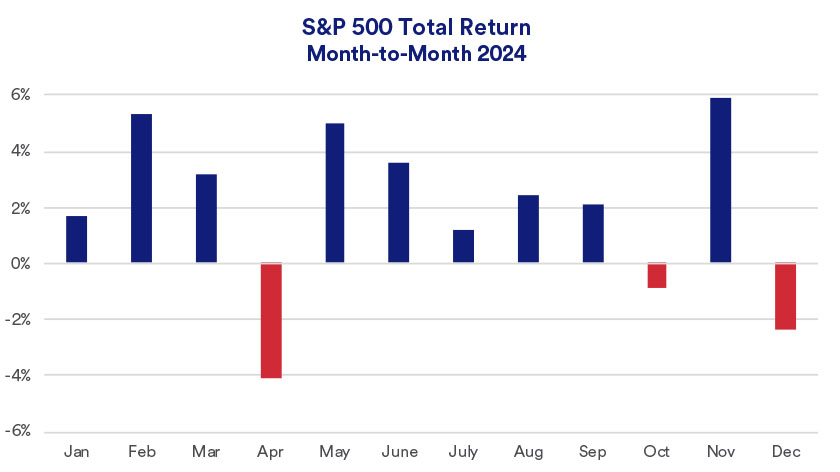

Rob Haworth, senior investment strategy director with U.S. Bank Wealth Management, adds that the stock market reacted positively to the outcome of the 2024 election, adjusting its pricing once the uncertainty of the outcome was removed.

What happens over the next four years depends on a number of other factors, however. “We continue to see economic growth, inflation and Federal Reserve interest rate policy as the primary capital market drivers,” says Haworth. “There is potential for government policy to become more prevalent in investors’ minds as the new administration’s priorities develop.”

Even with stocks having risen significantly for two years in a row, Haworth believes that more upside potential remains for stock market investors.

Haworth says investors are increasingly focused on what’s to come from the new administration’s policies and their potential market impact. Several potential policies are already making headlines, such as extending tax cuts that were part of the Tax Cuts and Jobs Act and are set to expire at the end of 2025, and implementing potential new tariffs on imported goods.

“Markets will closely monitor the subsequent impact on economic growth and inflation,” says Haworth.

Haworth believes the U.S. economy could continue the growth it has seen since 2022. “Stock market earnings, as measured by the S&P 500 index, could actually be better in 2025 than what we saw in 2024,” he says.

Types of stocks to invest in