Putting home ownership within reach for a diverse workforce

Administrator accountability: 5 questions to evaluate outsourcing risks

Commercial real estate in 2020: Keeping up with the pace of change

High-yield bond issuance: 5 traits lawyers should look for in a service provider

Easier onboarding: What to look for in an administrator

How to choose the right custodian for your managed assets

3 tips to maintain flexibility in supply chain management

Insource or outsource? 10 considerations

Refining your search for an insurance custodian

4 questions you should ask about your custodian

Preparing for your custodian conversion

Service provider due diligence and selection best practices

Solutions banks can offer during the COVID-19 pandemic

Turn risk into opportunity with supply chain finance

Webinar: What’s new in international payments?

Best practices on securing cardholder data

Webinar: Managing foreign exchange risk in unpredictable markets

Hospitals face cybersecurity risks in surprising new ways

Webinar: Robotic process automation

Tactical Treasury: Fraud prevention is a never-ending task

Post-pandemic fraud prevention lessons for local governments

Webinar: Empower your AP automation with strategic intelligence

Webinar: Building digital bridges for treasury optimization

Webinar: Recording of the Central Securities Depository Regulation and Pivot

Evaluating interest rate risk creating risk management strategy

Authenticating cardholder data reduce e-commerce fraud

Webinar: Digitize your AP processes to optimize results

Risk management strategies for foreign exchange hedging

Webinar: AP automation—solve payment challenges with an invoice-to-pay solution

What is CSDR, and how will you be affected?

Webinar: CRE technology trends

Webinar: The future of digital onboarding for U.S. Bank clients

Webinar: Driving innovation to impact treasury management

Webinar: CRE treasury leader roundtable

Proactive ways to fight vendor fraud

Webinar: Redefine your business with technology

Webinar: Economic, political and policy insights

4 tips for protecting your business against Coronavirus-related scams

The latest on cybersecurity: Mobile fraud and privacy concerns

Webinar: The impact of innovation on processing receivables

5 Ways to protect your government agency from payment fraud

Redefining beneficial ownership in the Cayman Islands

Cayman Islands’ Private Funds Law: What you need to know

The latest on cybersecurity: Vulnerability testing and third-party software

Webinar: International payments

5 steps you should take after a major data breach

Fight the battle against payments fraud

Cybercrisis management: Are you ready to respond?

Complying with changes in fund regulations

The cyber insurance question: Additional protection beyond prevention

Protecting your business from fraud

The password: Enhancing security and usability

Avoiding the pitfalls of warehouse lending

Fraud prevention checklist

Why KYC — for organizations

Cybersecurity – Protecting client data through industry best practices

Business risk management for owners of small companies

Government agency credit card programs and PCI compliance

BEC: Recognize a scam

How to improve your business network security

Role of complementary new channels in your payments strategy

Unlocking payment flexibility with intelligent payment routing

Webinar: Approaching international payment strategies in today’s unpredictable markets.

White Castle optimizes payment transactions

What government officials should know about real-time payments

Higher education strategies for e-payment migration, fighting fraud

Want AP automation to pay both businesses and consumers?

Time is money: Intelligent Payment Routing saves businesses both

Webinar: CSM corporation re-thinks AP

Webinar: A closer look at U.S. Bank AP Optimizer

Digital banking for business: How connectivity improves customer experience

Banking connectivity: Helping businesses deliver the easier, faster, more secure customer experience of the future

Adjust collections to limit impact of USPS delivery changes

How to improve digital payments security for your health system

Increase working capital with Commercial Card Optimization

Crack the SWIFT code for sending international wires

Automate escheatment for accounts payable to save time and money

ePOS cash register training tips and tricks

Cashless business pros and cons: Should you make the switch?

Automate accounts payable to optimize revenue and payments

A simple guide to set up your online ordering restaurant

Addressing financial uncertainty in international business

Webinar: AP automation for commercial real estate

The benefits of payment digitization: Pushing for simplicity

5 winning strategies for managing liquidity in volatile times

Zelle® helps Sunriver Resort make payments efficient and secure

3 ways to make practical use of real-time payments

Artificial intelligence in finance: Defining the terms

The surprising truth about corporate cards

The future of financial leadership: More strategy, fewer spreadsheets

3 timeless tips to reduce corporate payments fraud

Can faster payments mean better payments?

Choosing your M&A escrow partner

Employee benefit plan management: trustee vs. custodian

4 ways Request for Payments (RfP) changes consumer bill pay

Protecting cash balances with sweep vehicles

Why retail merchandise returns will be a differentiator in 2022

High-cost housing and down payment options in relocation

The client-focused mindset: Adapting to differing personality types

The client-focused mindset: How to network effectively

The client-focused mindset: What do clients expect?

Innovative payroll solutions may help attract hourly workers

Automated escheatment – learn how to prevent and resolve unclaimed property

Webinar: CRE Digital Transformation – Balancing Digitization with cybersecurity risk

Webinar: Reviving mobility, what to expect

Treasury management innovations earn Model Bank awards

Webinar: Fraud prevention and mitigation for government agencies

Webinar: DEI tips for transforming your mobility program

For today's relocating home buyers, time and money are everything

10 tips on how to run a successful family business

Crypto + Relo: Mobility industry impacts

Empowering team members

How entrepreneurs can plan for what matters most

Business tips and advice for Black entrepreneurs

Opening a business on a budget during COVID-19

How to test new business ideas

How to get started creating your business plan

How to redefine challenges with business collaboration

8 ways to increase employee engagement

The role of ethics in the hiring process

How to hire employees: Employee referral vs. external hiring

Tips for building a successful customer loyalty program

Give a prepaid rewards card for employee recognition

Checklist: Increase lead generation with website optimization

How to reward employees and teams who perform well

5 steps for creating an employee recognition program

Gift cards can extend ROI into 2022

Omnichannel retail: 4 best practices for navigating the new normal

Is your restaurant Google-friendly?

3 simple brand awareness tips for your business

How a small business owner is making the workplace work for women

What you should know about licensing agreements

The growing importance of a strong corporate culture

Rethinking common time management tips

Business credit card 101

How to apply for a business credit card

Meet your business credit card support team

Prioritizing payroll during the COVID-19 pandemic

How jumbo loans can help home buyers and your builder business

Break free from cash flow management constraints

5 tips for managing your business cash flow

Improve online presence your business

How Shampoo’ed is transforming hair and inspiring entrepreneurs

The San Francisco bridal shop that’s been making memories for 30 years

How Al’s Breakfast is bringing people together

Celebrity Cake Studio’s two decades of growth and success

In a digital world, Liberty Puzzles embraces true connection

How a bar trivia company went digital during COVID-19

How a travel clothing retailer is staying true to its brand values

How community gave life to lifestyle boutique Les Sol

How a group fitness studio made the most of online workouts

How to build a content team

How Wenonah Canoe is making a boom in business last

How (and why) to get your business supplier diversity certification

Use this one simple email marketing tip to increase your reach

Year-end financial checklist

Reviewing your beneficiaries: A 5-step guide

How to protect your digital assets in your estate plan

How to keep your assets safe

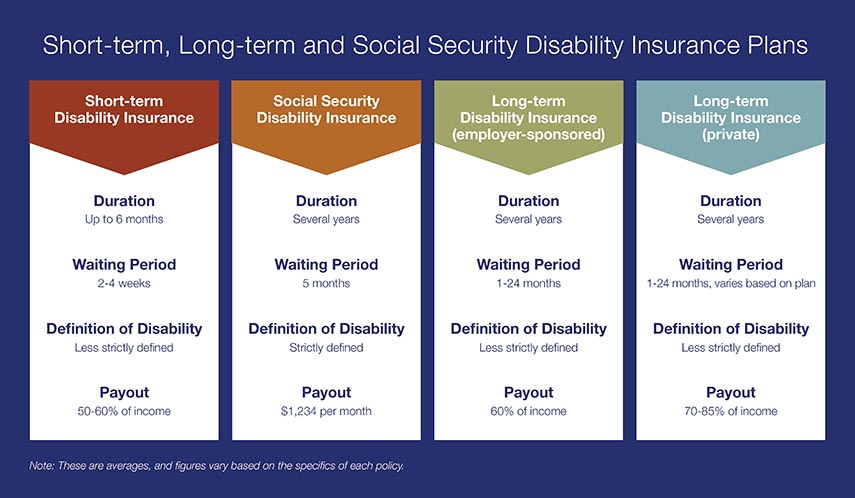

Is your employer long term disability insurance enough?

Learn to spot and protect yourself from common student scams

4 ways to outsmart your smart device

Protecting elderly parents’ finances: 6 steps to follow when managing their money

Webinar: Protect yourself or your loved ones from elder fraud

Keep your finances safe and secure: Essential tips for preventing check fraud

How to spot an online scam

Webinar: How to fight off fraud

Webinar: How to stay safe from cyberfraud

Money muling 101: Recognizing and avoiding this increasingly common scam

What is financial fraud?

Recognize. React. Report. Caregivers can help protect against financial exploitation

Learn how to spot scams related to COVID-19

From LLC to S-corp: Choosing a small business entity

What you need to know about identity theft

Recognize. React. Report. Don't fall victim to financial exploitation

Dear Money Mentor: What is cryptocurrency?

How you can prevent identity theft

Is online banking safe?

8 tips and tricks for creating and remembering your PIN

How-to guide: What to do if your identity is stolen

Webinar: U.S. Bank asks: Are you safe from fraud?

The mobile app to download before summer vacation

Webinar: Mobile banking tips for smarter and safer online banking

Webinar: Uncover the cost: International trip

How having savings gives you peace of mind

Allowance basics for parents and kids

Tips to overcome three common savings hurdles

3 awkward situations Zelle can help avoid

Helpful tips for safe and smart charitable giving

5 tips to use your credit card wisely and steer clear of debt

30-day adulting challenge: Financial wellness tasks to complete in a month

Travel for less: Smart (not cheap) ways to spend less on your next trip

Real world advice: How parents are teaching their kids about money

How to stop living paycheck to paycheck post-pay increase

Practical money tips we've learned from our dads

How to cut mindless spending: real tips from real people

6 ways to spring clean your finances and save money year-round

How to increase your savings

5 tips to use your credit card wisely and steer clear of debt

How to spot a credit repair scam