Liquidity management: A renewed focus for European funds

How liquid asset secured financing helps with cash flow

Renewing your custody contracts? Negotiate the fees.

The ongoing evolution of custody

Key considerations for launching an ILP

Case study: U.S. asset manager expands to Europe

Alternative assets: Advice for advisors

ABL mythbusters: The truth about asset-based lending

Can ABL options fuel your business — and keep it running?

When small companies buy big: The potential of asset-based lending

Custody or safekeeping: What’s the right solution for government investments?

Collateral options for ABL: What’s eligible, what’s not?

5 questions you should ask your custodian about outsourcing

How to choose the right custodian for your managed assets

3 tips to maintain flexibility in supply chain management

Bank vs. brokerage custody

10 ways a global custodian can support your growth

Refining your search for an insurance custodian

The reciprocal benefits of a custodial partnership: A case study

The benefits of a full-service warehouse custodian

The unsung heroes of exchange-traded funds

Preparing for your custodian conversion

Look to your custodian in times of change

Webinar: Cash management strategies for higher education

Solutions banks can offer during the COVID-19 pandemic

Hospitals face cybersecurity risks in surprising new ways

Webinar: Robotic process automation

Tactical Treasury: Fraud prevention is a never-ending task

Webinar: Empower your AP automation with strategic intelligence

Risk management strategies for foreign exchange hedging

What is CSDR, and how will you be affected?

Proactive ways to fight vendor fraud

5 steps you should take after a major data breach

The password: Enhancing security and usability

Avoiding the pitfalls of warehouse lending

Fraud prevention checklist

Why KYC — for organizations

BEC: Recognize a scam

How to improve your business network security

3 timeless tips to reduce corporate payments fraud

Alternative investments: How to track returns and meet your goals

Employee benefit plan management: trustee vs. custodian

Protecting cash balances with sweep vehicles

Delivering powerful results with SWIFT messaging and services

Look to your custodian in times of change

Manufacturing: 6 supply chain optimization strategies

Middle-market direct lending: Obstacles and opportunities

How RIAs can embrace technology to enhance personal touch

What corporate treasurers need to know about Virtual Account Management

Webinar: CRE Digital Transformation – Balancing Digitization with cybersecurity risk

Webinar: Fraud prevention and mitigation for government agencies

Make your business legit

Small business growth: 6 strategies for scaling your business

Healthcare marketing: How to promote your medical practice

Common small business banking questions, answered

3 signs it’s time for your business to switch banks

Does your side business need a separate bank account?

Do I need a financial advisor?

Reviewing your beneficiaries: A 5-step guide

Gifting money to adult children: Give now or later?

Financial steps to take after the death of a spouse

6 tips for trust fund distribution to beneficiaries

How to protect your digital assets in your estate plan

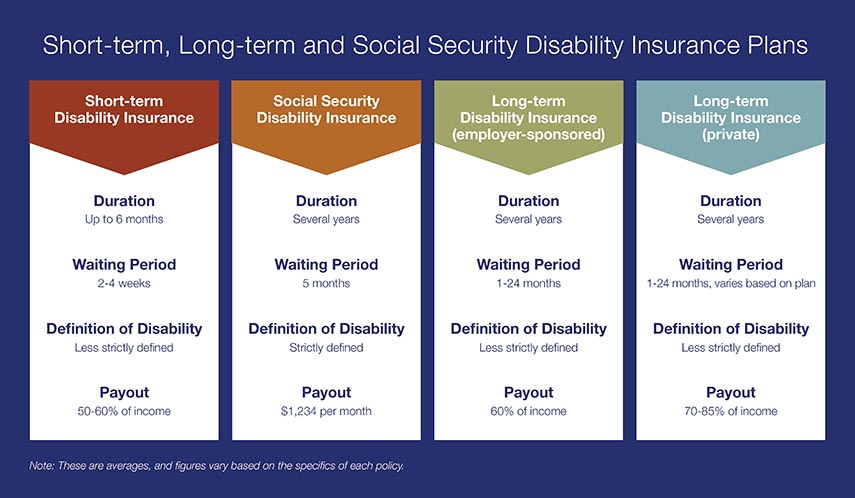

Is your employer long term disability insurance enough?

4 strategies for coping with market volatility

What types of agency accounts are available for investors?

What you need to know as the executor of an estate

Resources for managing financial matters after an unexpected death

Protecting elderly parents’ finances: 6 steps to follow when managing their money

How to spot an online scam

What is financial fraud?

Recognize. React. Report. Caregivers can help protect against financial exploitation

From LLC to S-corp: Choosing a small business entity

What you need to know about identity theft

Recognize. React. Report. Don't fall victim to financial exploitation

How you can prevent identity theft

Is online banking safe?

8 tips and tricks for creating and remembering your PIN

Webinar: U.S. Bank asks: Are you safe from fraud?

Webinar: Mobile banking tips for smarter and safer online banking

Does your savings plan match your lifestyle?

Adulting 101: How to make a budget plan

Which is better: Combining bank accounts before marriage — or after?

Personal finance for teens can empower your child

Don’t underestimate the importance of balancing your checking account

Is it time to get a shared bank account with your partner?

Here’s how to create a budget for yourself

Multiple accounts can make it easier to follow a monthly budget

Checking and savings smarts: Make your accounts work harder for you

5 reasons why couples may have separate bank accounts

5 tips for parents opening a bank account for kids

Myths vs. facts about savings account interest rates

First-timer’s guide to savings account alternatives

Dear Money Mentor: How do I pick a savings or checking account?