Webinar: Cash management strategies for higher education

Higher education and the cashless society: Latest trends

Ease your transition to remote banking

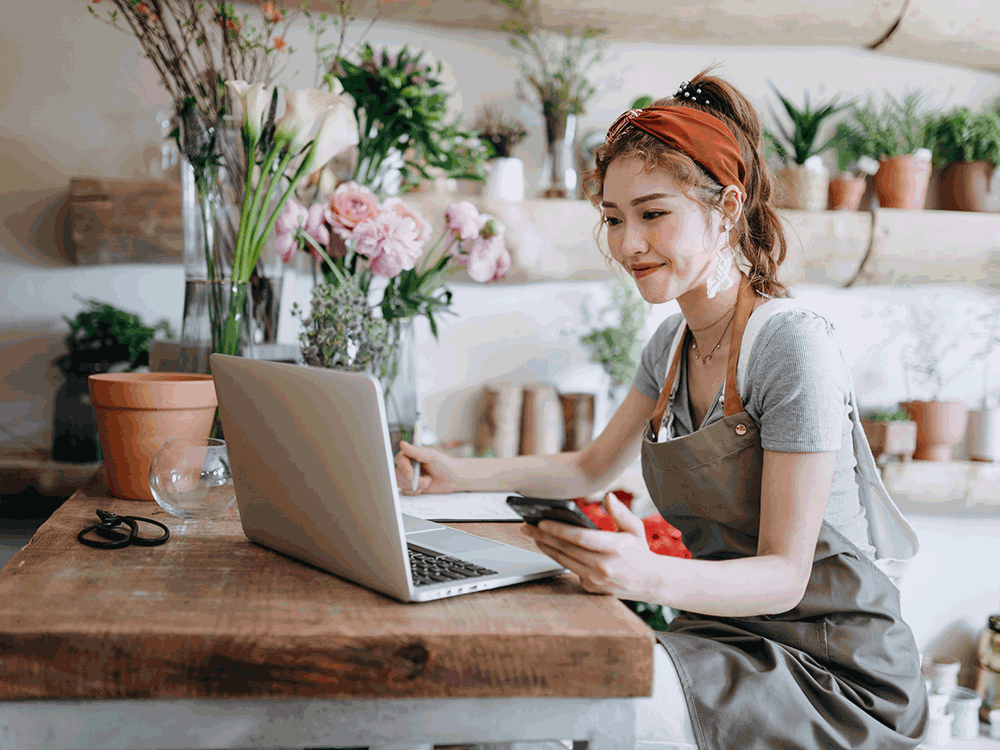

Costs to consider when starting a business

Meet your business credit card support team

How to choose the right business checking account

Break free from cash flow management constraints

How to track your spending patterns

How to manage your money: 6 steps to take

Key components of a financial plan

How to manage your finances when you're self-employed

Good money habits: 6 common money mistakes to avoid

Transitioning from the military to the civilian workforce

Achieving their dreams through a pre-apprenticeship construction program

How to Adult: 5 ways to track your spending

Preparing for adoption and IVF

11 essential things to do before baby comes

Webinar: Uncover the cost: Starting a family

Family planning for the LGBTQ+ community

Student checklist: Preparing for college

6 questions students should ask about checking accounts

College budgeting: When to save and splurge

Webinar: Uncover the cost: College diploma

How to gain financial independence from your parents

How to save money in college: easy ways to spend less

Webinar: 11 insider tips for student debt

Co-signing 101: Applying for a loan with co-borrower

How I did it: Paid off student loans

Practical money skills and financial tips for college students

5 things to know before accepting a first job offer

How to build credit as a student

Learn to spot and protect yourself from common student scams

Webinar: Bank Notes: College cost comparison

The A to Z’s of college loan terms

How to avoid student loan scams

Tips for handling rising costs from an Operation HOPE Financial Wellbeing coach

Webinar: U.S. Bank asks: Are you safe from fraud?

3 ways to keep costs down at the grocery store (and make meal planning fun)

5 tips for creating (and sticking to) a holiday budget

Financial checklist: Preparing for military deployment

Should you buy now, pay later?

6 pandemic money habits to keep for the long term

5 things to consider when deciding to take an unplanned trip

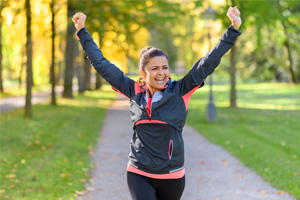

Working with an accountability partner can help you reach your goals

The mobile app to download before summer vacation

Webinar: 5 myths about emergency funds

How to decide when to shop local and when to shop online

How I kicked my online shopping habit and got my spending under control

Growing your savings by going on a ‘money hunt’

Webinar: Smart habits and behaviors to achieve financial wellness

A who’s who at your local bank

Your 4-step guide to financial planning

How to stay financially focused in the face of economic uncertainty

How I did it: Learned to budget as a single mom

What military service taught me about money management

Webinar: Train your brain for smart financial habits

Webinar: Common budget mistakes (and how to avoid them)

Webinar: Uncover the cost: Wedding

Adulting 101: How to make a budget plan

Allowance basics for parents and kids

Helpful tips for safe and smart charitable giving

Webinar: Mindset Matters: How to practice mindful spending

How to save money while helping the environment

You can take these 18 budgeting tips straight to the bank

How to manage money in the military: A veteran weighs in

How can I help my student manage money?

U.S. Bank asks: Do you know what an overdraft is?

Stay on budget — and on the go — with a mobile banking app

U.S. Bank asks: Do you know your finances?

Do you and your fiancé have compatible financial goals?

How to best handle unexpected expenses

Save time and money with automatic bill pay

U.S. Bank asks: Transitioning out of college life? What’s next?

Personal finance for teens can empower your child

Don’t underestimate the importance of balancing your checking account

9 simple ways to save

How to save for a wedding

It's possible: 7 tips for breaking the spending cycle

Here’s how to create a budget for yourself

Multiple accounts can make it easier to follow a monthly budget

7 steps: How couples and single parents can prepare for child care costs

Dear Money Mentor: How do I set and track financial goals?

Tips for working in the gig economy

How compound interest works

5 tips for parents opening a bank account for kids

Lost job finance tips: What to do when you lose your job

Tips to raise financially healthy kids at every age

Money management guide to financial independence

30-day adulting challenge: Financial wellness tasks to complete in a month

7 financial questions to consider when changing jobs

First-timer’s guide to savings account alternatives

Essential financial resources and protections for military families

What’s in your emergency fund?

Certificates of deposit: How they work to grow your money

What I learned from my mom about money

Practical money tips we've learned from our dads

Dear Money Mentor: How do I pick a savings or checking account?

What financial advice would you give your younger self?

Bank from home with these digital features

How to increase your savings

Financial gifts can be a valuable – and fun – choice for the holidays

Is a home equity loan for college the right choice for your student

Your financial aid guide: What are your options?

Parent checklist: Preparing for college

How to apply for federal student aid through the FAFSA

Be careful when taking out student loans

Consolidating debts: Pros and cons to keep in mind

How to use your unexpected windfall to reach financial goals

Military homeownership: Your guide to resources, financing and more

Spring cleaning checklist for your home: 5 budget-boosting tasks

Are professional movers worth the cost?

Beyond the mortgage: Other costs for homeowners

Webinar: Uncover the cost: Home renovation

Improving your credit score: Truth and myths revealed

Should you give your child a college credit card?

How I did it: Deciding whether to buy an RV