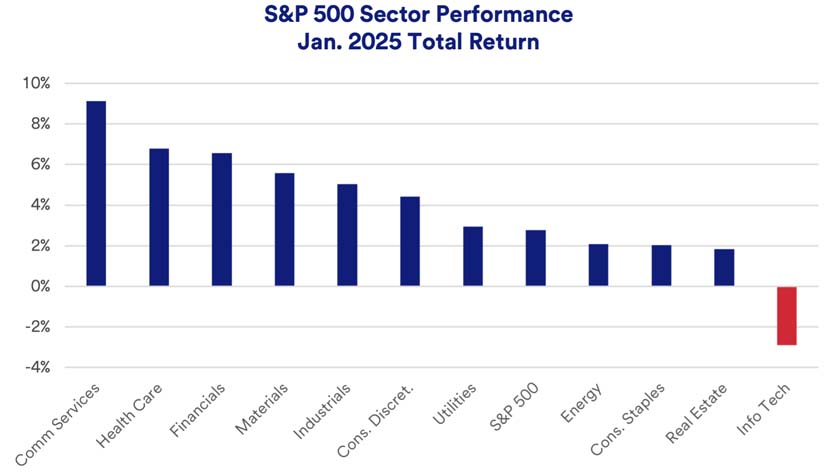

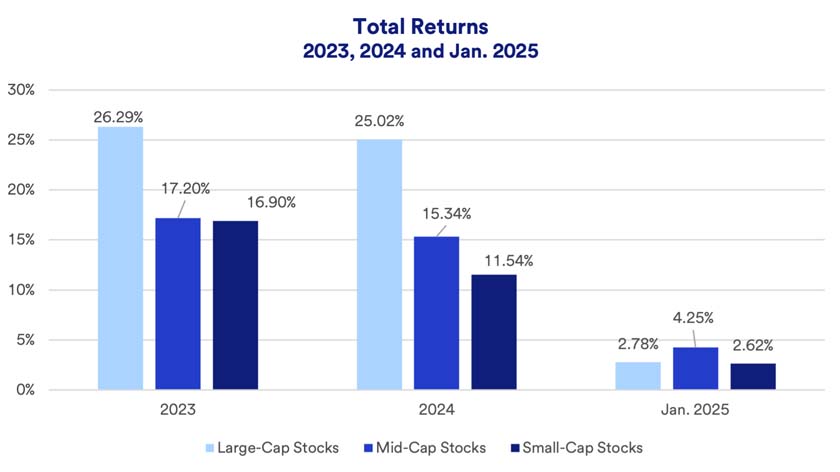

“January’s results reflect that the struggling information technology sector is less of a factor in mid-cap and small-cap indices than it is in the S&P 500,” says Haworth. “We’ve seen the environment improve for industrial stocks, which would benefit small- and mid-cap results.”

Stock market in 2025

Can U.S. stocks maintain the momentum of the last two years in 2025? “Inflation is waning, interest-rate cuts are in motion and earnings are trending higher, all of which bolster sentiment and provide (stock) valuation support,” says Terry Sandven, chief equity strategist for U.S. Bank Asset Management.

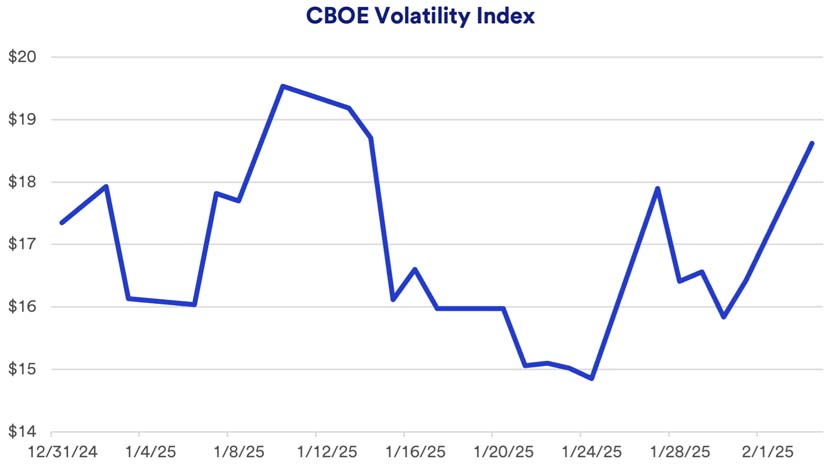

Yet potential new Trump administration policies remain a critical wild card, as evidenced by the market’s volatile performance around the President’s tariff plans. “Markets are still trying to evaluate how serious the tariff threat is,” says Haworth. “If fully implemented as planned, it will have a meaningful change in how we do business, from sourcing materials to supply chains.”

Haworth says it’s important to see how any changes are reflected in corporate earnings, which ultimately have the biggest impact on stock prices. “We’re early in the 4th quarter earnings season,” notes Haworth. “We won’t fully know where fourth quarter earnings stand until March.”

Considering broad opportunities

Anticipating continued solid economic growth, investors may wish to consider an equity overweight allocation, trimming fixed income positions within a diversified portfolio. “Our position is to own a globally diversified equity portfolio, not specifically focusing on U.S. stocks or particular sectors,” says Haworth. “It appears even though stocks have risen significantly for two years in a row, more upside potential remains.”

“We still think it’s a great time to be invested and for those with money in cash, it represents an opportunity to put capital to work in longer-term assets,” says Eric Freedman, chief investment officer with U.S. Bank Asset Management. He encourages investors to view markets with a long-term lens. “Timing the markets and trying to be precise on when to be in and when to be out is challenging,” says Freedman. “Investors should be aware there’s a lot of noise. We urge clients to take a deep breath, go back to your plan. That will increase your odds of success.”

This is an important time to check in with a wealth planning professional to make sure you’re comfortable with your current investments and that your portfolio is structured in a manner consistent with your time horizon, risk appetite and long-term financial goals.

The S&P 500 Index consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general. Diversification and asset allocation do not guarantee returns or protect against losses. The Russell MidCap Index provides investors with a benchmark for mid-sized companies. The index, which is distinct from the large-cap S&P 500, is designed to measure the performance of mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment. The Russell 2000 Index refers to a stock market index that measures the performance of the 2,000 smaller companies included in the Russell 3000 Index.