Beginning May 30, you’ll be able to sign up for U.S. Bank mobile and online banking to access your account information.

How to sign up for mobile and online banking

You can sign up for U.S. Bank mobile and online banking on May 30.

Use the Union Bank Mobile App or unionbank.com.*

- Log in to your account using your Union Bank login credentials.

- You’ll be prompted to verify your identity and create new U.S. Bank credentials.

*This enrollment process is only available for personal accounts.

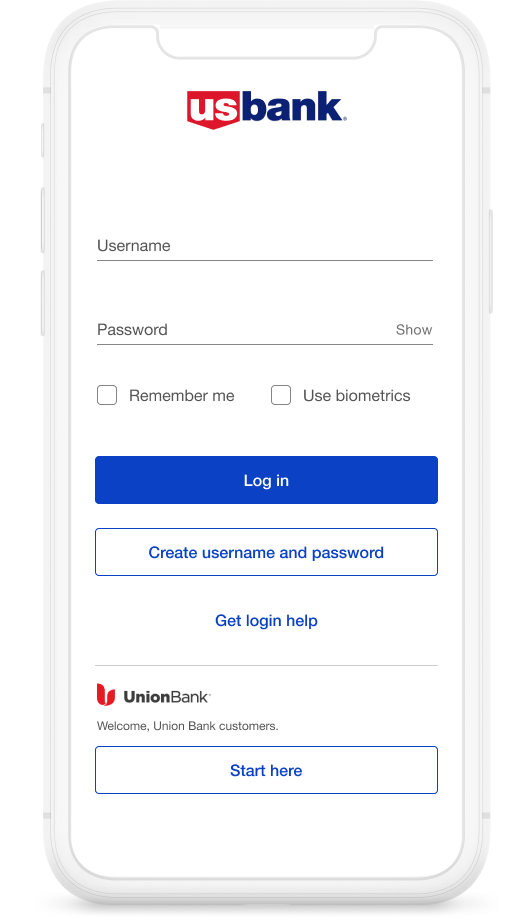

Use the U.S. Bank Mobile App on your phone or go to usbank.com/unionbank-enroll.

- Select Start here under the Union Bank logo on the app or go to the enrollment website.

- Enter your new U.S. Bank account number or your Union Bank Debit Card number and the last four digits of your Social Security number.

- Follow the step-by-step instructions.

Run your business anytime, anywhere.

With the Business EssentialsTM Dashboard in online banking, business customers can view and manage their money, track payments, send invoices and handle payroll – all from one location. U.S. Bank online and mobile banking makes running a business easier and more convenient than ever.

Already signed up? Here’s what you need to do now.

Check your payments and preferences.

Verify that your payments have transferred, update your alerts, check your paperless preferences and view your new account numbers.

Learn with interactive demos.

Keep an eye out for our simple, interactive demos in the U.S. Bank Mobile App and in online banking to learn how to easily do everyday banking tasks. You can also find these demos by visiting exploreusbank.com.

Update third-party apps and companies.

Keep your third-party apps up to date by adding your U.S. Bank accounts. See our third-party apps FAQ to learn how to manage sharing your financial data.

Key features and benefits

Whether making a purchase, paying bills or saving for the future, we want to provide accessible money-movement options.

Pay bills.

When you pay your bills through U.S. Bank mobile and online banking, you’re in charge. Set up advance or recurring1 payments to be delivered on the date you choose. You can edit or cancel any payment up to the time it’s processed.

Deposit checks.

With the U.S. Bank Mobile App, you can deposit checks in seconds using the camera on your phone or tablet. You'll receive an immediate confirmation that we've received your deposit, and another when we've accepted it for processing.

Answers to your questions about mobile and online banking.

Digital banking

Yes. As long as you let us know right away, you are not liable for unauthorized transactions that are initiated online at usbank.com or through the U.S. Bank Mobile App. Visit usbank.com/guarantee to learn more about our Digital Security Coverage.

Yes. If you had e-statements at Union Bank, they’ll transfer to U.S. Bank mobile and online banking. However, we recommend that you print past Union Bank statements on or before May 26 for your records.

Your paperless preferences will stay the same, but you’ll need to set up alerts. Sign up for mobile and online banking beginning May 30, and we’ll show you how.

Yes. Creating a separate business user ID will grant you access to the Business Essentials Dashboard, which offers a robust suite of capabilities to fulfill your needs. The Business Essentials Dashboard offers tools such as:

- ACH

- Zelle® for Business

- Cash flow analysis and forecast tools

- Integration with merchant services (Elavon and talech users only)

- Integration with accounting software (QuickBooks® and FreshBooks®)

After signing up for U.S. Bank Business Essentials, business users can link their personal accounts and seamlessly toggle between profiles. We will show you where to access the profile switch feature during the onboarding process. Note that your personal profile must be created first. You can activate this feature through the Business Essentials Dashboard.

Payments and statements

Yes. Once you sign up for U.S. Bank mobile and online banking, your existing bills and biller information from the Union Bank bill pay4 system will automatically transfer. Your Union Bank bill pay history will transfer to your new U.S. Bank account in mobile and online banking. We recommend that you log in to your U.S. Bank account and validate that your automatic and scheduled payments were transferred accurately.

U.S. Bank will automatically notify financial institutions from which you receive direct deposits and other automatic debit and credit transactions about your account changes.

The originator of your automatic debit or credit transaction may contact you to verify the changes and ask you to complete new paperwork to have the automatic transaction continue.

We’ll begin to move existing Zelle® contact methods, recipients, transaction history and most scheduled transactions on May 25 for personal accounts. However, please retain this information for your records now.

After May 30, log in to U.S. Bank mobile and online banking and verify that they transitioned accurately and make any updates as needed.

Third-party apps

No. You’ll need to work with third parties directly to provide your financial data. During enrollment with a third-party service, you should be redirected to a U.S. Bank login screen. You will be prompted to enter your personal ID and password. Authenticating your identity directly with us allows you to share your account information without disclosing your login credentials.

For privacy, ensure that the URL in the web browser is usbank.com and the trusted website lock icon is displayed. Click the lock icon to make sure it is registered to usbank.com. Once you’re logged in, you may be redirected to Akoya for added security and to choose your account.

For QuickBooks Web Connect, select U.S. Bank business banking (U.S. Bank bus.E banking) from the list on QuickBooks. Follow these instructions (PDF) to transfer your QuickBooks data from Union Bank to U.S. Bank.

If the duplicate transactions have not been added to the register, they can be deleted individually prior to accepting. If the transactions have already been added to the register, they can be deleted from the register individually or in groups. You can learn more about removing duplicate transactions in QuickBooks Desktop by visiting the QuickBooks website.

If you created a backup, restore and start over with the conversion steps. If you didn’t create a backup file, you will need to disconnect the online banking connectivity, manually delete erroneous transactions and then reconnect to the proper account. You may be required to manually enter your transactions as they may not download into the same data file a second time.

If you’re having trouble connecting your U.S. Bank account with QuickBooks, it’s possible that there’s an issue with Web Connect, which can occur for several reasons. You can learn how to resolve Web Connect import issues in QuickBooks Desktop by visiting the QuickBooks website.

ATMs, withdrawals and deposits

All Union Bank ATMs will soon be U.S. Bank ATMs. From now until May 30, you'll only be able to access and perform transactions using your primary checking and primary savings accounts. Once the transition is complete, you'll have full access to all of your accounts and all ATM capabilities.

No. Your PIN won’t change. You’ll be able to use your existing PIN with your new U.S. Bank debit card or ATM card.

From Memorial Day weekend through July 31, you won’t be able to change the PIN for your Union Bank and U.S. Bank debit card or ATM card. If you forgot your PIN, please call 24-Hour Banking to request a PIN mailer, which will provide your original PIN.

You won’t be able to deposit checks at ATMs beginning May 25 at 9 p.m. PT through May 29. Mobile check deposits will be unavailable beginning around 3 p.m. PT on May 26 through May 29. Consider cashing or depositing any checks before or after the transition.