How liquid asset secured financing helps with cash flow

Renewing your custody contracts? Negotiate the fees.

Key considerations for launching an ILP

What is a CLO?

An investor’s guide to marketplace lending

Alternative assets: Advice for advisors

Beyond Mars, AeroVironment’s earthly expansion fueled by U.S. Bank

ABL mythbusters: The truth about asset-based lending

Can ABL options fuel your business — and keep it running?

When small companies buy big: The potential of asset-based lending

Collateral options for ABL: What’s eligible, what’s not?

Maximizing your infrastructure finance project with a full suite trustee and agent

How to choose the right custodian for your managed assets

How to maximise your infrastructure finance project

Emerging A/R solutions use artificial intelligence to target efficiency

6 timely reasons to integrate your receivables

Drivers for changing accounts receivable in 2021

Integrated receivables management solution supports customer focus at MSC Industrial Supply

Webinar: Digitizing receivables to transform B2B rent payments

Evaluating interest rate risk creating risk management strategy

Webinar: Redefine your business with technology

Webinar: The impact of innovation on processing receivables

How AR technology is helping advance payment processing at Avera Health

Protecting cash balances with sweep vehicles

Changes in credit reporting and what it means for homebuyers

What’s the difference between Fannie Mae and Freddie Mac?

Tech lifecycle refresh: A tale of two philosophies

4 benefits of independent loan agents

Middle-market direct lending: Obstacles and opportunities

At your service: outsourcing loan agency work

Tailor Ridge eBill case study

Digital receivables to meet changing demand

Streamline operations with all-in-one small business financial support

Opening a business on a budget during COVID-19

How to fund your business without using 401(k) savings

How to establish your business credit score

How to get started creating your business plan

Costs to consider when starting a business

How a small business is moving forward during COVID-19

When to consider switching banks for your business

Prioritizing payroll during the COVID-19 pandemic

How jumbo loans can help home buyers and your builder business

5 tips to help you land a small business loan

Investing in capital expenditures: What to discuss with key partners

Do I need a financial advisor?

Gifting money to adult children: Give now or later?

Financial steps to take after the death of a spouse

6 tips for trust fund distribution to beneficiaries

Resources for managing financial matters after an unexpected death

Student checklist: Preparing for college

Webinar: Uncover the cost: College diploma

Co-signing 101: Applying for a loan with co-borrower

How I did it: Paid off student loans

Practical money skills and financial tips for college students

The A to Z’s of college loan terms

Is online banking safe?

Personal loans first-timer's guide: 7 questions to ask

Common unexpected expenses and three ways to pay for them

Is a home equity loan for college the right choice for your student

Your financial aid guide: What are your options?

Parent checklist: Preparing for college

How to apply for federal student aid through the FAFSA

Be careful when taking out student loans

Everything you need to know about consolidating debts

What’s a subordination agreement, and why does it matter?

How to use debt to build wealth

Understanding the true cost of borrowing: What is amortization, and why does it matter?

Your quick guide to loans and obtaining credit

7 steps to keep your personal and business finances separate

Dear Money Mentor: What is cash-out refinancing and is it right for you?

Overcoming high interest rates: Getting your homeownership goals back on track

What are conforming loan limits and why are they increasing

How I did it: My house remodel

Money Moments: How to finance a home addition

What is a home equity line of credit (HELOC) and what can it be used for?

Webinar: Mortgage basics: What is refinancing, and is it right for you?

Should you get a home equity loan or a home equity line of credit?

These small home improvement projects offer big returns on investment

Webinar: Mortgage basics: How much house can you afford?

Webinar: Mortgage basics: Prequalification or pre-approval – What do I need?

Is it the right time to refinance your mortgage?

What is refinancing a mortgage?

What to know when buying a home with your significant other

Webinar: Mortgage basics: What’s the difference between interest rate and annual percentage rate?

Webinar: Mortgage basics: 3 Key steps in the homebuying process

How do I prequalify for a mortgage?

Webinar: Mortgage basics: Finding the right home loan for you

Webinar: Mortgage basics: Buying or renting – What’s right for you?

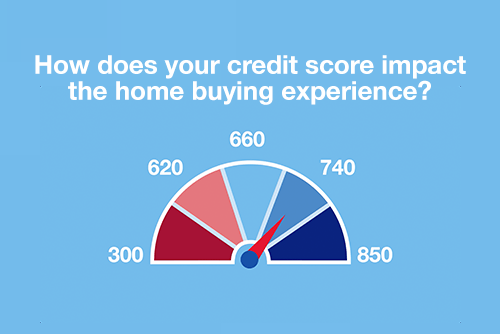

Webinar: Mortgage basics: How does your credit score impact the homebuying experience?

Is a home equity line of credit (HELOC) right for you?

Can you take advantage of the dead equity in your home?

How to use your home equity to finance home improvements

4 questions to ask before you buy an investment property

10 uses for a home equity loan

8 steps to take before you buy a home

6 questions to ask before buying a new home

Test your loan savvy

What you need to know before buying a new or used car

How to choose the best car loan for you

Questions to ask before buying a car

What you should know about buying a car