The economy remains on a positive trajectory. Gross Domestic Product (GDP) growth was 2.3% in the fourth quarter, down from second and third quarter readings of 3.0% and 3.1% respectively.4 In the meantime, inflation, as measured by the Consumer Price Index, trended higher, from its 2024 low of 2.4% to 2.9% by year’s end.5 “On average, most households remain resilient, supported by a healthy jobs market,” says Beth Ann Bovino, chief economist, U.S. Bank. “It signals that the economy can withstand fewer Fed rate cuts without falling into recession.”

Higher government deficits, occurring in conjunction with elevated interest rates, require the U.S. Treasury to increase debt supply to fund federal government spending. In early 2025, Treasury officials noted that it was utilizing extraordinary measures to avoid a debt default. “In the short-term, that means the Treasury will need to release liquidity into the system, which could temporarily lower interest rates,” says Haworth. “However, growing government deficits, over the long term, risk putting upward pressure on rates.”

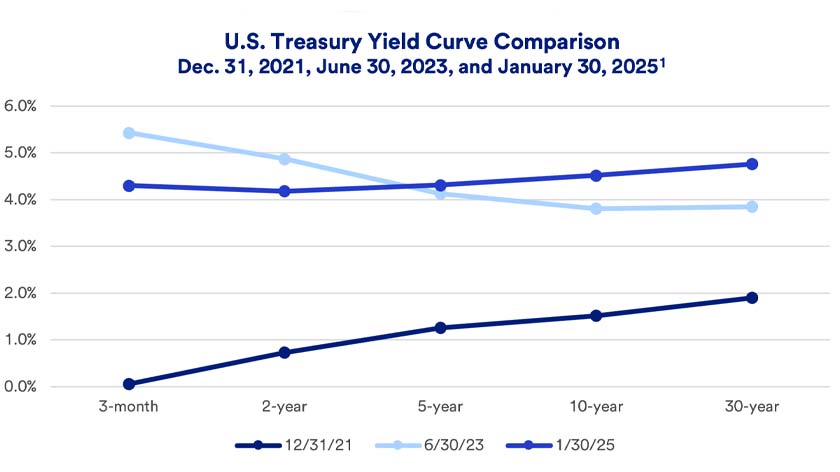

A more normal yield curve

For more than two years, an unusual environment persisted. The yield curve, reflecting yields across the Treasury security maturity spectrum, is typically upward sloping (see the line in the chart below representing the yield curve as of Dec. 31, 2021). In a normal environment, the shortest-term securities offer the lowest yields, and those with the longest maturities pay the highest yields. However, in 2022, the yield curve inverted as short-term rates rose dramatically, exceeding long-term yields (see the line on the chart showing the yield curve on June 30, 2023). In recent months, the market began shifting. Now the yield curve is again mostly upward-sloping, though relatively flat (see the line on the chart showing the yield curve on Jan. 30, 2025).6 “A normal upward sloping yield curve might require continued strong economic growth, which would likely keep long-term yields higher.” Haworth says such a trend would need to be combined with modest enough inflation to allow the Fed to continue cutting short-term rates, which would be reflected on the shorter end of the yield curve.