Where to invest today

“Be prepared to take what the capital markets offer given the current environment’s realities,” says Freedman. He advises that long-term investors consider positioning their portfolios with an overweight position in equities relative to fixed income, and a neutral weight invested in real assets. Freedman adds, “It’s critical to have a financial plan that’s tied to the specific goals you hope to achieve.” With a plan in place, you can more readily identify investment strategies that align with your goals.

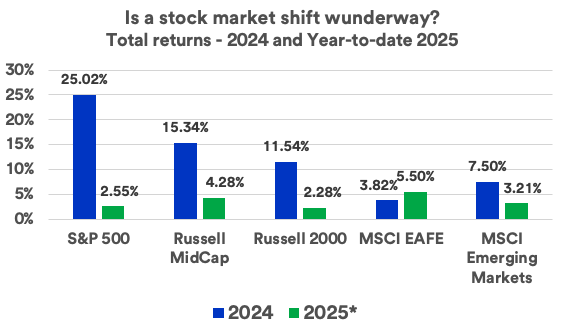

Investors should capitalize on the opportunity to add global diversification, says Haworth. “Although it looks like the U.S. economy remains stronger than those of overseas markets, valuations of non-U.S. stocks are more attractive, so they offer some opportunity as well,” says Haworth.

Based on your goals, timeline and risk appetite, consider these additional portfolio strategies:

- Broad-based, global equity market exposure to capitalize on potential opportunities both domestically and overseas.

- For tax-aware investors, consider slightly longer-than-average durations in municipal bonds, including a modest allocation to high-yield municipal bonds.

- For non-taxable fixed income diversification, consider maintaining near-benchmark portfolio duration, and adding non-government agency issued mortgage-backed securities.

- For trust portfolios, investors may consider reinsurance to capture differentiated cash flow with low correlation to other portfolio factors such as market or economic trends.

Have questions about the economy, markets or your finances? Your U.S. Bank Wealth Management team is here to help.