How liquid asset secured financing helps with cash flow

Housing market trends and relocation impact

Hybridization driving demand

What type of loan is right for your business?

Maximizing your infrastructure finance project with a full suite trustee and agent

Programme debt Q&A: U.S. issuers entering the European market

Luxembourg's thriving private debt market

Integrating regulated and unregulated debt investment vehicles

Top 3 considerations when selecting an IPA partner

How to maximise your infrastructure finance project

Private equity and the full-service administrator

Evaluating interest rate risk creating risk management strategy

Restaurant survey shows changing customer payment preferences

Managing the rising costs of payment acceptance with service fees

3 reasons governments and educational institutions should implement service fees

Higher education and the cashless society: Latest trends

Changes in credit reporting and what it means for homebuyers

CFO survey: A shifting focus on ESG in business

CFO report: Driving growth via new business models and technology

CFO insights: Leading the recovery for sustainable growth

Streamline operations with all-in-one small business financial support

How to establish your business credit score

Common small business banking questions, answered

3 signs it’s time for your business to switch banks

What kind of credit card does my small business need?

Using merchant technology manage limited staffing

Do I need a credit card for my small business?

When to consider switching banks for your business

How to establish your business credit score

Leverage credit wisely to plug business cash flow gaps

LGBTQ+ financial planning tips

5 financial goals for the new year

How to track your spending patterns

How to manage your money: 6 steps to take

Should rising interest rates change your financial priorities?

Avoid these 6 common mistakes investors make

LGBTQ+ estate planning considerations

Good debt vs. bad debt: Know the difference

LGBTQ+ retirement planning: What you need to know

The connection between your health and financial well-being

Working after retirement: Factors to consider

How I did it: Switched career paths by taking an unexpected pivot

How do interest rates affect investments?

Preparing for adoption and IVF

11 essential things to do before baby comes

Webinar: Uncover the cost: Starting a family

Student checklist: Preparing for college

Co-signing 101: Applying for a loan with co-borrower

Practical money skills and financial tips for college students

5 things to know before accepting a first job offer

How to build credit as a student

Webinar: Bank Notes: College cost comparison

The A to Z’s of college loan terms

6 pandemic money habits to keep for the long term

How I kicked my online shopping habit and got my spending under control

5 myths about emergency funds

What military service taught me about money management

Does your savings plan match your lifestyle?

Webinar: Uncover the cost: International trip

How having savings gives you peace of mind

Allowance basics for parents and kids

What’s your financial IQ? Game-night edition

Personal loans first-timer's guide: 7 questions to ask

Tips to overcome three common savings hurdles

3 awkward situations Zelle can help avoid

Helpful tips for safe and smart charitable giving

How to save money while helping the environment

Things to know about the Servicemembers Civil Relief Act

Do you and your fiancé have compatible financial goals?

Common unexpected expenses and three ways to pay for them

Which is better: Combining bank accounts before marriage — or after?

Myths vs. facts about savings account interest rates

5 tips to use your credit card wisely and steer clear of debt

30-day adulting challenge: Financial wellness tasks to complete in a month

Travel for less: Smart (not cheap) ways to spend less on your next trip

How to open and invest in a 529 plan

Is a home equity loan for college the right choice for your student

Parent checklist: Preparing for college

How grandparents can contribute to college funds instead of buying gifts

Using 529 plans for K-12 tuition

How to talk to your lender about debt

Which debt management technique is right for you?

How to apply for federal student aid through the FAFSA

Be careful when taking out student loans

Everything you need to know about consolidating debts

Consolidating debts: Pros and cons to keep in mind

5 tips to use your credit card wisely and steer clear of debt

How to use credit cards wisely for a vacation budget

5 steps to selecting your first credit card

What’s a subordination agreement, and why does it matter?

Know your debt-to-income ratio

How to use debt to build wealth

Understanding the true cost of borrowing: What is amortization, and why does it matter?

Your quick guide to loans and obtaining credit

How to use your unexpected windfall to reach financial goals

7 steps to keep your personal and business finances separate

Dear Money Mentor: What is cash-out refinancing and is it right for you?

Dear Money Mentor: How do I begin paying off credit card debt?

Money Moments: How to finance a home addition

How you can take advantage of low mortgage rates

Should you get a home equity loan or a home equity line of credit?

These small home improvement projects offer big returns on investment

Webinar: Mortgage basics: How much house can you afford?

Is it the right time to refinance your mortgage?

Webinar: Mortgage basics: What’s the difference between interest rate and annual percentage rate?

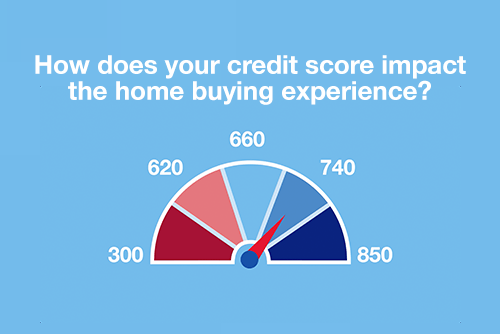

Webinar: Mortgage basics: How does your credit score impact the homebuying experience?

Is a home equity line of credit (HELOC) right for you?

Can you take advantage of the dead equity in your home?

How to use your home equity to finance home improvements

4 questions to ask before you buy an investment property

10 uses for a home equity loan

How to spot a credit repair scam

Webinar: Uncover the cost: Home renovation

Improving your credit score: Truth and myths revealed

Test your loan savvy

Credit: Do you understand it?

How to build and maintain a solid credit history and score

Should you give your child a college credit card?

Myth vs. truth: What affects your credit score?

Decoding credit: Understanding the 5 C’s

6 essential credit report terms to know

5 unique ways to take your credit card benefits further

What types of credit scores qualify for a mortgage?

What is a good credit score?

U.S. Bank asks: What do you know about credit?

Credit score help: Repairing a bad credit score