Earnings and stock valuations

The P/E ratio doesn’t just measure broad market valuation but is also applied to individual stocks. It is the ratio of the current price of a stock compared to the company’s earnings. A stock trading at $30 per share with annual earnings of $2 per share would have a P/E ratio of 15.

When trying to assess which of two stocks offer the best investment opportunity based on their P/E ratios, it’s not always an “apples-to-apples” comparison. “Determining fair value has a lot to do with the underlying growth rate of the industry in which the company competes,” says Haworth. In some cases, investors may be willing to bid up prices based not on current earnings, but on expectations of future profitability. “This tends to be the case, for example, with stocks that invest in new technology that may not have an immediate payoff but offer the potential of future strong earnings if they succeed,” says Haworth. “Other stocks may have lower P/E multiples, but those companies generate steadier earnings, so the payoff on the investment needs to happen in a more compressed timeframe.”

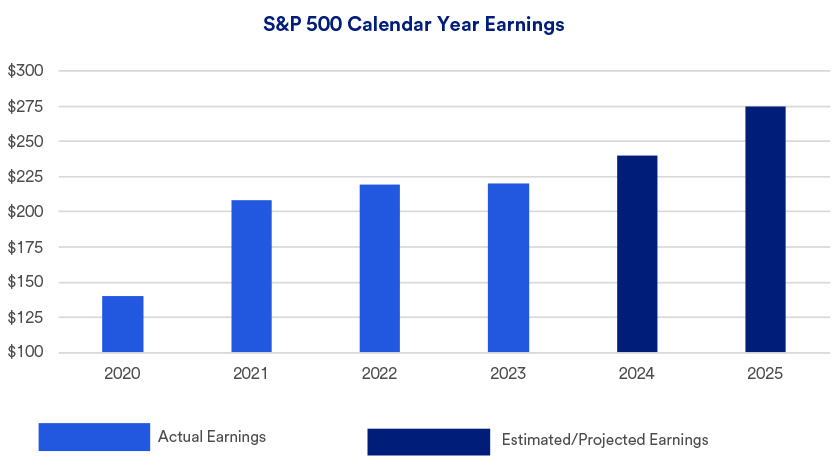

Investors also consider P/E valuations of the broader market. According to Standard & Poor’s as of January 31, 2025, the S&P 500’s P/E ratio based on earnings in the prior 12 months was 28.77, while the P/E ratio based on projected earnings for the next 12 months is 24.57.2 Analysts may set different market valuations based on varied sets of earnings projections. “At these levels, it would be challenging to generate further market gains if we saw earnings issues arise,” notes Haworth.

The underlying economic environment

2024’s positive corporate earnings record was credited in large part to solid U.S. economic growth. The outlook remains favorable going forward, but there is more economic uncertainty given the Trump administration’s economic proposals. The implementation of broader tariffs and a possible workforce reduction through proposed immigration crackdowns create potential inflation concerns.

“We still have a reasonably strong labor market,” says Haworth, “but recent surveys show consumers anticipate higher inflation going forward.” While consumer spending is the key driver of recent economic growth, Haworth says recent data raise questions about whether consumers might pull back spending activity.

On the other hand, if 2024’s economic trends continue, it may benefit a broader stock universe. “In recent times, technology-oriented stocks dominated market performance, but we think we’re seeing some broadening in the market today,” says Haworth. “In the current environment, a globally diversified portfolio puts investors in a position to capitalize on a broad array of opportunities.”

As you assess your investment options and how to best position your portfolio, it can be helpful to do so in the context of a financial plan. Talk with your wealth professional to review whether changes to your investment strategy may be warranted to better reflect your goals, risk appetite and time horizon.