Economic underpinnings appear solid

Prior to the election, says Tom Hainlin, senior investment strategist for U.S. Bank Asset Management, “Investors worried about what would happen if inflation reaccelerated, what if the Fed had to raise interest rates, what if the election outcome is uncertain. We overcame all these hurdles.” Along with a narrow but clear Trump victory in November accompanied by the Republican sweep of the House and Senate, Hainlin notes that consumer spending remains solid and corporate earnings are positive, all factors that contributed to positive, post-election market sentiment.

While many underlying economic fundamental factors are pointing in the right direction, Trump administration policies are a wild card. “There’s a lot of uncertainty about what government actions will have an impact on markets going forward,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management. He notes that the tariff plans, if implemented as laid out by Trump in early February, would likely have serious economic repercussions. “It’s very clear to the market that some form of tariffs will be an active part of the Trump administration’s agenda in the near term,” says Haworth.

Trump’s top economic and policy priorities for 2025

Although President Trump has issued many executive orders, other action will require Congressional approval. Trump has the benefit of his own Republican party controlling both the House and Senate, but the advantages are narrow. Republicans hold a 53-47 Senate advantage. In the House, the split is even closer, currently with 218 Republicans to 215 Democrats.3 Two seats held by Republicans are currently open, with another likely to open, which will further narrow the Republican majority.

Along with Trump’s tariff proposals, two other key issues are on the table, likely to have an economic impact:

Trump immigration policy

President Trump has emphasized reducing the number of undocumented immigrants currently residing in the U.S. This includes plans to deport millions of immigrants. “An economic consideration is that many of these immigrants, regardless of legal status, are part of the labor market,” says Haworth. He notes that losing this portion of the workforce could have inflationary implications, though the impact might be delayed by a year or more. Foreign-born workers make up nearly 20% of the U.S. labor force.4

While action on immigration, much of which can be enacted by Presidential executive order without Congressional approval, is expected in the administration’s early weeks.

Trump’s tax plan

In his first term, President Trump’s primary domestic achievement was the 2017 passage of the Tax Cut and Jobs Act (TCJA). It implemented significant income and estate tax cuts along with other tax law changes. However, the TCJA sunsets at the end of 2025. During the campaign, Trump emphasized his desire to extend the tax cut package. “This is more of a 2026 issue since the current tax rates extend through 2025,” says Haworth. “Therefore, it may be later in 2025 before Congressional action occurs.” Narrow Republican majorities in the House and Senate may also complicate the legislative process. Congressional leaders have discussed trying to pass legislation that addresses multiple issues, including tax policy, in one or two bills. However, much work appears left to be done.

One key issue is the federal budgetary impact. According to a non-partisan organization’s recent estimate, extending the individual income and estate tax provisions from the 2017 Act would add nearly $4 trillion plus interest costs to deficits through fiscal year 2035.5 Congress may look for places to cut spending to offset some of the TCJA extension’s costs. “Offsets will require negotiation,” says Hainlin. “Nevertheless, directionally, it appears personal and corporate income tax rates are likely headed lower, not higher.”

Inflation and interest rates under Trump

A major consideration is how Trump administration policies may impact inflation and how soon interest rates, which remained elevated, might come down. Tariff impacts, in particular, are a concern. “The magnitude of tariffs as proposed will be immediately inflationary for certain sets of goods,” says Haworth. “Previous tariff increases weren’t as dramatic and had little inflationary impact, but adding tariffs at the scale being discussed would have inflation implications.”

An immigration crackdown could have a mixed impact. If it meaningfully reduces the workforce, it could push labor costs higher. At the same time, it could have a favorable impact on the housing market. “Lower immigration could relieve some price pressures on rents,” says Hainlin. However, Hainlin also points out that the interest rate environment also has a significant impact on the availability of single-family homes. Rates remain elevated, with the 10-year U.S. Treasury note hovering near the 4.5% level,6 and average 30-year mortgage rates close to 7%.7

Stock market under Trump

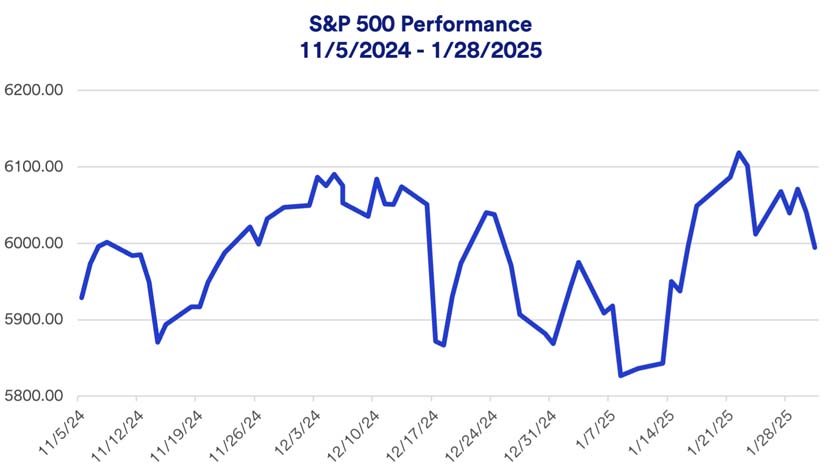

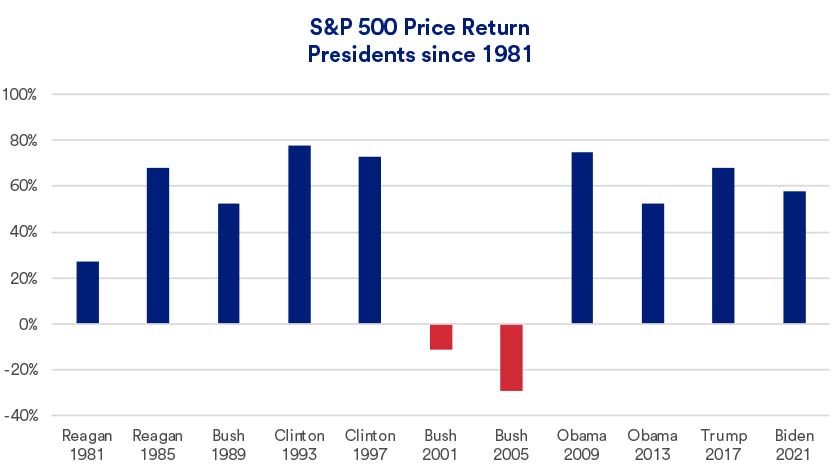

Early market enthusiasm for Trump’s victory may in part reflect the fact that markets generally prospered from 2017 to 2021, during Trump’s first term.