ABL mythbusters: The truth about asset-based lending

Easier onboarding: What to look for in an administrator

Easing complex transactions: Project finance case studies

The reciprocal benefits of a custodial partnership: A case study

Look to your custodian in times of change

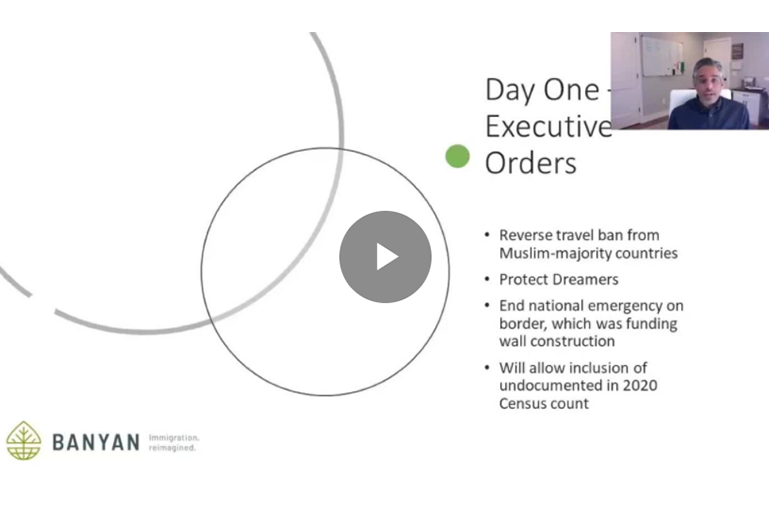

Webinar: Key issues impacting relocation in 2021

What is CSDR, and how will you be affected?

Avoiding the pitfalls of warehouse lending

How electronic billing platforms improve government payments

Higher education strategies for e-payment migration, fighting fraud

Time is money: Intelligent Payment Routing saves businesses both

Adjust collections to limit impact of USPS delivery changes

Crack the SWIFT code for sending international wires

Automate escheatment for accounts payable to save time and money

What to know when investing in AP automation solutions

Ways prepaid cards disburse government funds to the unbanked

Ease your transition to remote banking

Challenging market outlook reveals the power of partnership

Changes in credit reporting and what it means for homebuyers

Tapping into indirect compensation to recruit foreign talent

Look to your custodian in times of change

What’s the difference between Fannie Mae and Freddie Mac?

How institutional investors can meet demand for ESG investing

Bits and bots: CRE trends for 2023 and beyond

Why other lenders may be reaching out to your employees

Digital Onboarding helps finance firm’s clients build communities

Mortgage buydowns and subsidies in today’s talent-focused relocation policies

A checklist for starting a mobility program review

Sustainability + mobility: Trends and practical considerations

Managing complex transactions: what your corporate trustee should be doing

New technology streamlines M&A transactions

Why retail merchandise returns will be a differentiator in 2022

High-cost housing and down payment options in relocation

4 benefits of independent loan agents

Middle-market direct lending: Obstacles and opportunities

At your service: outsourcing loan agency work

How RIAs can embrace technology to enhance personal touch

Best practices for optimizing the tech lifecycle

The client-focused mindset: Adapting to differing personality types

Save time with mobile apps for business finances

The client-focused mindset: What do clients expect?

Innovative payroll solutions may help attract hourly workers

Flexibility remains essential for public sector workforces

Automated escheatment – learn how to prevent and resolve unclaimed property

Tailor Ridge eBill case study

What corporate treasurers need to know about Virtual Account Management

Webinar: CRE Digital Transformation – Balancing Digitization with cybersecurity risk

CFO survey: A shifting focus on ESG in business

Digital receivables to meet changing demand

Webinar: Reviving mobility, what to expect

ABCs of ARP: Answers to American Rescue Plan questions for counties

CFO report: Driving growth via new business models and technology

Webinar: Navigating today’s work-from-anywhere world

Treasury management innovations earn Model Bank awards

Webinar: Fraud prevention and mitigation for government agencies

CFO insights: Leading the recovery for sustainable growth

Mobile treasury management – redesigned with your business in mind

An asset manager’s secret to saving time and money

Webinar: DEI tips for transforming your mobility program

Overcoming the 3 key challenges of a lump sum relocation program

For today's relocating home buyers, time and money are everything

Crypto + Relo: Mobility industry impacts

Technology strategies to complement your business plan