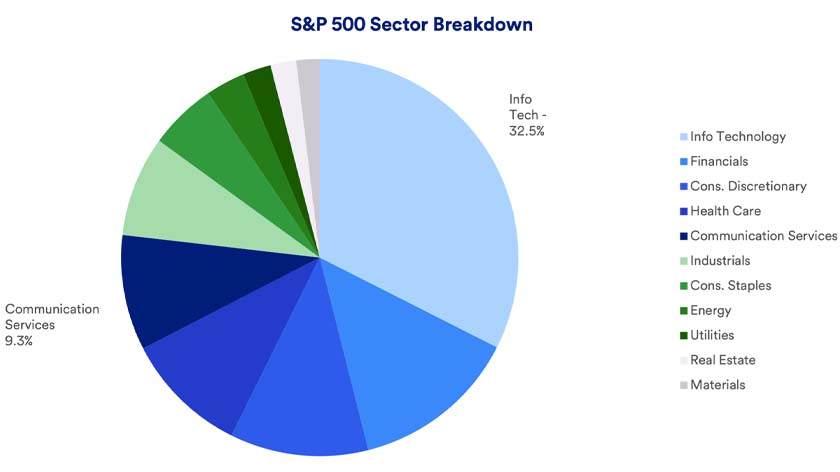

Large technology companies, which already dominate the investment landscape and, in 2023 and 2024, led a strong equity market rally, remained highly visible at 2025’s outset. The so-called “Magnificent Seven” stocks (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla) continue to command the attention of investors, with significant focus centered around artificial intelligence (AI) breakthroughs.

Most notable was the introduction, in late January, of a Chinese-developed AI platform known as DeepSeek. Along with delivering results comparable to many existing, American platforms, it was reportedly developed for a far lower cost and requires much less energy demand to operate than other models. The stock market’s reaction was swift. In a single day, Nvidia’s stock lost a record-breaking $600 billion in value, a 17% drop. Nvidia is currently the largest producer of high-end semiconductor chips used for AI development. Markets suffered a significant, one-day loss, though on the following day, stocks regained some lost ground.

“There are a lot of questions about DeepSeek’s impact that have yet to be answered,” says Rob Haworth, senior investment strategy director with U.S. Bank Asset Management. “The immediate concern is that not as many Nvidia chips will be required to develop AI applications. On the other hand, based on time-tested economic theory, if programming costs decline, demand for chips could rise.”

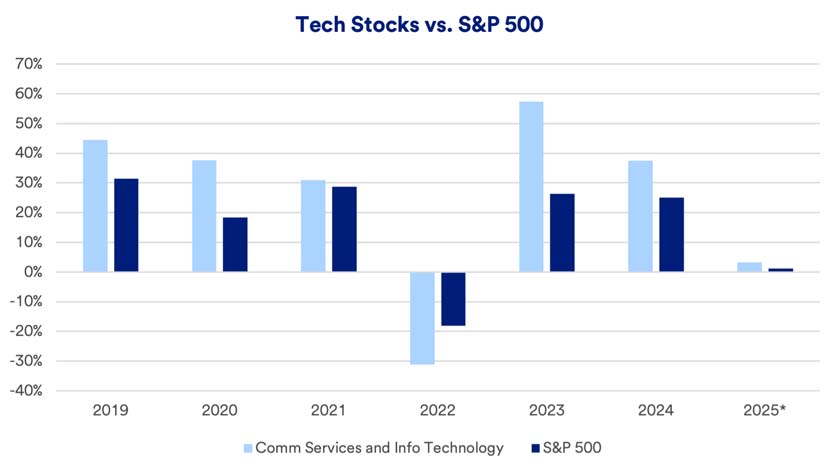

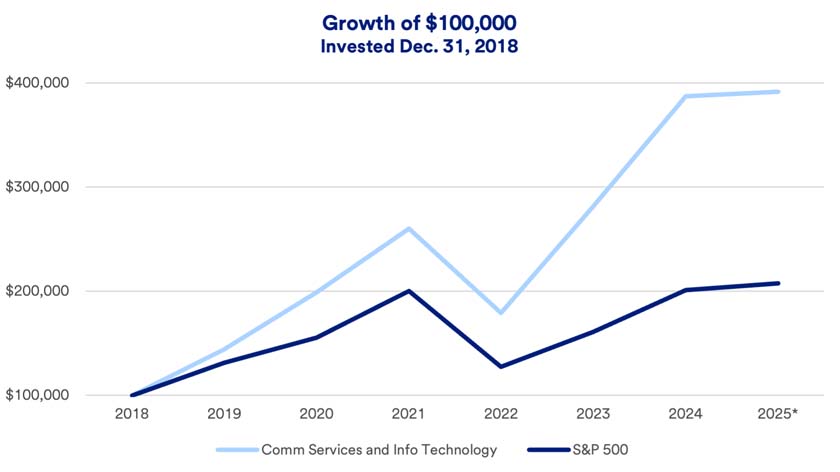

These developments come following a second consecutive year of stellar technology stock performance. In 2024, the S&P 500 Communications Services and Information Technology index gained 37.39%, following 2023’s gain of 57%. By comparison in 2024, the broader S&P 500 Index gained 25.02%. Year-to-date through January 28, 2025, performance was flatter at just 1.12% for the technology index, while the S&P 500 gained 3.24% over the same period.1

Can the tech stock run continue?

Although January’s AI developments added a level of technology sector uncertainty that didn’t exist before, the outlook in general remains favorable. AI and cloud computing account for a significant portion of today’s corporate spending, as companies seek to enhance productivity and boost their bottom lines. “The information technology spending we’re seeing is not just from consumers, but on a business-to-business basis,” says Eric Freedman, chief investment officer for U.S. Bank Asset Management. “That’s what companies are spending their capital on, so that’s where we want to be positioned.”