3 ways to make practical use of real-time payments

Can faster payments mean better payments?

Corporate treasury professionals will find faster payment technology is driving major changes in how businesses and consumers are moving money.

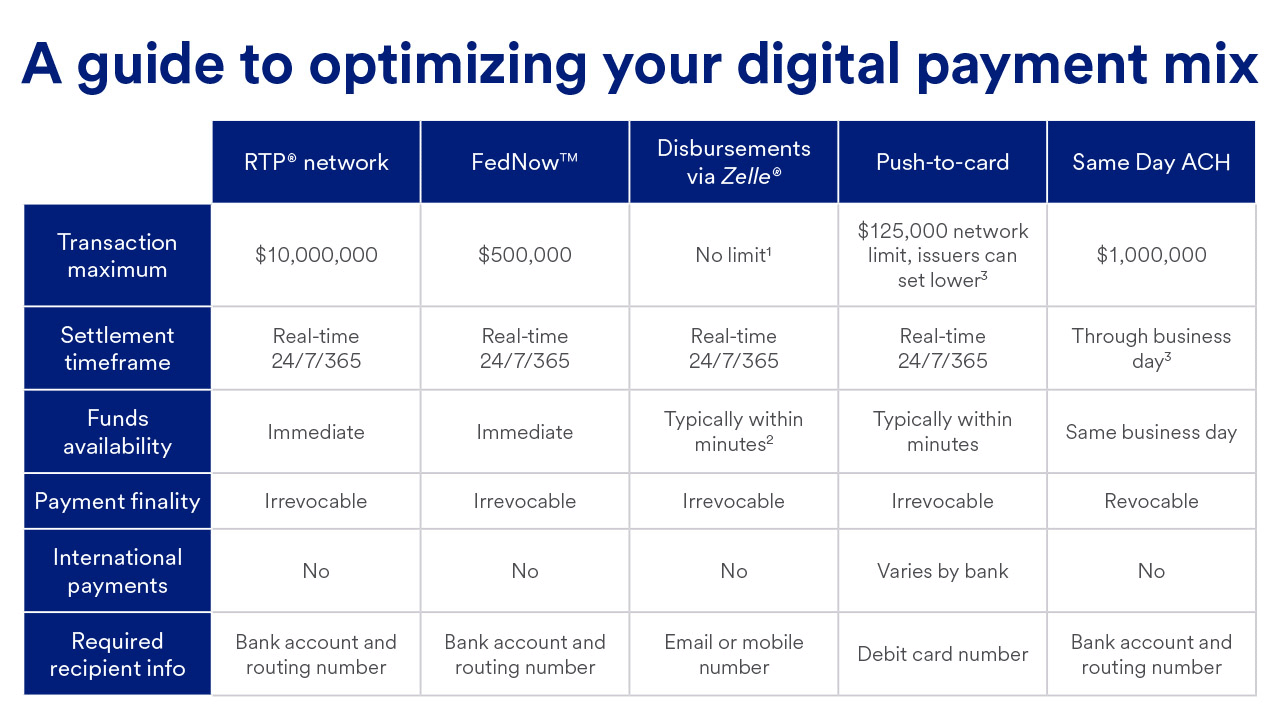

Beyond changing payment behaviors, the payments ecosystem has boomed in recent years thanks to a government push toward payment modernization that started with the Federal Reserve’s Faster Payments Task Force in 2015. This push resulted in payment offerings like Same Day Automated Clearing House (ACH), the RTP® network, Zelle® and several other bank and Fintech led initiatives.

Adoption of instant payments is on the rise, according to our survey of more than 2,000 senior finance leaders. The research showed 51% of businesses are currently using instant payments and 80% plan to use them by 2026. Dive into what’s driving the rise of instant payments.

With all this happening in the overall landscape, evolving customer expectations and improvements in the enabling technologies became the catalysts that expedited these trends in treasury management, according to Anuradha Somani, Head of Payments, Global Treasury Management at U.S. Bank. “When everything from food, coffee and a taxi ride is available instantly with a click, why does it take three days for me to transfer funds from one of my bank accounts to the other?” she says.

“The supercomputer that you carry in your pocket (your phone) and the underlying APIs on apps enable you to access literally the entire world through your touchscreen. While neither the smartphone or APIs are new, the sheer pervasiveness and the power of these technologies combined with some of the development that has occurred in the payments ecosystem – that’s what is leading the new payment revolution. COVID-19 and the increased desire for contactless payments accelerated it further.”

In fact, faster payment technologies are powering a digital shift in business-to-business (B2B) and business-to-consumer (B2C) payments.

“Companies want to make payments more efficiently, and they want more control over those payments,” says Adam Kruis, senior vice president and manager, working capital consulting with Global Treasury Management at U.S. Bank. “And on the receiving side, companies want to be able to receive payments quicker, and accurately apply them as close to real-time as possible.”

While traditional payments are still widely used, faster payment platforms offer the additional benefits that Kruis describes. ACH and wire transfers are excellent for making automated electronic payments, but they can take additional effort to implement. Meanwhile, checks restrict efficiency gains for both the sender and receiver. And checks can be difficult to sufficiently control.

To accomplish their payment objectives, organizations needed other options to supplement their existing tools. To achieve those goals, the Federal Reserve established a Faster Payments Task Force in 2015 to identify “end-to-end faster payments solutions that could address the need for safe, ubiquitous, faster payments.”

The task force concluded its work in July 2017 after receiving 16 proposals to shape the future of payments. Four of those solutions have gained traction for business payments.

More recently, Fed added an initiative called the FedNow® Service : A new rail for real-time gross settlement launched in July 2023. It is early days for the initiative but continued evidence of the constant evolution happening in the payments space.

“When everything from food, coffee, and a taxi ride is available instantly with a click, why does it take three days for me to transfer funds from one of my bank accounts to the other?”

Anyone whose paycheck deposits directly into a bank account is using the ACH network, an electronic network through which money moves directly from one bank account to another. Although setting up instructions for a payment can be time-consuming — payees must provide banking information, which is easier to acquire from existing payee relationships — transfers are easy thereafter.

Traditional ACH deposits are also subject to a one to three business day turnaround, which might not work in time for critical situations.

Enter Same Day ACH payments. Introduced in September 2016, Same Day ACH uses the existing ACH infrastructure but processes payments within the same business day instead of one to two business days. Same Day ACH transactions are easy to execute for those already familiar with ACH. Another advantage of ACH is the ability to send both credit and debit transactions, as well as the ubiquity of the ACH network. All banks are required to receive Same Day ACH transactions, which allows originators to send a payment to any bank or credit union in the United States.

“Same Day ACH is certainly the easiest new solution to capitalize on, as it doesn’t require new technology investment,” says Kruis. “It makes sense to utilize Same Day ACH when the standard 1-3-day settlement time will not suffice, but an irrevocable payment is not required.”

For example, imagine a manufacturer receives a panicked call from a supplier who’s made an error and needs to send payment that day. The manufacturer can accept a Same Day ACH transfer to help the supplier pay the bill on time and avoid harming their relationship with the manufacturer.

Same Day ACH does have requirements you need to consider. It’s limited to domestic transactions, payments are capped at $1 million, and there are fixed windows during which the payment must be received in order to be posted on the same day.

As the names would suggest, Visa Direct (Visa’s real-time push payments platform) and Mastercard Send leverage the Visa and Mastercard debit networks, respectively, to allow U.S. bank business-to-consumer (B2C) deposits into consumer bank accounts, in real-time, 24 hours a day, seven days a week.

The top benefits of Visa Direct and Mastercard Send include:

That sort of flexibility comes in handy in one-time payment situations, in particular. “Imagine a natural disaster where insurance companies typically send agents to go door-to-door to review claims,” Somani explains. “The claim agent can provide the homeowner money using their debit card in a matter of minutes right then and there, instead of the payment arriving by mail days later.”

Yet while the speed and ease of payment are strong advantages of these solutions, Somani has some advice. “In order to reap the benefits of increased efficiency through debit card payments to individuals, consumers should safeguard their debit card credentials,” she notes. Additionally, as with other faster payment options, you need to be aware of transaction limits, which sometimes the issuing bank may impose, leading to transaction rejection.

Zelle® is a token-based payment system that addresses a significant issue for many consumer payments. People aren’t always comfortable sharing their bank information and businesses don’t necessarily want to collect it for infrequent payments either.

With Zelle®, consumers enroll through their mobile banking app or in the Zelle® app (if their financial institution does not offer Zelle®). They then identify and register a token, either their email address or U.S. mobile phone number. Following the enrollment, transactions are conducted by using their registered token and without sharing bank information, creating an added level of banking security in addition to the system’s flexibility.

“You can send money to almost anyone with a bank account within the U.S., knowing just their email or U.S. mobile phone number,” Kruis says.

The Zelle Network® includes more than 700 financial institutions, including U.S. Bank. Member institutions represent 70 percent of the online deposit accounts in the U.S. and can reach 97 percent of U.S. debit card holders. Zelle® is available for peer-to-peer (P2P) payments as well as disbursements to consumers and small businesses, in addition to receivables for small businesses.

The RTP® network was launched in November 2017 by The Clearing House. Of all the new payment systems, perhaps the RTP network has generated the most buzz.

With the RTP network, consumers and businesses can send or receive money between any participating financial institutions in real time. Unlike wire transfers and ACH payments, however, funds can move at any time – and settle instantly, meeting the customer expectation of instant gratification. This can provide significant value for organizations as well that can benefit from 24/7 payment processing and payment irrevocability.

Not only this, but the RTP network also facilitates a level of accompanying data, such as bill details and potentially invoices, that will enable AP/AR teams within these organizations to mitigate longstanding reconciliation problems.

“The largest pain point with many electronic transactions is often the exchange of information associated with the payment – when will the payment be made?" Kruis says. "Facilitating this communication digitally should provide significant process efficiencies.”

The FedNow® Service, launched in July 2023, is a new instant payment infrastructure developed by the Federal Reserve that will enable financial institutions of every size across the U.S. to provide safe and efficient instant payment services.

Many banks that participate in the RTP network will also use the FedNow Service to deliver the full reach of instant payment endpoints.

At U.S. Bank, we can help you get started. We’ll begin with a comprehensive assessment of your payment strategy, and then explore how faster payment options can fit within your plan. If you’re on the fence about faster payments, we’re happy to provide additional information.

To learn how real-time payments are changing the way companies do business, visit our instant payments resource page, explore our survey of 2,030 American businesses, or schedule a call with a treasury management expert.