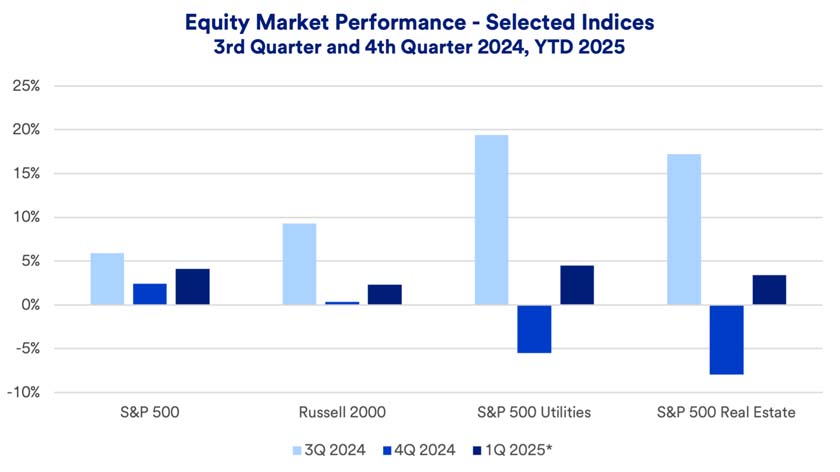

Haworth says the real estate sector is slowly working through challenges it faced since 2022 when interest rates began moving higher. “Despite ongoing debt concerns, there’s room for repair in the real estate market, which should help improve the environment for REITs (Real Estate Investment Trusts) going forward.” REITs are a common way individual investors gain access to real estate markets.

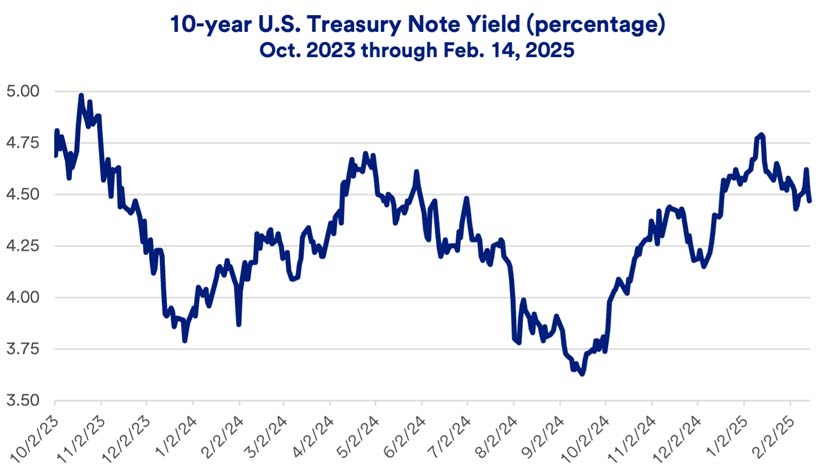

The stock market’s path forward amid rate changes

Interest rates remain an important consideration for equity investors. “The Fed isn’t headed back to the pre-2022 ‘zero interest rate’ environment,” says Haworth. “Inflation may be settling in at a higher level, in the 2.5% to 3.0% range. If that’s the case, the Fed is likely to ultimately set the federal funds target rate somewhere close to 3.0%.” The fed funds target rate currently stands at 4.25% to 4.50%. Given present interest rate trends, Haworth believes equities in general remain well positioned, driven primarily by strong economic fundamentals and solid corporate earnings growth.

As you assess your own circumstances, be prepared for potential stock price fluctuations in the near term. Stocks should continue to represent a key component of any long-term investor’s diversified portfolio. “In part, this is due to the fact that equity returns can help investors keep pace with inflation,” says Haworth.

Talk with your wealth professional about your comfort level with your portfolio’s current mix of investments and discuss whether any changes are appropriate in response to an evolving capital market environment consistent with your goals, risk appetite and time horizon.

Note: The Standard & Poor’s 500 Index (S&P 500) consists of 500 widely traded stocks that are considered to represent the performance of the U.S. stock market in general. The S&P 500 is an unmanaged index of stocks. It is not possible to invest directly in the index. Past performance is no guarantee of future results. The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index and is representative of the U.S. small capitalization securities market. The Russell 2000 is an unmanaged index of stocks. It is not possible to invest directly in the index. Past performance is no guarantee of future results.