Debating the causes of stock market changes before and after midterm elections

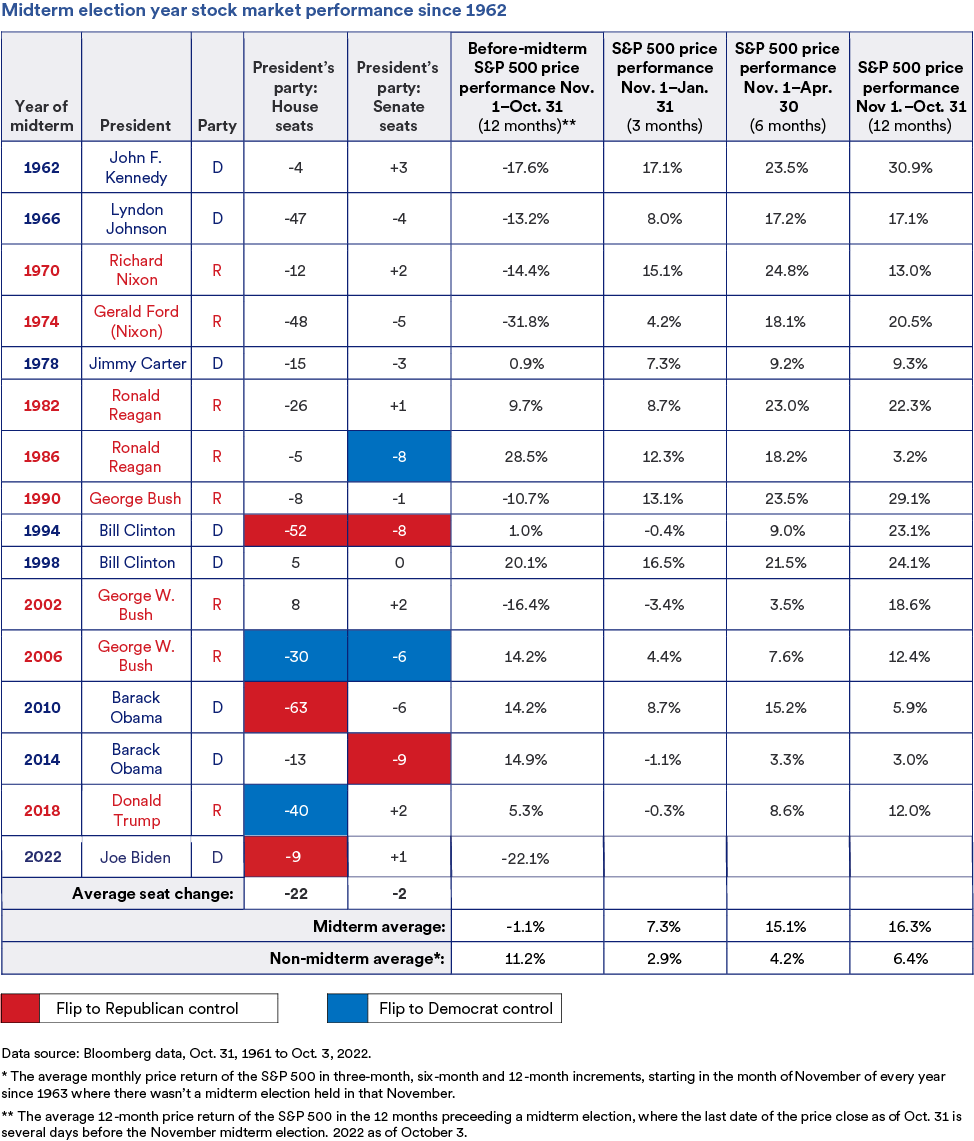

Why does the market underperform in the 12 months leading up to midterm elections and overperform the 12 months after midterm elections? One factor might be policy uncertainty. Without knowing which political party will hold majorities in Congress, it’s unclear which social and economic policies will take priority. This uncertainty resolves after the midterm election.

The problem with this theory is that the outcome of midterm elections has no noticeable impact on overall equity market performance, according to our analysis. The party or parties controlling Congress—and whether they change after a midterm election—is historically not an indicator of market performance.

The biggest stock market performance influence in midterm election years

Our analysis shows that the health of the economy is a much more important factor than midterm election results. The last time the S&P 500 Index produced negative returns during the 12 months after a midterm election was 1939—a time of tremendous economic contraction and uncertainty as the U.S. battled the Great Depression and World War II began in Europe.

This also explains why negative pre-midterm market returns dominated the 1960s and 1970s, pulling down the overall pre-midterm average. The late 1960s and 1970s were a time of slow economic growth marked by high unemployment, rising energy prices and significant inflation. If you exclude the five midterm elections in the 1960s and 1970s, the average S&P return for pre-midterm election years is 8.1%—roughly in line with average annual S&P 500 performance.

Since then, the economy has grown steadily, with accommodating central bank policy keeping inflation low. This suggests that a healthy overall macroeconomic environment carries greater weight than any policy uncertainty.