Implications for further Fed interest rate cuts

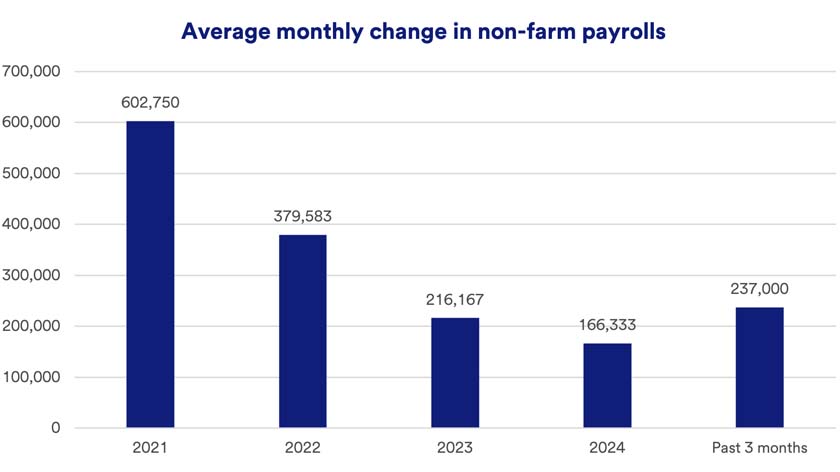

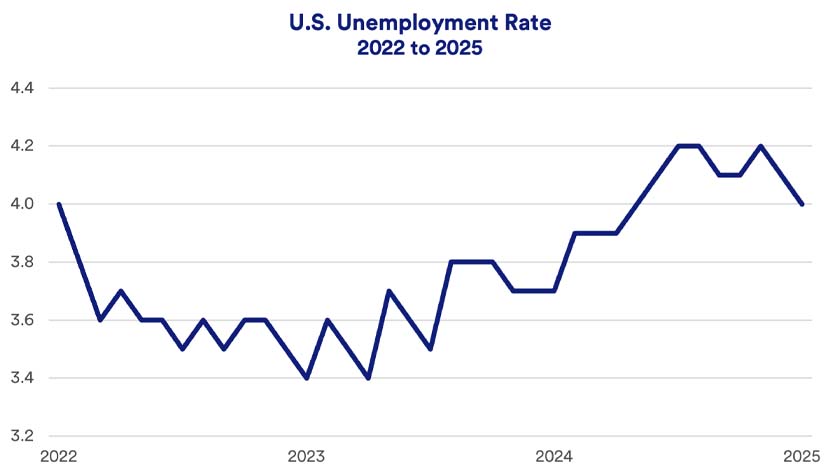

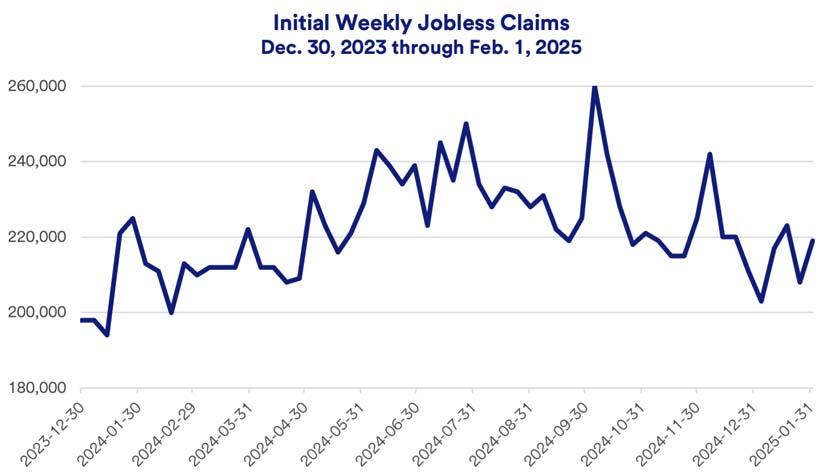

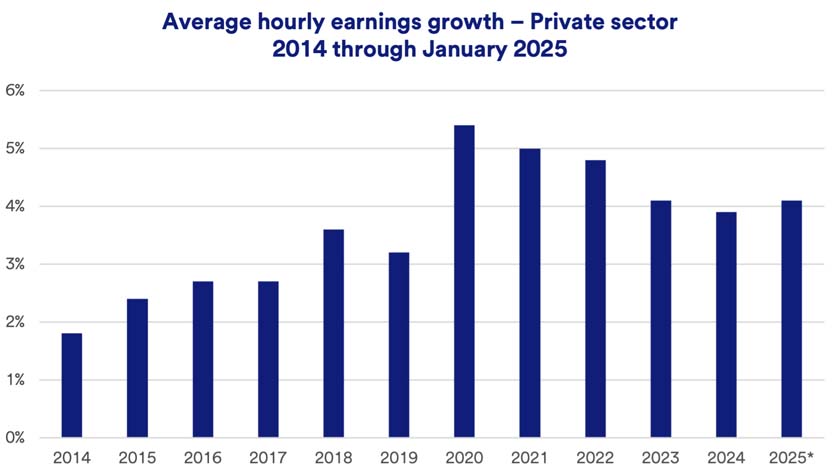

Labor market data is a key consideration as the Federal Reserve (Fed) assesses interest rate policy. Between September and December 2024, the Fed cut the federal funds target rate (a rate used by banks in overnight lending that influences mortgage rates and other consumer credit products) by 1.00%, the first cuts in more than four years. Early labor market weakness signals contributed to the Fed’s rate cut decisions. So far in 2025, the Fed held rates steady as it signaled plans to limit 2025 rate cuts.5 In recent comments, Fed Chair Jerome Powell stated, “Overall, a wide set of indicators suggests that conditions in the labor market are broadly in balance. The labor market is not a source of significant inflationary pressures.”6

With no labor market warning signals on the immediate horizon, Haworth says the Fed may have more leeway to remain patient about further fed funds target rate cuts. “Issues like tariffs, if implemented to the extent the Trump administration has proposed, could result in temporary higher inflation,” says Haworth. “But the Fed is more concerned with long-term structural inflationary issues than with transitory issues like a tariff increase.”

What to expect going forward

Investors closely track jobs data as an important economic indicator and a potential signal about Fed monetary policy. Fed rate cuts are considered a way to boost the economy, help support the stock market rally that began in 2023, and over time, reduce bond market interest rates. However, the yield on the benchmark 10-year U.S. Treasury note, which prior to Fed rate cuts dropped to 3.63%, had by early 2025, risen to 4.79%. By early February, the 10-year Treasury note yield stood closer to 4.50%.

A new issue Haworth is watching is the labor market impact of tighter immigration policy proposed by the Trump administration. “People subject to deportation, in many cases, came to America to work, so if they leave, other workers will need to step into those jobs.” Haworth says the construction industry is a key area where the labor market may tighten.

Talk with a wealth professional if you have questions about your personal financial circumstances or investment portfolio.