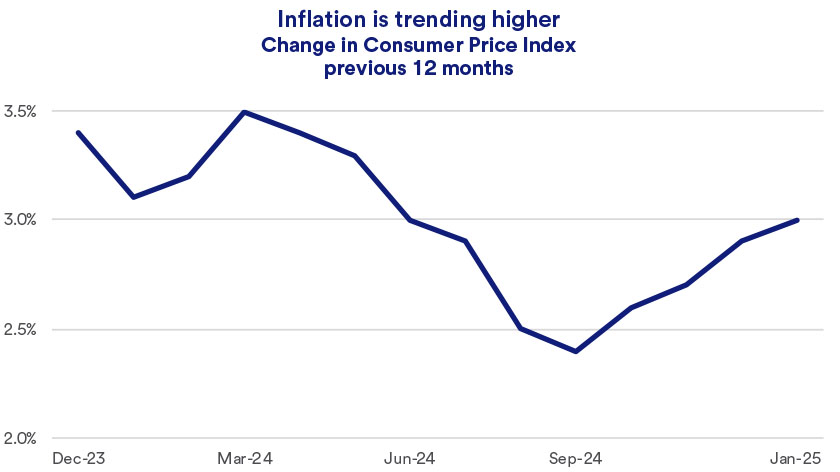

“The Federal Reserve is most focused on core data versus the headline CPI number,” says Rob Haworth, senior investment strategy director for U.S. Bank Asset Management. “Shelter costs are one area that is closely monitored here.” Shelter costs make up more than one-third of CPI. In the 12 months ending in January, shelter costs rose 4.4%, contributing to inflation’s upward trend, although the category’s increase is down from previous peaks. Transportation services costs, which include components such as auto insurance and repairs, are up 8.0% from January 2024.1

All eyes on the Fed

From September to December 2024, the Fed reduced the federal funds target rate, a key rate that can impact mortgage rates, auto loans and other key borrowing measures, by 1.0%. A combination of slowing inflation and rising concerns about labor market strength were key factors motivating Fed rate cuts. At its January policymaking meeting, the Fed held interest rates steady. “Recent strong labor reports put more of the Fed’s focus on inflation again,” says Haworth.

In recent Congressional testimony, Fed chair Jerome Powell confirmed that the Fed’s interest rate policy may not change much in the near term. “With our policy stance now significantly less restrictive that it had been and the economy remaining strong, we do not need to be in a hurry to adjust our policy stance,” said Powell.2

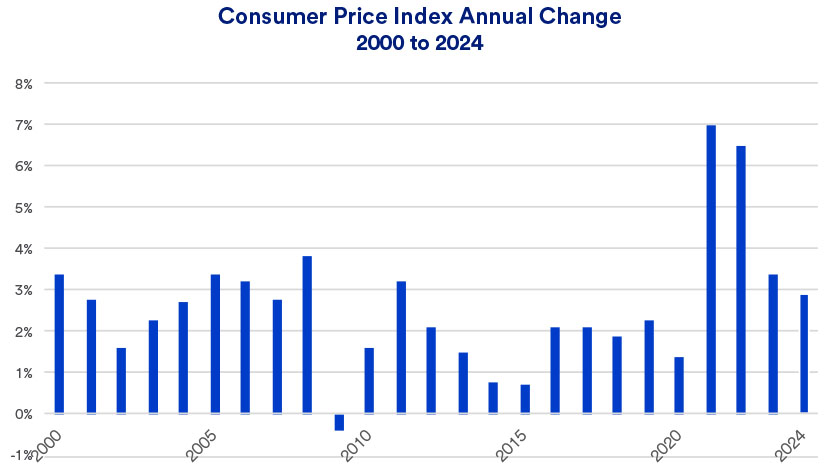

Does inflation’s recent uptick raise the prospect of the Fed shifting its stance and again raising the fed funds target rate? Haworth doesn’t see an immediate risk. “It will take more sustained inflation before the Fed flips its rate stance,” says Haworth. “To this point, the Fed likely views the recent inflation upturn as transitory.”

Nevertheless, interest rate trades currently see no more than a modest chance of another Fed rate cut before July.3

Trade policy’s impact on inflation

While existing inflation challenges are a key focus for markets and Fed policymakers, future inflation factors are less clear. The Trump administration is threatening to impose 25% tariff increases on products imported from two key trading partners, Mexico and Canada. “The magnitude of tariffs currently being proposed are well beyond previous tariff levels,” says Haworth. “This could push prices higher.” President Trump did implement an additional 10% tariff on Chinese goods and implemented a 25% tariff on steel and aluminum imports.