least 3-6 months of income in cash to meet emergency needs or to cover near-term spending plans.”

Within a long-term investment portfolio, Haworth says investors must maintain a different perspective. For example, cash provides retirees with peace of mind that they have sufficient liquid reserves to weather periods of uncertainty or an economic downturn. A portion of a retirement portfolio can be directed to cash equivalents to help meet income needs over a 2- or 3-year period. Those funds won’t be subject to equity or bond market fluctuation.

Investors with years to go before retirement and primarily focused on wealth accumulation have the flexibility to seek higher returns that come with an associated risk. Holding a modest percentage of your portfolio in cash and cash equivalents allows you to quickly take advantage of investment opportunities, particularly at times of market disruptions or fluctuation. “In this case, cash is more part of a transactional process,” says Haworth. “Cash may be held as a result of liquidating one security, but it should be put to work relatively quickly in another investment consistent with your risk tolerance level and long-term goals.”

What can I expect to earn on cash and cash equivalents?

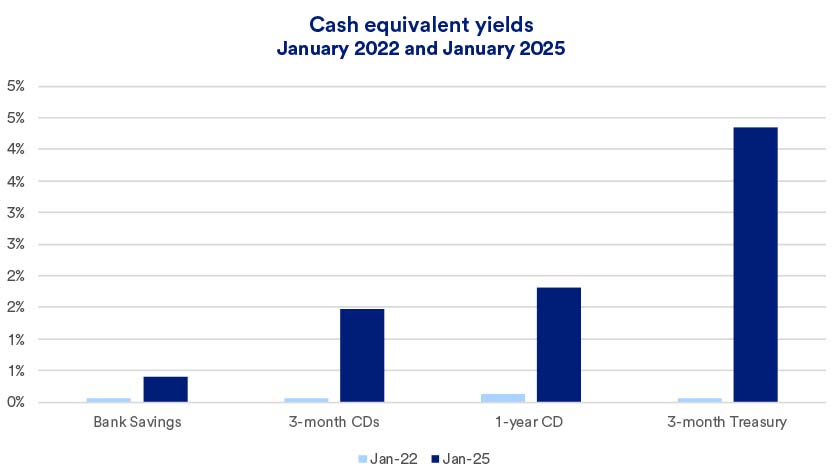

Today’s interest rate environment has dramatically changed compared to even a few years ago. This creates an opportunity to enhance your overall portfolio results. If you have cash "on the sidelines" earning very little return, consider more appropriate options.

“A first step is to move cash into short-term instruments that pay more attractive yields given today’s interest rates,” says Haworth.