FDIC-Insured - Backed by the full faith and credit of the U.S. Government

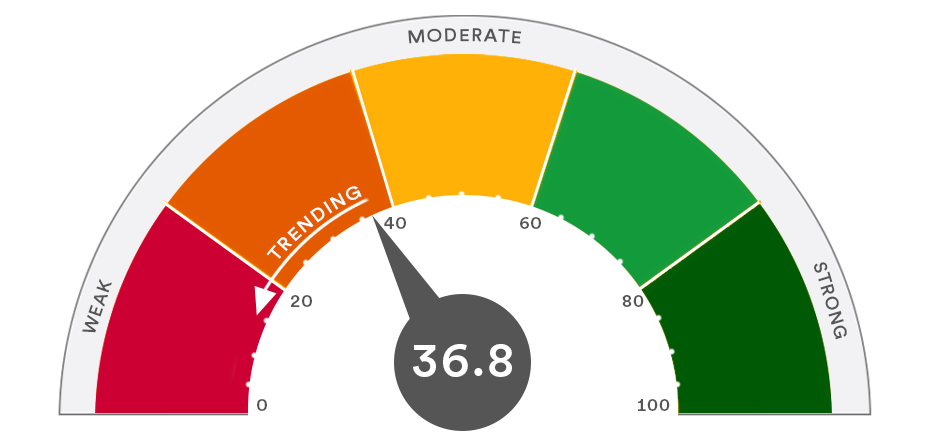

Source: Global Economic Health Check, U.S. Bank Asset Management Group, January 20, 2023.

Weekly market analysis

The U.S. Treasury is now deploying “extraordinary measures” to pay the federal government’s bills. How long can Treasury keep this up and what are the implications for investors?

2023 investment outlook: A tale of two halves

While the U.S. economy will likely struggle at the outset of 2023 due to higher interest rates, slowing inflation by the second half of the year could help support economic recovery and a more favorable investment environment.

News and updates

Stay informed on key topics likely to impact markets, the economy and investors.

Featured story

Secure Act 2.0: How new legislation could change the way you save for retirement

January 6, 2023

The Secure Act 2.0, signed into law at the end of 2022, may empower you to reach your savings goals sooner and offer more flexibility in retirement.

How do supply chain issues contribute to inflation?

January 25, 2023

While constraints have eased, ongoing supply chain issues continue to exert an inflationary influence on some sectors of the global economy.

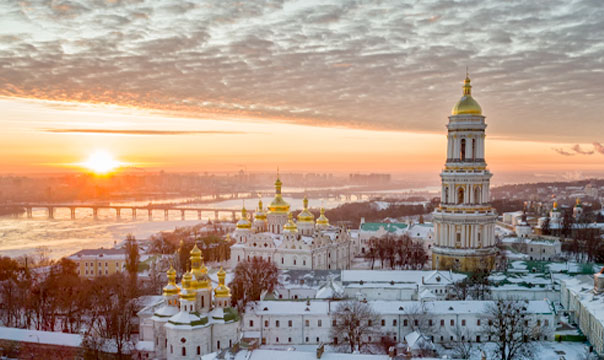

Russia-Ukraine conflict and its continued impact on global markets

January 23, 2023

The most significant military conflict in Europe since World War II, the Russia-Ukraine war creates particular challenges for the global economy.

How far will the market correction go?

January 20, 2023

With stocks slipping in and out of bear market territory, learn how the market correction and ongoing volatility could impact your investments in 2023.

The debt ceiling debate in focus

January 20, 2023

With the U.S. government’s authority to borrow money bumping up against the federally mandated debt limit in 2023, is a political confrontation brewing that could impact capital markets?

Treasury yields invert as investors weigh risk of recession

January 17, 2023

What does an inverted yield curve say about the economy’s prospects for a recession?

Analysis: How persistent might inflation be?

January 17, 2023

Inflation spiked sharply over the past year. Learn what this could mean for your finances and if there’s any end in sight to higher prices.

The effect of the job market on the economy

January 13, 2023

Set against the backdrop of a slowing economy, the strong job market has drawn the attention of the Federal Reserve as it adjusts monetary policy to help curb inflation.

Understanding tax law changes

January 6, 2023

Learn what new tax law changes included in the Inflation Reduction Act and SECURE Act 2.0 may mean for you.

Is the economy at risk of a recession?

December 28, 2022

The Federal Reserve is focused on fighting inflation with aggressive policy moves intended to slow consumer demand. Does this put the economy at risk of a recession in 2023?

Federal Reserve recalibrates monetary policy to fight inflation

December 16, 2022

With the Federal Reserve raising short-term interest rates and no longer providing liquidity to the bond market, investors should prepare for change as the Fed intensifies its focus on fighting inflation.

Federal Reserve delivers 0.5% rate hike in effort to cool inflation

December 14, 2022

The Federal Reserve hiked interest rates 0.5% on Wednesday and signaled that officials expect higher rates through next year – with no reductions likely until 2024. Learn what this may mean for markets, the economy and investors.

How do rising interest rates affect the stock market?

December 13, 2022

With interest rates going up this year, learn what the likely ripple effect across capital markets may mean for investor portfolios in 2023.

Stock market under the Biden administration

December 8, 2022

Explore how the stock market has fared so far under the Biden administration and what to expect moving forward.

How rising interest rates impact the bond market

December 1, 2022

With the Federal Reserve increasing interest rates to get inflation under control, what opportunities does this create for bond investors?

The impact of rising interest rates on the housing market

November 28, 2022

The Federal Reserve’s aggressive war on inflation is slowing the housing market and curbing investor appetite for real estate. Learn how this could impact the broader economy and investors.

2022 midterm election results: A review of capital market implications

November 9, 2022

While the adage “markets like political gridlock” may hold true, our investment strategists anticipate more nuanced capital market implications stemming from the results of this year’s midterm elections.

How midterm elections affect the stock market

October 11, 2022

The 2022 midterm elections are coming up—but could the result affect your portfolio? Our historical analysis offers some food for thought.

Investment portfolio tactics in a challenging market

September 28, 2022

Tactical positioning, dollar cost averaging and rebalancing can help enhance investment returns and manage overall portfolio risk.

Financial planning considerations when inflation is high and interest rates are rising

September 21, 2022

The resurgence of inflation combined with rising interest rates creates challenges for investors. These tactical considerations can help you navigate today’s unique market dynamics.

Higher-than-expected inflation puts downward pressure on markets

September 13, 2022

Stock and bond prices fell on Tuesday reflecting heightened investor concerns surrounding the release today of a report showing higher-than-expected inflation. Learn more in this situation analysis from our asset management and economics teams.

Balancing opportunities and risks in today’s market

September 12, 2022

The U.S. Bank investment team remains focused on two primary factors that will help determine the direction of capital markets through the remainder of 2022 and into 2023 – the degree to which the U.S. economy slows and inflationary trends.

The recovering value of the U.S. dollar and what it means for investors

September 8, 2022

Taking measure of global currency trends as you position your investment portfolio.

What is tax loss harvesting?

August 17, 2022

With major stock market indices down in 2022, a portion of your portfolio may be in the red. Tax-loss harvesting is a strategy that may provide some relief from investment losses by potentially reducing your tax liability.

How commodity prices can impact the market and inflation

August 12, 2022

As volatile commodity prices fuel surging inflation, what opportunities does this create for investors?

Media mentions

S&P 500 futures rise after better-than-expected GDP and Tesla results

1.26.23 | CNBC | Article

“Clearly, we’re moving through the heart of earnings season at this point,” said Bill Northey, senior investment director at U.S. Bank Wealth Management. “There has been some positive news and some less positive news.”

How do rising interest rates affect the stock market?

1.22.23 | Inside Bitcoins | Article

“Supportive monetary policy was crucial for risk asset owners, regardless of whether it be in domestic equity, real estate or cryptocurrency,” says Eric Freedman, chief investment officer for U.S. Bank.

Wall Street is worried about a recession. What happens to the stock market if there isn’t one?

1.19.23 | Yahoo! Money | Article

The 2022 selloff in the S&P 500 reflected some, though not all, of the risk of a recession, according to Rob Haworth, senior investment strategist at U.S. Bank Wealth Management.