Hybridization driving demand

Supply chain analysis: Merging technology and commerce

The ongoing evolution of custody

3 emerging technology trends for bankers

Easier onboarding: What to look for in an administrator

Luxembourg's thriving private debt market

3 questions to ask your equity, quant and CTA fund administrator

Private equity and the full-service administrator

The secret to successful service provider integration

Insource or outsource? 10 considerations

10 ways a global custodian can support your growth

The benefits of a full-service warehouse custodian

Integrated receivables management solution supports customer focus at MSC Industrial Supply

Webinar: Robotic process automation

Webinar: Building digital bridges for treasury optimization

Authenticating cardholder data reduce e-commerce fraud

Webinar: CRE technology trends

Webinar: Driving innovation to impact treasury management

Webinar: CRE treasury leader roundtable

Webinar: Redefine your business with technology

Managing the rising costs of payment acceptance with service fees

Tech tools to keep your restaurant operations running smoothly

3 reasons governments and educational institutions should implement service fees

The benefits of payment digitization: Pushing for simplicity

5 winning strategies for managing liquidity in volatile times

Higher education and the cashless society: Latest trends

The future of financial leadership: More strategy, fewer spreadsheets

Empowering managers with data automation and integration

Delivering powerful results with SWIFT messaging and services

New technology streamlines M&A transactions

How RIAs can embrace technology to enhance personal touch

Flexibility remains essential for public sector workforces

Tailor Ridge eBill case study

What corporate treasurers need to know about Virtual Account Management

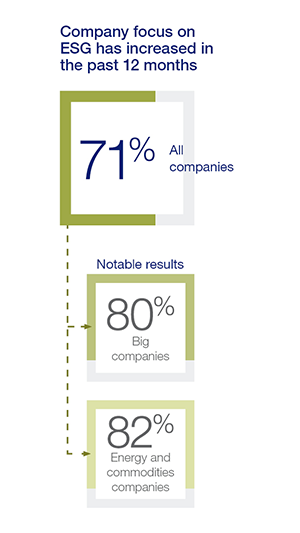

CFO survey: A shifting focus on ESG in business

Digital receivables to meet changing demand

CFO report: Driving growth via new business models and technology

CFO insights: Leading the recovery for sustainable growth

Staying organized when taking payments

Tools that can streamline staffing and employee management

Key considerations for online ordering systems

How iPads can help increase efficiency in your salon

How does an electronic point of sale help your business keep track of every dime?

Planning for restaurant startup costs and when to expect them

How to identify what technology is needed for your small business

How small businesses are growing sales with online ordering

The business behind environmental sustainability

5 ways to build your business through community engagement

How I did it: Switched career paths by taking an unexpected pivot

Student checklist: Preparing for college

Co-signing 101: Applying for a loan with co-borrower

5 things to know before accepting a first job offer

Webinar: Bank Notes: College cost comparison

The A to Z’s of college loan terms

What’s your financial IQ? Game-night edition

How to open and invest in a 529 plan

Is a home equity loan for college the right choice for your student

Parent checklist: Preparing for college

How grandparents can contribute to college funds instead of buying gifts

Using 529 plans for K-12 tuition

How to apply for federal student aid through the FAFSA