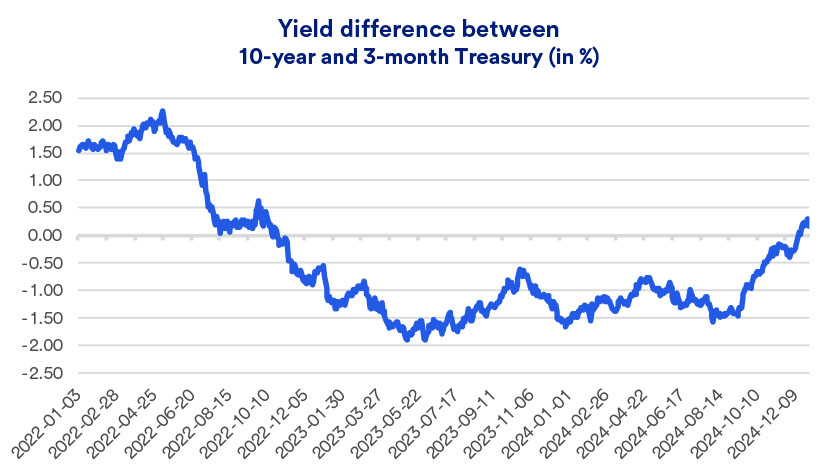

A false recession indicator?

For some market observers, the onset of an inverted yield curve is considered a harbinger of an economic recession. But throughout the inverted curve period, the economy demonstrated significant strength. As measured by Gross Domestic Product (GDP), the economy grew 2.9% in 2023 and by 3% or more (annualized rate) in 2024’s second and third quarters.2 “This indicates that, at least in this cycle, the U.S. economy was less interest rate sensitive than was the case previously,” says Haworth. “Many homebuyers already locked in low mortgage rates before the Fed raised interest rates. In addition, larger corporations had sufficient financing in place, also at lower rates, so they weren’t as directly affected by the need to borrow additional dollars at higher rates.”

These factors contributed to a strong job market that helped support solid consumer spending, a key factor in ongoing economic growth.

Investment considerations in today’s market

For investors holding a diversified portfolio of equities, fixed income and real assets, Haworth says it may be time to consider modestly underweighting fixed income investments. “Given the opportunities in other parts of the market, such as global equities, investment grade bonds are likely to generate lower relative returns in the near term.”

Haworth says while a bond laddering strategy – owning bonds of different maturities and reinvesting matured bonds into longer-term debt securities over time – is a more viable option today, investors may not want to limit themselves to Treasury issues. “This is a time when taking on additional risk with lower quality bonds can pay off, as they tend to hold up well in a solid economic environment.” With certain non-taxable portfolios, this includes non-government agency issued residential mortgage-backed securities, while managing total portfolio duration using longer-maturity U.S. Treasuries. Certain tax-aware portfolios can benefit from municipal bonds, including some longer-duration and high-yield municipal securities. Trust portfolios may benefit from reinsurance as a way of capturing differentiated cash flow with low correlation to other portfolio factors such as economic trends.

Check-in with your wealth planning professional to make sure you’re comfortable with your current mix of investments and that your portfolio’s asset allocations remain consistent with your goals, risk appetite and time horizon.